The on-chain analytics company CryptoQuant has highlighted five crucial Bitcoin on-chain alerts to monitor in the upcoming week.

Bitcoin Is Witnessing Developments in These Metrics

In a recent thread on X, CryptoQuant discussed several Bitcoin on-chain alerts that warrant attention during the cryptocurrency’s current consolidation phase.

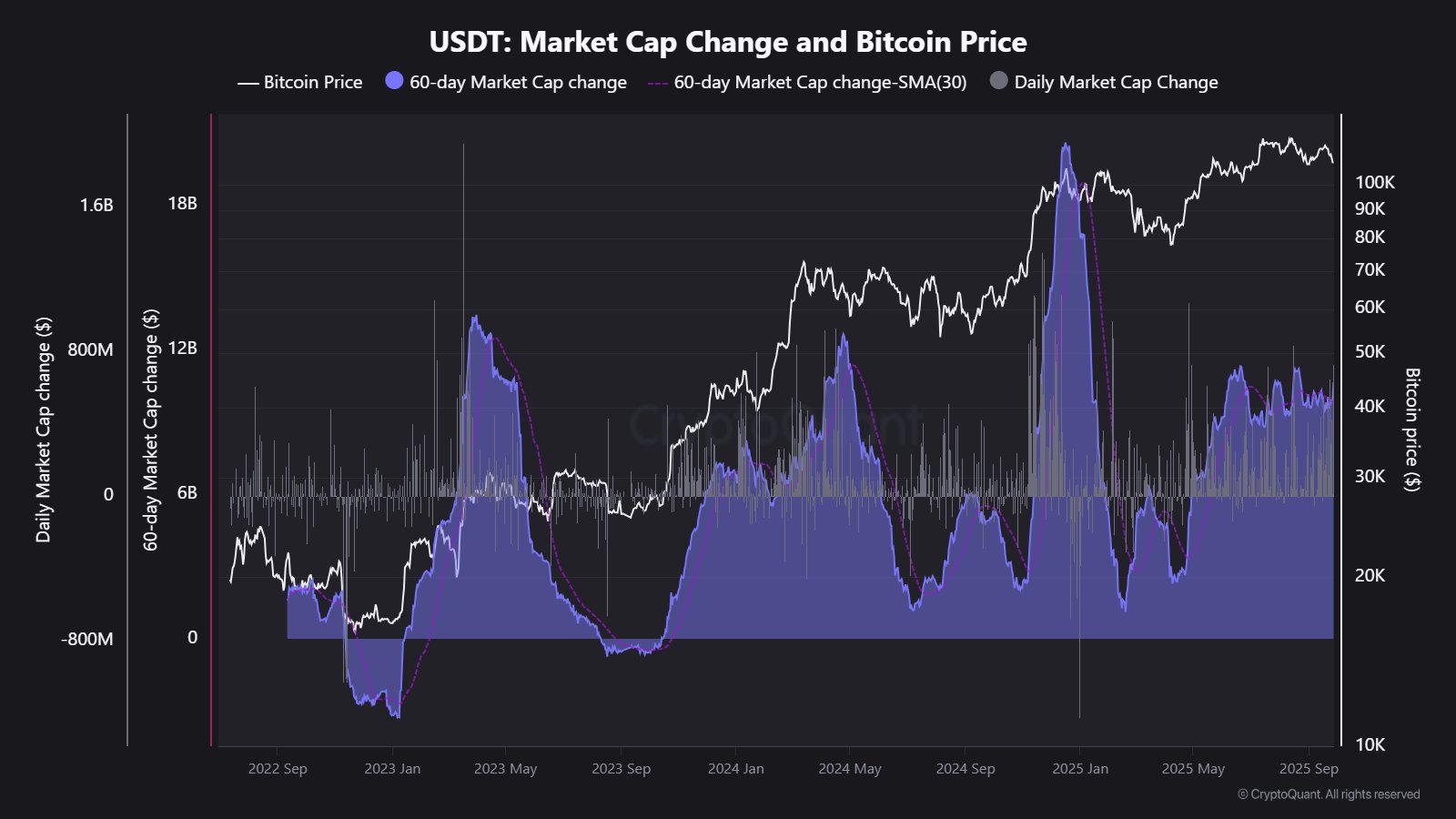

The first indicator presented by the analytics firm is the 60-day change in the market cap of USDT, the leading stablecoin.

As illustrated in the chart above, the 60-day change in the USDT market cap has consistently remained at a significant positive level recently, signifying growth in the stablecoin.

Stablecoins play a vital role in driving capital into the cryptocurrency market, so an increase in their value is generally a positive indicator. Currently, the 60-day change in the USDT market cap holds a value of $10 billion. “This clearly indicates fresh liquidity is entering the market,” notes CryptoQuant.

