Next Technology Holding’s stock, NXTT, experienced minor losses following the announcement of its intentions to raise $500 million for acquiring more Bitcoin (BTC) and other corporate initiatives.

It’s not the only Bitcoin treasury firm facing challenges. KindlyMD’s NAKA stock plunged over 55% after the CEO warned investors about an anticipated increase in ‘share price volatility.’

Next Tech Holding Plans $500 Million Offering, Shares Fall

Sponsored

Sponsored

In a Form S-3 filing with the US Securities and Exchange Commission, the firm revealed plans to sell up to $500 million in common stock through one or more offerings, noting that the raised funds would support general corporate activities, including Bitcoin acquisition.

“We intend to use the net proceeds from the sale of any securities offered under this prospectus for general corporate purposes, including, but not limited to, the acquisition of Bitcoin,” the filing states.

This decision aligns with a broader trend of corporations seeking greater exposure to digital assets, with Bitcoin being the primary choice. According to Bitcoin Treasuries, Next Technology Holding is already among the top 20 corporate holders of BTC, possessing 5,833 coins valued at $673.96 million.

However, the announcement failed to bolster investor confidence, as Yahoo Finance data indicated NXTT stock dropped 4.79% to $0.14.

KindlyMD Stock Crashes 55% After PIPE Shares Hit Market

Meanwhile, the difficulties faced by Next Technology are not unique. KindlyMD, a Nasdaq-listed healthcare firm that merged with Nakamoto Holdings to create a Bitcoin Treasury, experienced even larger losses.

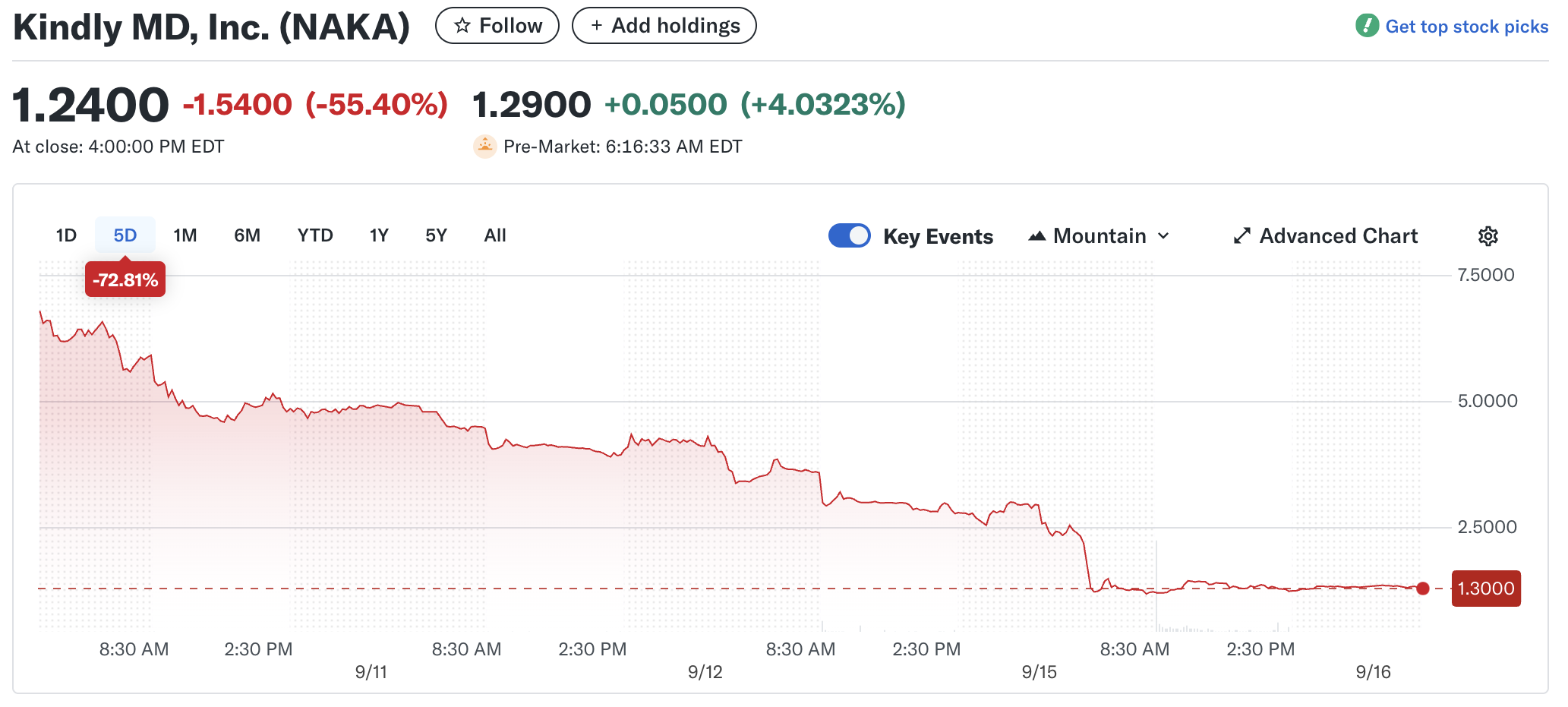

NAKA fell over 55%, closing at $1.24. In pre-market trading, the stock gained a modest boost of around 4%, insufficient to offset the losses.

Sponsored

Sponsored

The decline is indicative of a larger trend, as the stock has plummeted nearly 73% over the past five days, with a monthly decrease of 90.9%.

So what triggered this latest drop? In a shareholder letter released Monday, KindlyMD’s CEO, David Bailey, explained that increased volatility was expected as a new batch of shares entered the market.

“On Friday, September 12th, we filed Form S3, registering the shares sold in our PIPE fundraising. With these shares entering the market, we expect share price volatility may increase for a period,” Bailey stated.

Nonetheless, the CEO highlighted this as an opportunity to solidify the company’s foundation with shareholders who align with its long-term vision. He urged short-term traders to step back, emphasizing that the upcoming weeks and months would be crucial for uniting committed supporters.

He asserted that the company is well-equipped to advance its strategy and emerge from this phase with stronger alignment and conviction among investors.

While Bailey’s remarks convey optimism, the stock’s erratic movements underscore ongoing worries about performance tied to cryptocurrencies—a sector known for its volatility. This decline has also drawn significant criticism from Peter Schiff, a notable economist and BTC skeptic.

“From the outset, I warned that Bitcoin treasury companies were Ponzis built on a pyramid. Today NAKA, one of these companies, dropped by 55%. Shares are now down 96% since the May peak that aligned with the Vegas Bitcoin Conference, where I advised attendees against investing,” Schiff remarked.

These events highlight the challenges faced by companies transitioning to Bitcoin treasuries, where despite advocates arguing for long-term value growth, recent stock declines reflect market skepticism regarding rapid expansions and the risks involved.