Certainly! Here’s the rewritten content while keeping the HTML tags intact:

Crypto prices began the week on a downward trend, with traders showing caution as Uptober approaches, reflecting a decline in top tokens from their recent peaks.

Summary

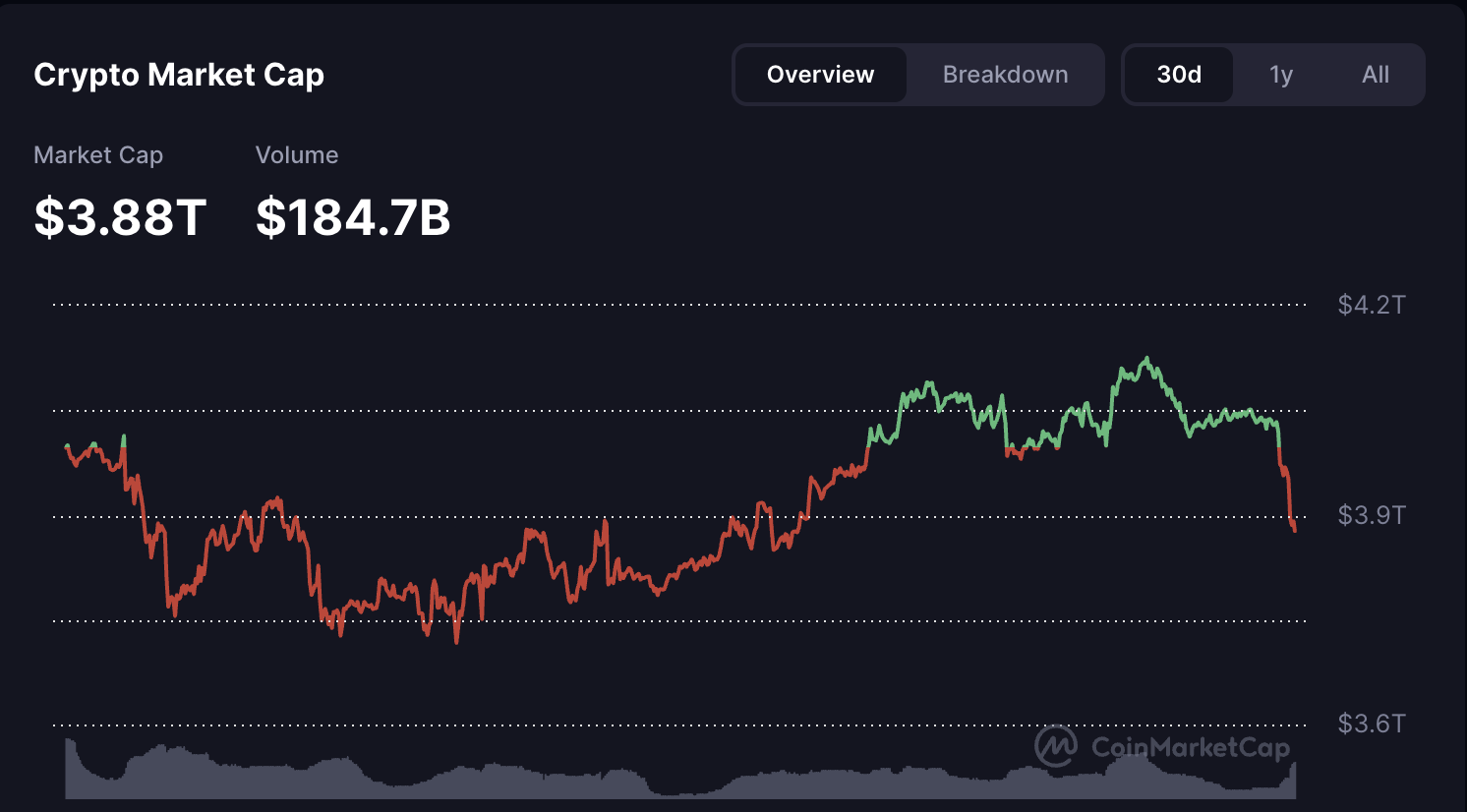

- Crypto values have decreased by 5.6% over the past four days, erasing $230 billion in total market capitalization.

- Bitcoin has fallen from $117,000 to $112,000, with Ethereum and Solana also experiencing significant losses.

- Profit-taking following recent price rallies has intensified the selling pressure on major cryptocurrencies.

- In the last 24 hours, over $1.7 billion in leveraged positions were liquidated.

Uptober, just eight days away, is historically a time when Bitcoin sees notable gains, yet traders are becoming wary as recent price trends indicate a loss of momentum. The overall crypto market cap has declined by nearly 4% in the last 24 hours, losing about $158 billion according to CoinMarketCap data.

As the total crypto market cap declines, the Bitcoin (BTC) rally has shifted to a consistent downward trend. Starting the day above $115,000, the leading cryptocurrency has dropped to as low as $112,000, placing it down 2.31% on the day as of this writing. Other major altcoins are experiencing a similar pullback. Ethereum (ETH) has seen a decline of around 6% in the past 24 hours and approximately 10% this week, settling around $4,200.

Solana (SOL) has faced even steeper declines, reversing last week’s gains after climbing from approximately $230 to above $250. The token is currently down over 7% on the day, trading close to $222. Other cryptocurrencies like XRP (XRP) and ADA have also dipped in the broader market downturn, experiencing drops of about 5% to 6%.

What is driving the decline in crypto prices?

The pullback in prices, undermining the optimism surrounding Uptober, can be attributed to profit-taking, actions from the Fed, leveraged liquidations, and bearish market signals. As investors lock in profits instead of pursuing new highs, the ongoing retracement in crypto values is apparent. Bitcoin briefly reached $118,000 last week, while Ethereum peaked at $4,600, with altcoins like BNB (BNB) recently surpassing $1,000 for the first time.

This wave of selling amid strength has exerted additional pressure on the market, leading to substantial liquidations. In the past 24 hours, more than $1.7 billion in leveraged positions have been wiped out, primarily from long trades on Bitcoin and Ethereum.

Meanwhile, the long-anticipated Federal Reserve rate cut announced last week did little to buoy the crypto market. The 25 basis point reduction to 4.00%–4.25% initially lifted market sentiment, but the uptick quickly diminished. Chairman Jerome Powell reinforced that further cuts are not assured, emphasizing that policymakers are focused on data and inflation control. This caution dampened market sentiment, turning expected post-cut optimism into a widespread sell-off.

Current market sentiment and technical analysis indicate a shift. The Bitcoin Fear & Greed Index has decreased to 45 from 49 just a day prior, indicating a rapid shift towards caution among traders.

Looking forward to ‘Uptober’

Despite the ongoing decline, history shows that October tends to bring solid returns for Bitcoin and the crypto market, earning the moniker “Uptober.” Over the past five years, the month has typically seen double-digit percentage increases, a trend that many traders are watching as a potential trigger for renewed buying.

If macroeconomic conditions stabilize and risk sentiment improves, capital may flow back into the market. On-chain data indicates continued outflows from exchanges, suggesting that long-term holders are transferring assets off trading platforms, indicative of sustained conviction. Should buying pressure resurface, the seasonal uptick in October could enable crypto prices to regain their momentum.