Here’s the rewritten content with the HTML tags preserved:

Bitfinex analysts predict that Bitcoin may target the $117K–$120K range, but its recovery relies on new capital flowing into the spot market.

Summary

- Bitfinex analysts observe a 2.5x disparity between sellers and buyers in the cryptocurrency markets

- $1 trillion was wiped off the crypto market due to escalating U.S.–China trade tensions

- Bitcoin’s recovery is contingent on new capital entering the market, given the current ambiguous fundamentals

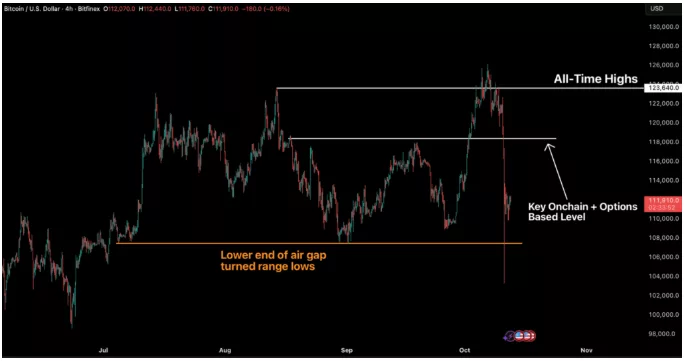

Having endured one of the most severe liquidation events in cryptocurrency history, Bitcoin appears to be on the verge of a recovery. On Monday, October 13, Bitfinex published a report detailing the crash and offering insights on potential recovery pathways. Nevertheless, the outlook is heavily influenced by spot demand and broader economic clarity.

BTC managed to recover from the largest liquidation event when measured by notional value. Triggered by U.S.-China trade tensions, the crash erased nearly $1 trillion from the crypto market’s cap within hours, dropping from $4.26 trillion to $3.30 trillion.

While Bitcoin (BTC) dropped by 18.1%, altcoins saw declines of up to 80%, with some experiencing temporary illiquidity. The report highlights a 2.5x imbalance favoring sellers as a key factor that led to the flash crash, resulting in $19 billion worth of futures liquidations in just one day. Although BTC has seen some rebound, its further recovery remains uncertain.

Is Bitcoin set to recover to $120,000?

Bitfinex analysts indicate that the recovery is primarily dependent on BTC maintaining its key support level at $110,000, positioning it to potentially retest the $117,000 to $120,000 range. However, further gains will hinge on spot demand and overarching economic conditions.

For a complete recovery, Bitcoin must attract new capital flows to increase spot demand. This influx is largely tied to macroeconomic conditions, which are currently obscured by the absence of economic data due to the U.S. government shutdown.

“Currently, the lack of data may be concealing underlying weaknesses. Should the shutdown continue, postponed reports on inflation and employment could heighten volatility once they are eventually released. Nevertheless, the market’s message is clear: liquidity, credit confidence, and expectations of further easing from the Fed are sustaining the economy, even as political uncertainty persists in Washington,” remarked analysts at Bitfinex.