Bitcoin is undergoing a structural transformation, and institutional investors are steadily tightening their grip on the cryptocurrency. As of mid-2025, institutional investors are becoming a dominant force in Bitcoin ownership and are steadily capturing a large portion of its circulating supply.

Institutional Bitcoin Holdings Barrel Toward 20% Of Supply

Recent data shows that institutions, ranging from ETFs to public companies, now control an unprecedented share of Bitcoin, worth hundreds of billions of dollars. Estimates place institutional ownership anywhere between 17 and nearly 31 percent of total supply when also factoring the amount controlled by governments.

Related Reading

According to data from Bitbo, entities such as ETFs, public and private companies, governments, and DeFi protocols collectively hold more than 3.642 million BTC, equal to about 17.344% of the total supply. At today’s prices, that represents roughly $428 billion worth of Bitcoin locked away in institutional treasuries.

ETFs are the largest contributors, with over 1.49 million BTC, while public companies such as Strategy, Tesla, and others account for 935,498 BTC. Strategy’s role is especially noteworthy, as the firm’s relentless accumulation strategy in recent years has seen it amass 628,946 BTC, or about three percent of the entire circulating supply.

Bitbo data shows private companies hold 426,237, worth $50.17 billion, and about 2.03% of the total circulating supply. BTC mining companies own 109,808 BTC (0.523% of the total circulating supply), while DeFi protocols own 267,236 BTC (1.273% of the total circulating supply).

Bitcoin holdings by category. Source: Bitbo

Other reports, including a joint study by Gemini and Glassnode, suggest the numbers could be even higher. Their findings point to centralized treasuries composed of governments, ETFs, corporations, and exchanges controlling up to 30.9% of circulating Bitcoin, which equates to over 6.1 million BTC. This increase represents a 924% surge in institutional control of Bitcoin compared to a decade ago.

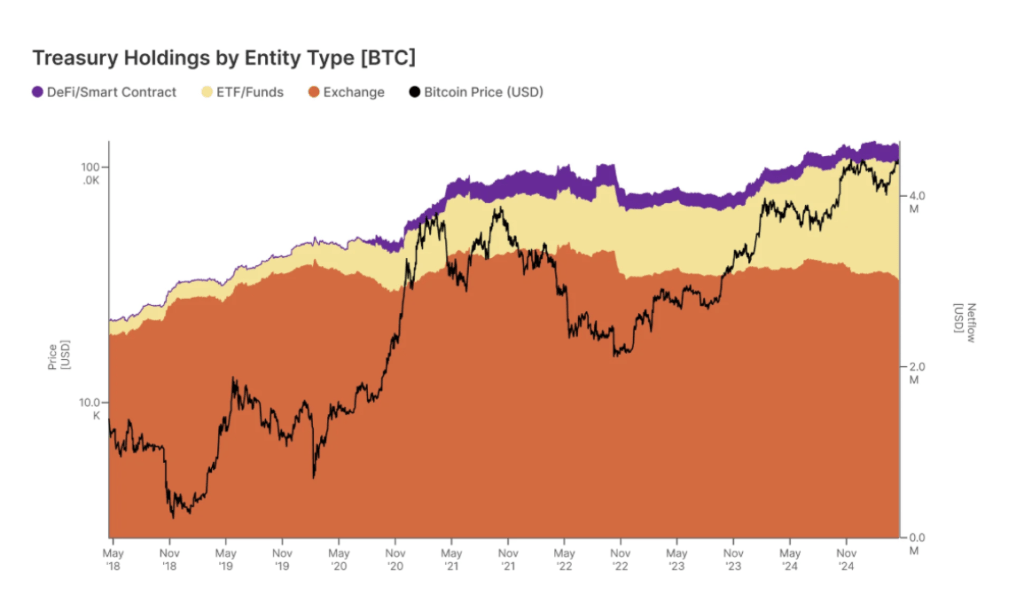

Chart Image From Gemini: Bitcoin treasury holdings by entity type

Is Bitcoin The New Wall Street Playground?

Bitcoin’s rise in its early years was based on a mix of enthusiasm from retail investors and long-term conviction from early adopters, but the market’s balance of power is shifting. According to the holding data, Bitcoin is increasingly becoming much less affordable for retail traders and is now becoming a playground for large Wall Street institutions.

Institutional demand for Bitcoin has not been confined to corporations and ETFs alone. Governments are beginning to make their presence felt, and the United States took the most notable step earlier this year. In March 2025, the US government established a Strategic Bitcoin Reserve filled with seized and forfeited digital assets. Other governments like El Salvador and Bhutan are also accumulating Bitcoin through intentional, ongoing purchases, further tightening the supply in circulation

Related Reading

Some analysts believe this could reduce Bitcoin’s price volatility and support its price growth over the long term. On the other hand, the concentration of Bitcoin among a relatively small number of entities could undermine its decentralization and the natural growth of its price. Either way, the data shows that Bitcoin is now becoming Wall Street’s newest playground.

At the time of writing, Bitcoin was trading at $117,460.

Featured image from Unsplash, chart from TradingView