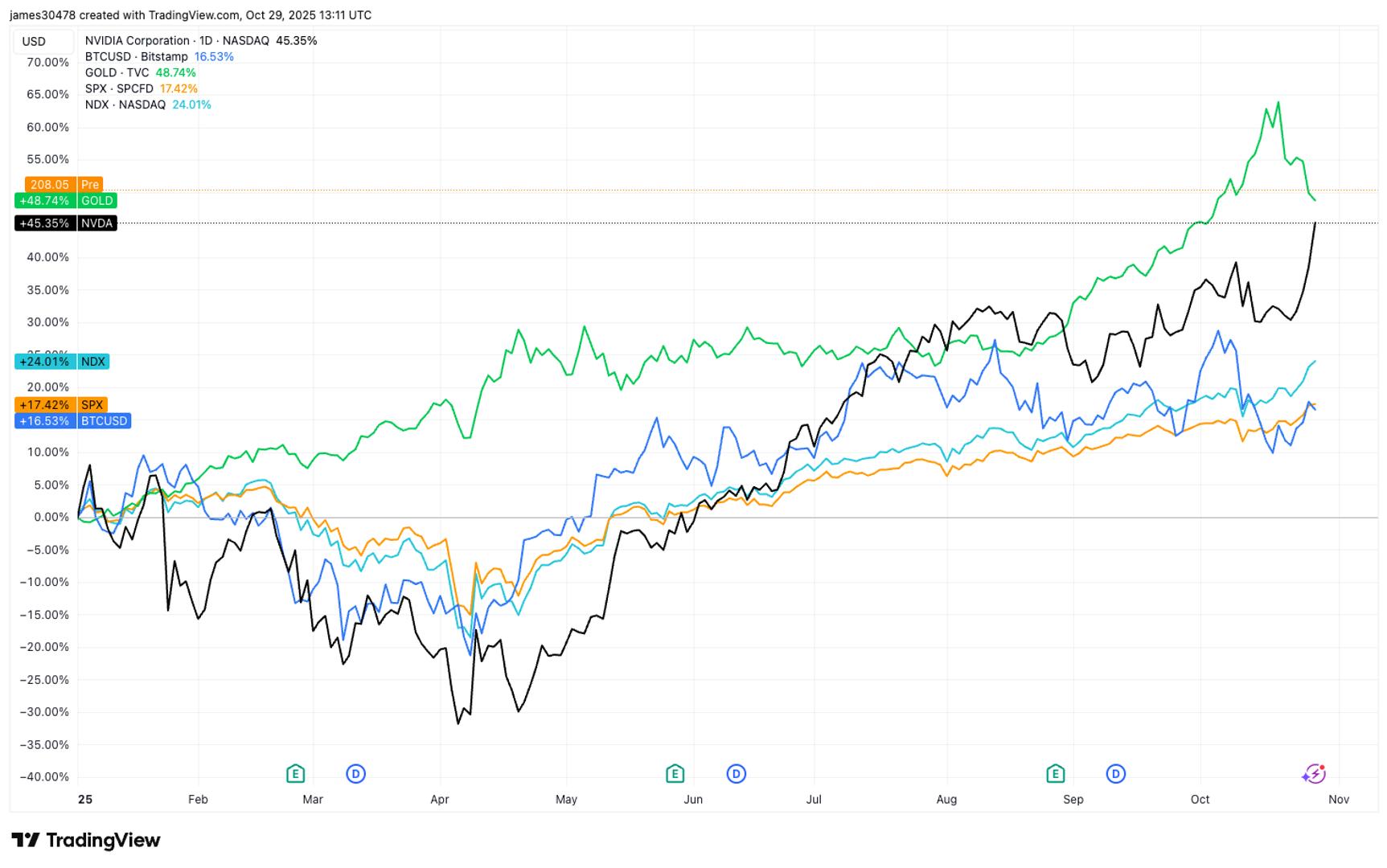

The recent surge in stocks, driven by Nvidia (NVDA), has resulted in the S&P 500 and Nasdaq outperforming bitcoin .

With further gains observed on Tuesday and a decline in bitcoin, the S&P 500’s 17% year-to-date rise surpasses BTC’s 16% increase. Meanwhile, the Nasdaq has extended its advantage over bitcoin, rising by 24%. Gold continues to dominate as the leading asset class with a remarkable 50% increase.

No discussion of the U.S. stock rally is complete without mentioning the Mag 7, particularly Nvidia (NVDA). Shares have risen by 17% over the last five days, fueled by a steady stream of AI-related partnership announcements, propelling the company’s market cap past $5 trillion early Wednesday.

Microsoft (MSFT) and Apple (AAPL) are positioned just behind Nvidia, each hovering around a $4 trillion market cap.

Per the X account Hedgie Markets, Nvidia accounts for nearly 20% of the S&P 500’s gains this year, representing 8.3% of the index’s overall weighting.

In perspective, Nvidia’s market cap exceeds the combined valuations of AMD, Arm Holdings, ASML, Broadcom, Intel, Lam Research, Micron, Qualcomm, and Taiwan Semi, as reported by Dow Jones Market Data.

Nvidia’s growth trajectory aligns with significant advancements in artificial intelligence. On Tuesday alone, the company unveiled several new partnerships with Palantir (PLTR) and Samsung, announced a $1 billion investment in Nokia, and explored potential collaboration with the U.S. Department of Energy for new supercomputers.

On Wednesday’s market open, the trend continues, with the Nasdaq up by 0.5%, Nvidia gaining 4.6%, and bitcoin slipping back under $113,000, approximately 10% below its peak.