Solana’s DeFi ecosystem has experienced remarkable growth, approaching historic highs, yet SOL remains behind in performance.

Summary

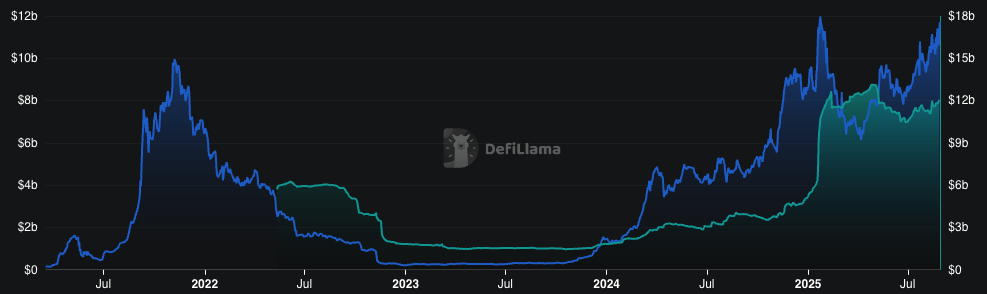

- Solana’s DeFi total value locked (TVL) stands at $11.725 billion, nearing its peak from January

- Despite this, the price of SOL lags significantly, far from the January all-time high

- DeFi indicators imply that SOL may continue to fall behind its DeFi ecosystem

Solana (SOL) is drawing near-record levels of investment, yet its price is not reflecting this trend. As of Thursday, August 28, the overall DeFi value locked on Solana hit $11.725 billion, close to the record levels seen in January. Concurrently, the total stablecoin market capitalization was at $12 billion, while the bridged TVL reached $42 billion.

Nevertheless, despite promising metrics, SOL’s price remains around $200, considerably below its January peak of $294.33. At that time, Solana’s DeFi TVL was similar to its present August high, indicating that DeFi TVL and SOL’s price are starting to show a divergence.

Reasons for SOL price lagging behind its DeFi ecosystem

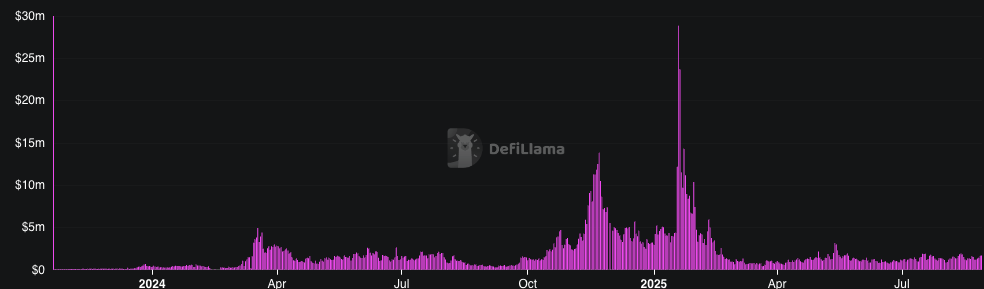

Conversely, the fees generated on Solana are still relatively low at $1.68 million each day, which is far from the record of $28.89 million in January. This limited on-chain revenue likely explains why SOL struggles to keep pace with the growth of its DeFi ecosystem.

Presently, much of the activity within Solana’s ecosystem takes place on platforms that emphasize low costs. This includes decentralized exchange (DEX) aggregators like Jupiter, which represents a significant portion of the trading volume on Solana. For these protocols, a higher TVL translates to greater liquidity and improved trading conditions.

However, this does not result in increased revenue for the Solana network, which is a critical factor in determining SOL’s price dynamics. Enhanced revenue leads to greater staking rewards, thus increasing the value of Solana. Due to efficiency improvements, SOL is likely to continue underperforming compared to its DeFi TVL until transaction fees rise.