Today, December 2, the cryptocurrency market saw a notable rebound, with Bitcoin and leading altcoins increasing by more than 1% within the last 24 hours, pushing the total market capitalization of all tokens close to $3 trillion.

Summary

- The crypto market is experiencing gains today as liquidations decrease.

- This surge is partly attributed to the 90% likelihood that the Federal Reserve will reduce interest rates in December.

- However, the current rebound could potentially be a dead-cat bounce, often referred to as a bull trap.

Crypto market rises as liquidations decline and open interest increases

Bitcoin (BTC) and various altcoins have shown recovery, as data from third parties indicated a slight uptick in futures market engagement.

According to CoinGlass, liquidations dropped significantly by 60% on Tuesday, totaling $328 million, while futures open interest showed a slight increase to $125 million.

A reduction in liquidations is considered a positive indicator, suggesting that fewer bullish positions are being forcibly liquidated by both centralized and decentralized exchanges.

Nonetheless, signs among crypto investors indicate a level of concern regarding liquidations, especially following the catastrophic event on October 10, which eliminated over 1.6 million traders and saw total liquidations surpassing $20 billion—marking the worst performance in a single day.

Cryptocurrencies rise as Fed cut probabilities soar to 90%

The crypto market’s rebound corresponds with investor anticipation that the Federal Reserve will lower interest rates by 0.25% in its forthcoming meeting.

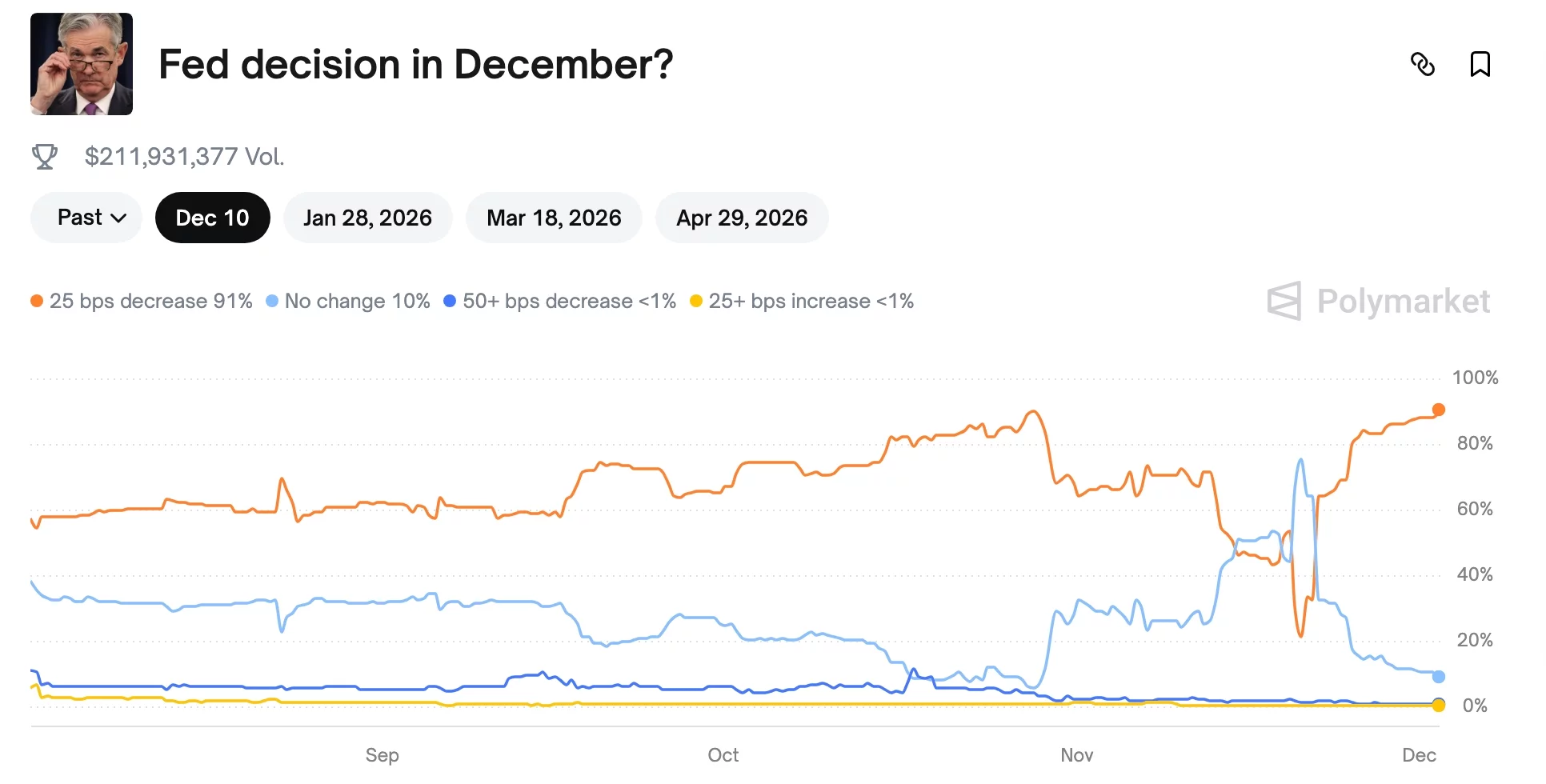

A Polymarket poll featuring over $212 million in assets indicates that the likelihood of a rate cut in December has risen to 90%, up from under 50% in November.

Simultaneously, the Fed has halted its quantitative tightening strategy, which resulted in a $2 trillion reduction in its balance sheet over the last two years.

Moreover, indications suggest that the bank might soon start quantitative easing, aimed at injecting liquidity into the economy to foster growth.

Recently, the bank injected $13.5 billion into the banking system through overnight repos, marking the second-largest capital infusion since the pandemic.

Risk of a dead-cat bounce or bull trap

The rise in the crypto market is also fueled by investors capitalizing on the dip, a common reaction after assets decline, as seen on Monday.

This creates a potential risk that the current resurgence in cryptocurrency values may be a dead-cat bounce, or a bull trap.

A dead-cat bounce occurs when a declining asset initially rises again but then continues its downward trajectory. This term is known as a bull trap because it misleads traders into thinking a bull market is developing, only for prices to revert to their decline.

Over the last few months, the crypto market has experienced several bull traps. For instance, it rebounded from $98,990 on November 3 to $107,276 on November 11, before continuing its downward trend.