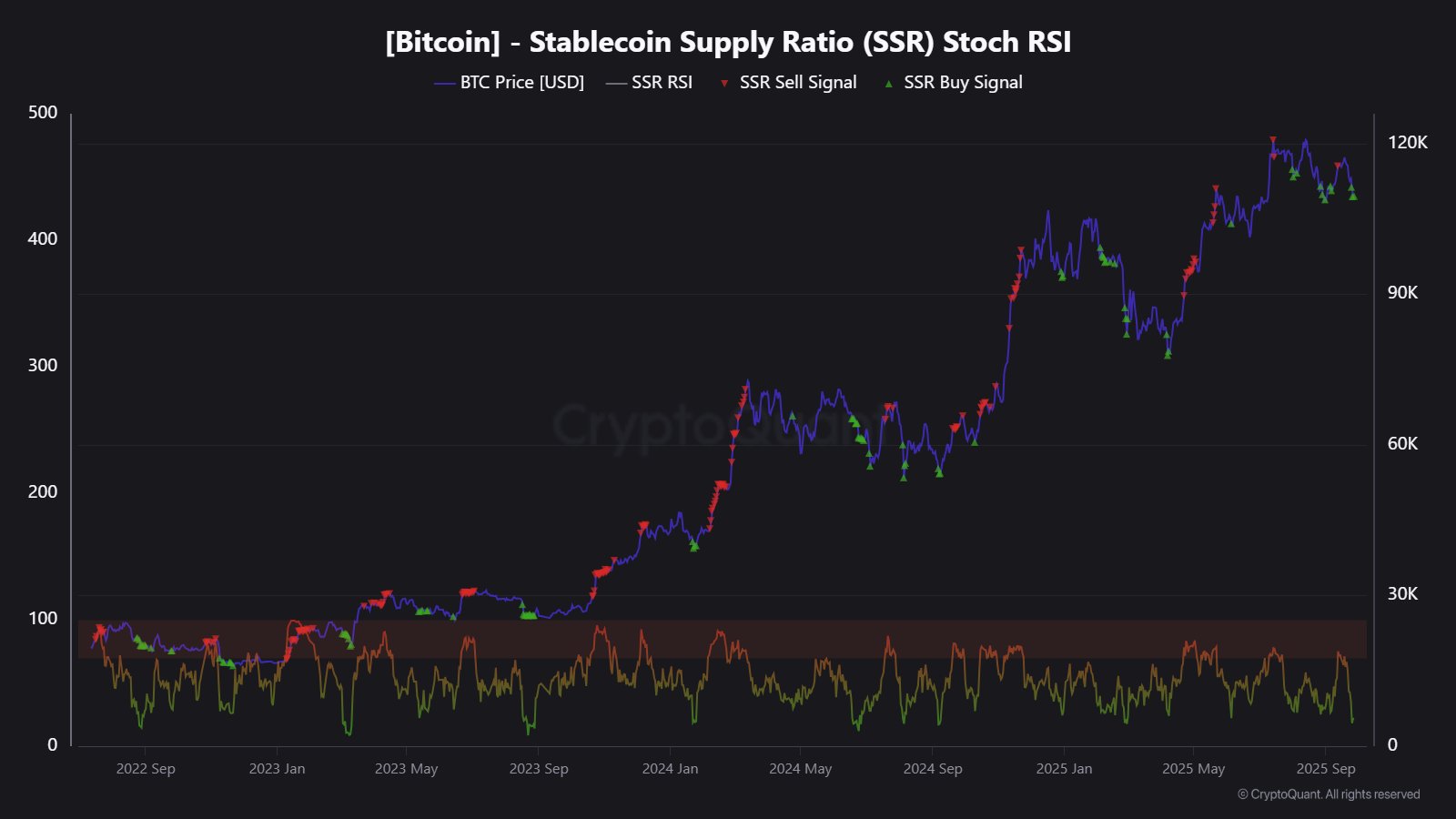

Another stablecoin-related metric of interest for Bitcoin is the Stablecoin Supply Ratio (SSR), which gauges the relationship between Bitcoin’s market cap and the total market cap of all stablecoins.

A low indicator value can signal bullish potential, suggesting that investor purchasing power in stablecoins is substantial relative to the Bitcoin market cap.

The chart below reflects that the Relative Strength Index (RSI) of the BTC SSR currently stands at 21, considered to be within the “buy” territory.

Another developing bullish sign for Bitcoin is in the Accumulator Address Demand, an indicator that tracks the interest from wallets with no history of selling the cryptocurrency. These long-term holders now possess 298,000 BTC, marking a new high.

