XRP has fallen below a crucial technical threshold after an unsuccessful breakout attempt, with significant volume indicating a shift towards short-term bearish dominance.

News context

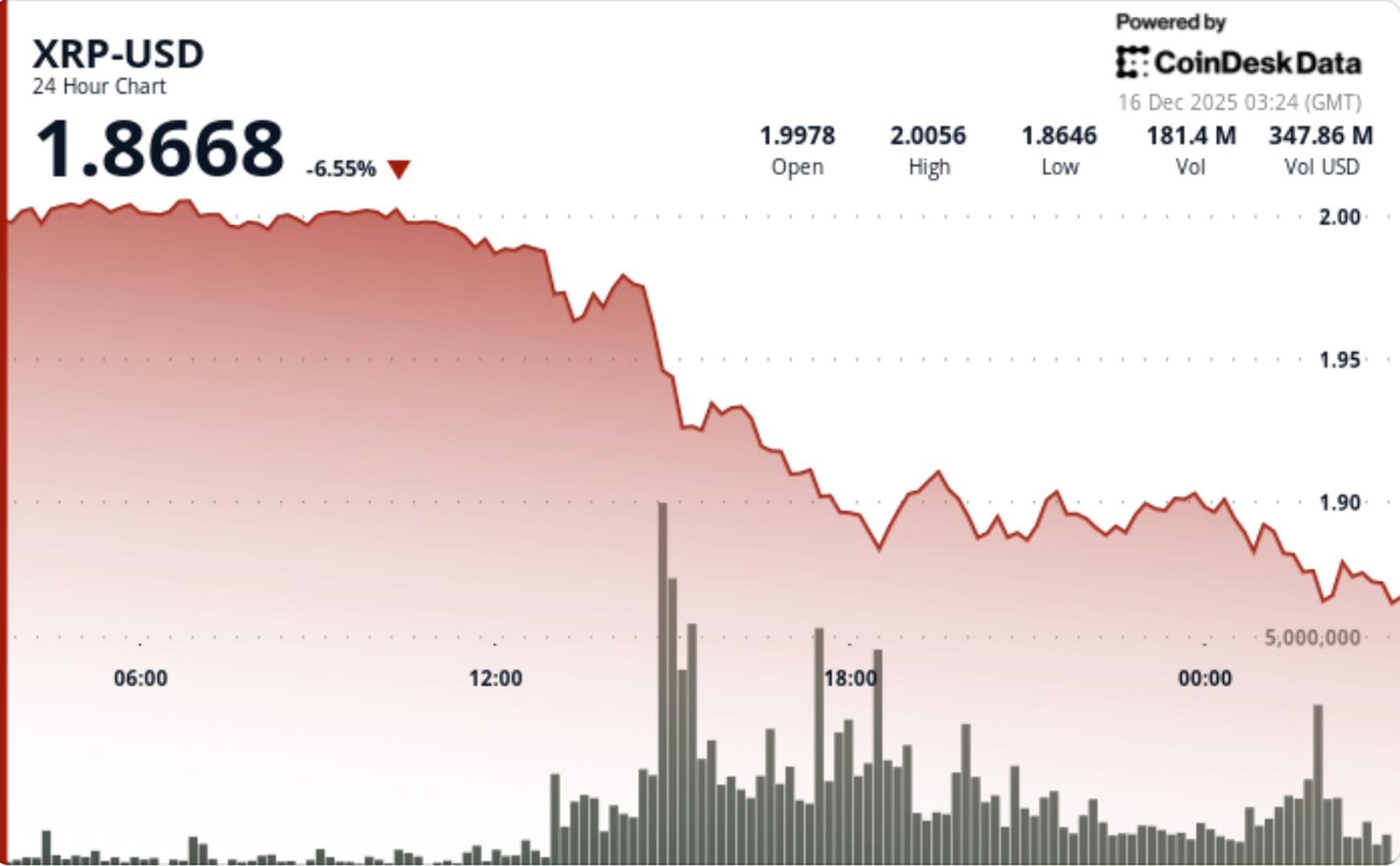

XRP experienced a 2.6% decline in the last 24 hours, dropping from $1.95 to $1.90 as the overall cryptocurrency markets exhibited signs of weakness. This decline followed several failed attempts to maintain momentum above recent resistance, making XRP susceptible to renewed support tests.

No new fundamental drivers were behind this selloff. Instead, the event transpired in a technically vulnerable area, where positions had accumulated after earlier rebound efforts. As the price stalled near resistance, selling pressure resurfaced, overwhelming buy orders during European trading hours.

Technical insight

The drop below the $1.93 Fibonacci level signified a clear technical misstep. This level had previously served as a pivot point during consolidation, and its loss indicates a reversion of short-term dynamics favoring sellers.

Volume saw a sharp increase during the rejection phase, with turnover rising 107% above daily averages, confirming the move was influenced by active distribution rather than low liquidity. The attempt to rally towards $1.95 demonstrated initial upward momentum with higher highs, but the failure to maintain levels above $1.92 triggered systematic selling into the strength.

From a structural standpoint, XRP has moved from range expansion to range rejection. As long as the price remains capped below the $1.93–$1.95 region, upward attempts are likely to be corrective rather than indicative of a trend change.

Summary of price action

XRP fluctuated in a $0.09 range during the session, initially rising towards $1.95 before a sharp reversal. Selling pressure intensified as the price fell back into the $1.92–$1.94 range, leading to thin buying near the lower boundary.

Following the breakdown, XRP found stability around $1.90, where selling pressure diminished and volume began to return to normal levels. Hourly price movements suggest consolidation forming just above the $1.88–$1.90 area, although no strong reversal signals have yet appeared.

Key points for traders

The $1.93 mark now serves as the primary resistance. Any recovery effort must reclaim this area on substantial volume to shift momentum back towards a neutral stance. Failing to do so keeps downside risks on the table.

On the downside, the $1.88–$1.90 range is crucial to monitor. A sustained break below this level would reveal deeper support levels, while a successful defense could enable XRP to consolidate ahead of the next directional move.

For the time being, monitoring volume behavior is essential. Continued selling on rallies would validate ongoing distribution, while diminishing volume near support would indicate the market is moving from breakdown to stabilization.