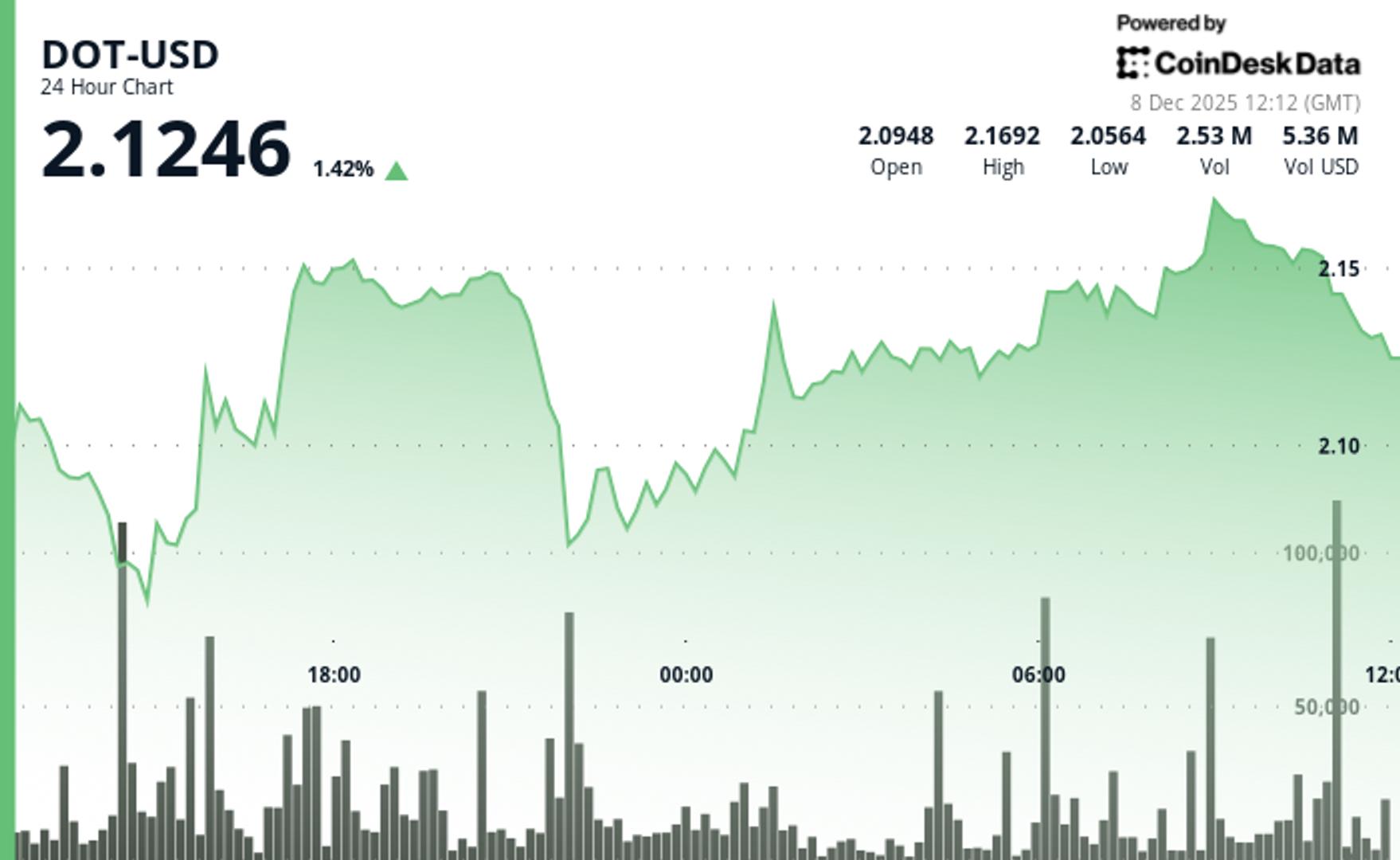

advanced by 0.8% to $2.12 over the last 24 hours, lagging behind the broader cryptocurrency market.

The CoinDesk 20 (CD20) index showed an increase of 2.8% at the time of publication.

The failure of the token to keep pace with crypto market trends indicates a reluctance in investor confidence toward the Polkadot ecosystem, as per CoinDesk Research’s technical analysis model.

This model revealed that the rise occurred on significantly higher trading volume, with 24-hour activity exceeding the seven-day moving average by 26%.

The observed volume trend suggests strategic positioning by market actors rather than random fluctuations, although the relative underperformance points to profit-taking outweighing new investments, according to the analysis.

DOT surged from $2.09 to $2.14 during the session, forming an upward trend with higher lows at $2.05 and $2.09, resulting in a total trading range of $0.13, representing 6.1% volatility, according to the analysis.

A notable volume spike occurred with 5.75 million tokens traded, exceeding the 24-hour average by 134%, pushing the price past resistance at $2.12 to reach session highs near $2.16.

Technical Analysis:

- Strong support has been established at $2.05, with resistance forming around $2.16; immediate support at $2.140 is vital for maintaining a bullish outlook

- Remarkable volume increase of 134% over average during resistance testing; a recent 60-minute volume spike of 145K tokens coincides with distribution patterns

- The upward trend with higher lows from $2.05 to $2.09 contradicts the descending channel observed in shorter time frames

- Potential for an upward target towards $2.16 resistance exists, provided volume supports; downside risks towards $2.05 support reflect a 6.1% range vulnerability

Disclaimer: Portions of this article were generated with assistance from AI tools and reviewed by our editorial team for accuracy and compliance with our standards. For further details, refer to CoinDesk’s full AI Policy.