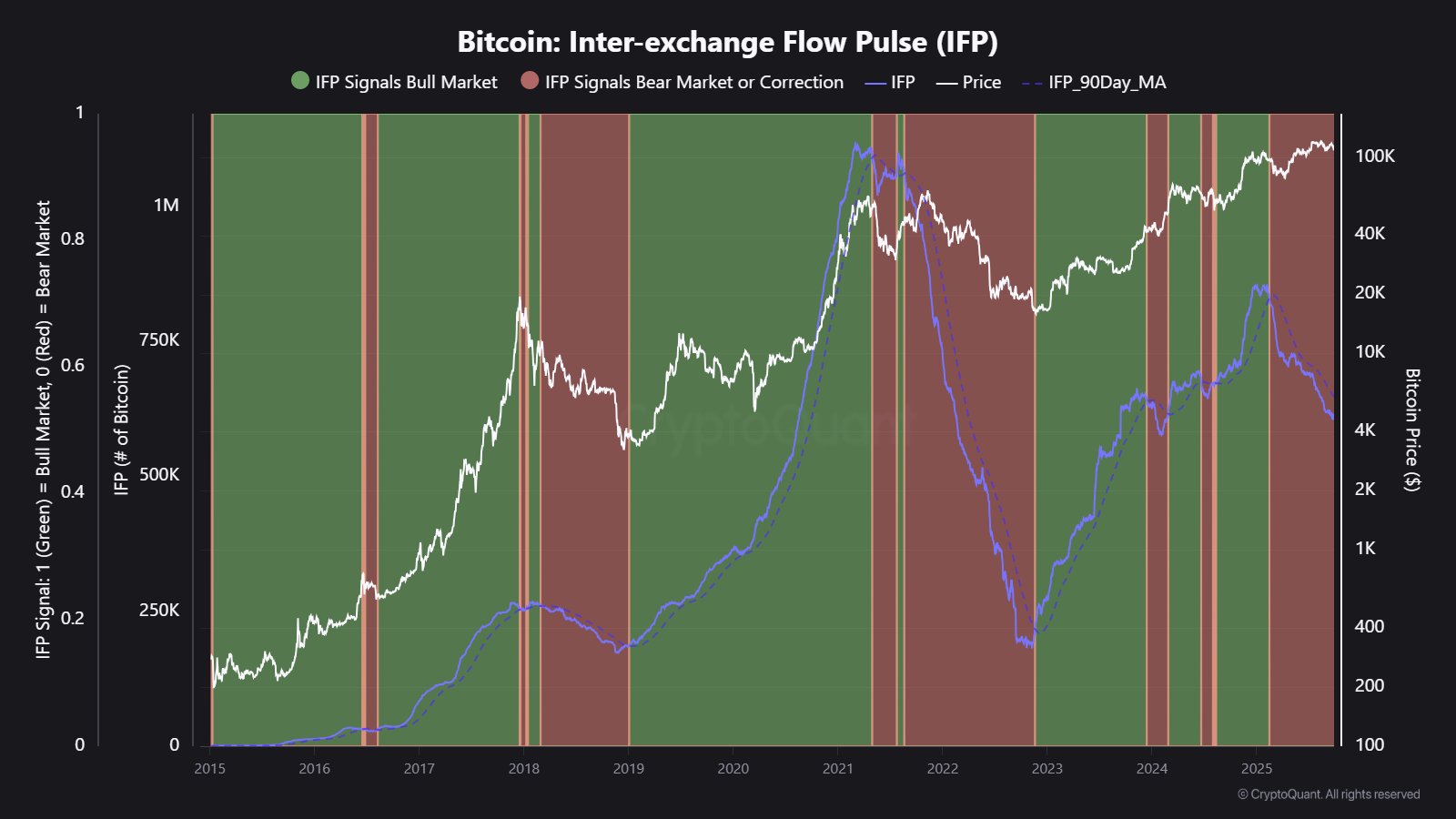

However, a metric still positioned in the bearish zone is the Inter-Exchange Flow Pulse (IFP). This indicator monitors the BTC movement between spot and derivatives exchanges.

The indicator has shown a downtrend over the past few months, which is typically indicative of a bear market. “Keep an eye out: an upward shift often signals the onset of bullish momentum,” advises the analytics firm.

Lastly, CryptoQuant presented the Realized Price of short-term holders (STHs), which evaluates the average cost basis for Bitcoin investors who entered the market in the last 155 days.

During BTC’s recent downturn, STHs briefly faced losses, but the asset has since rebounded above their Realized Price of $109,775. Historically, bullish trends have followed when the coin trades above this threshold.

BTC Price

Bitcoin has surged back to $114,200 following its recent recovery over the past couple of days.