Key Insights

- The Philippines intends to acquire 2,000 BTC each year for five years.

- Bitcoin reserves may aid in reducing national debt and enhancing economic resilience.

- Nations such as El Salvador and Bhutan have already embraced Bitcoin as a valuable asset.

Philippines Proposes Strategic Bitcoin Reserve to Enhance Economic Stability

Should the bill for a strategic Bitcoin reserve be approved, the Central Bank of the Philippines would acquire 2,000 BTC annually for a duration of five years. This ambitious initiative, introduced by Congressman Miguel Luis Villafuerte, aims to establish a long-term reserve of 10,000 BTC for the nation.

The bill stipulates that the assets will be held in cold wallets for at least 20 years, a strategy designed to shield the country from economic turbulence. Throughout this time, authorities could sell or swap portions of the Bitcoin to reduce national debt, further incorporating digital assets into the Philippines’ economic framework.

The Vision Behind a National Bitcoin Reserve: Why the Philippines is Leading the Charge

After the holding period lapses, the bank would be permitted to liquidate no more than 10% of the reserve biennially. Villafuerte highlighted that Bitcoin’s increasing influence in the global market necessitates proactive legislative actions from the Philippines.

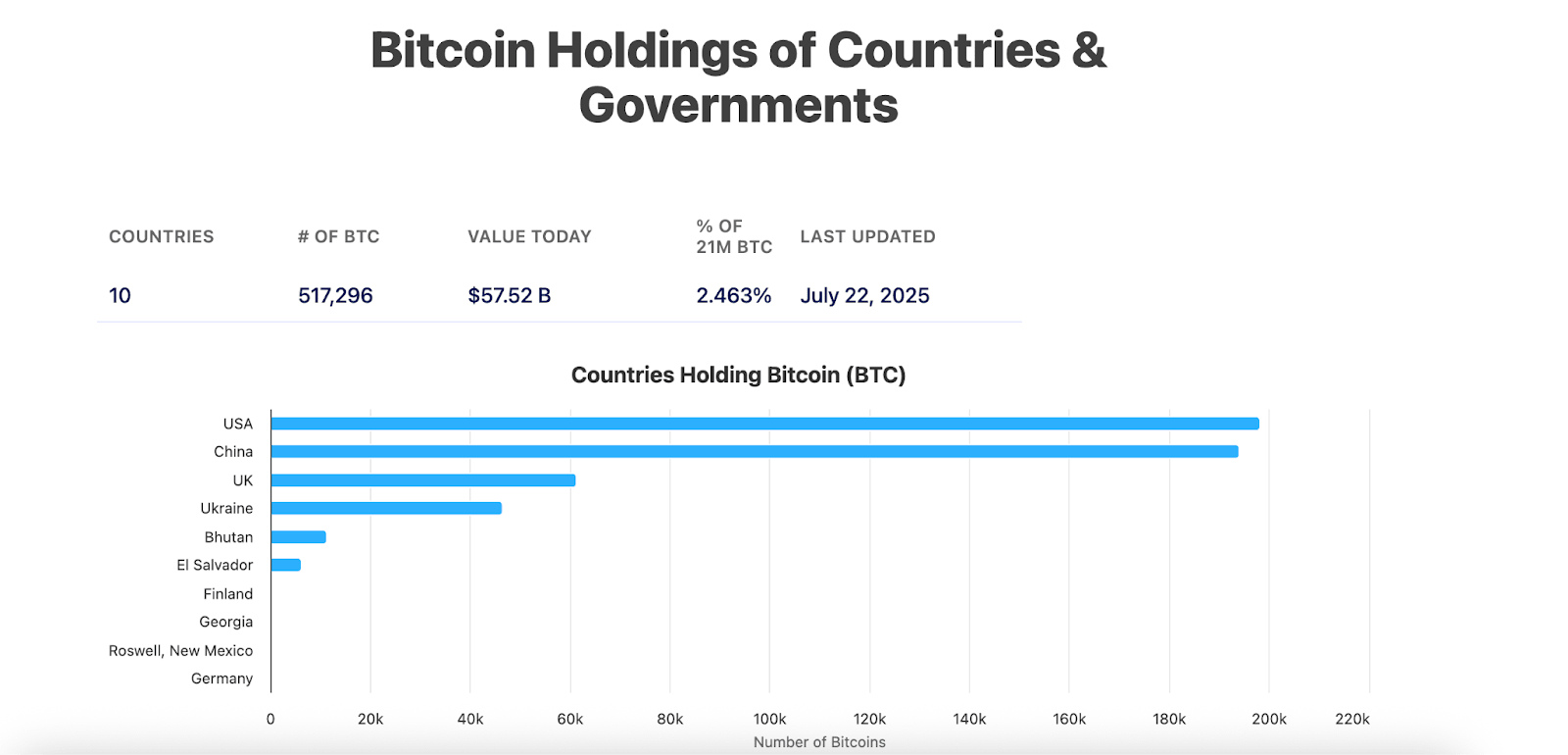

This initiative aligns the country with others like El Salvador and Bhutan, which have acknowledged Bitcoin, or “digital gold,” as a national asset. By embracing Bitcoin, these nations are reflecting the cryptocurrency’s growing significance in the international financial arena.

More Nations Considering Bitcoin Reserves for Economic Security

Worldwide, there are 517,296 BTC held by governments, constituting 2.46% of Bitcoin’s available supply. The US and China are at the forefront in terms of seized Bitcoin holdings. This increasing trend paves the way for countries globally to adopt parallel approaches.

In November, Brazil suggested a bill for reallocating up to 5% of its international reserves into Bitcoin, mirroring the Philippines’ approach.

What Could a Strategic Bitcoin Reserve Imply for the Philippines’ Future?

As Bitcoin solidifies its status as a global asset, the Philippine government’s initiative to create a 10,000 BTC reserve could offer economic adaptability and strengthen the nation’s standing in the digital economy.

Nonetheless, this strategy faces criticism, with various nations and analysts expressing doubts regarding its long-term sustainability.

Will this initiative safeguard the Philippines from global economic fluctuations, or will it subject the country to the potential risks associated with a volatile digital asset?