A significant surge in crypto liquidations is highlighting how many traders have increased their leverage in recent months.

Related Reading

According to a new report from Glassnode and Fasanara, average daily liquidations have risen from approximately $28 million in long positions and $15 million in shorts during the previous cycle to around $68 million long and $45 million short in the current cycle. This change has resulted in far more extreme sell-offs.

Early Black Friday Shock

Reports indicate that October 10 marked a clear indication of this shift. On that day, over $640 million per hour in long positions were liquidated as Bitcoin plummeted from $121,000 to $102,000.

Open interest dropped by about 22% in under 12 hours, sliding from nearly $50 billion to $39 billion. Traders experienced the consequences quickly. Positions were liquidated on a scale that Glassnode described as one of the most severe deleveraging events in Bitcoin’s history.

Futures Activity Hits Records

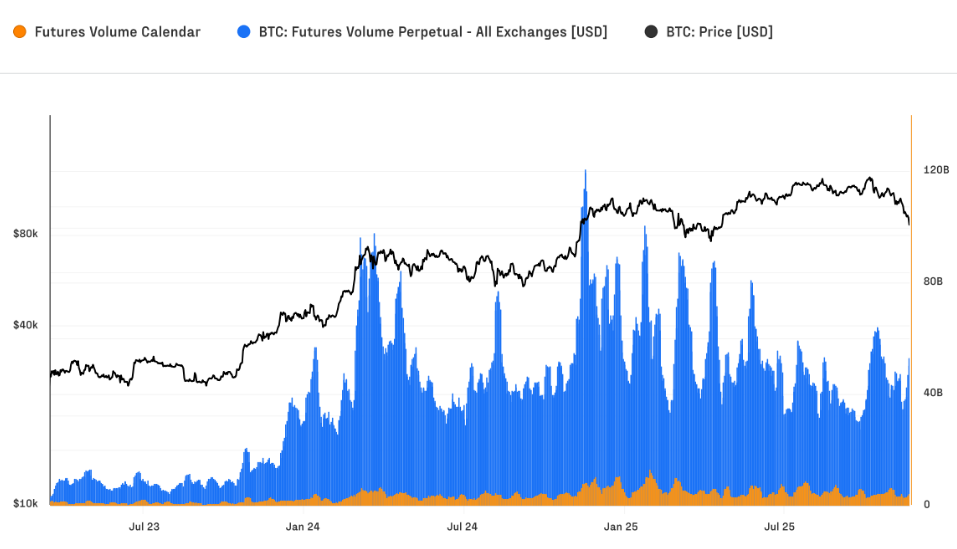

Futures markets have expanded significantly. Open interest surged to an all-time high of $68 billion, with daily futures turnover exceeding $69 billion in mid-October.

Currently, perpetual contracts make up more than 90% of that activity, concentrating risk in instruments that continuously reset.

The increase in average daily futures wipeouts to $68 million long and $45 million short indicates the stakes involved when substantial fluctuations occur.

Spot Trading Doubles

Reports show that spot trading has also gained momentum. Bitcoin’s spot volume has surged into a daily range of $8 billion to $22 billion—approximately double that of the previous cycle.

During the crash on October 10, hourly spot volume surged to $7.3 billion, with many traders opting to buy the dip instead of fleeing the market. This trend has influenced where price discovery occurs.

Capital Flows And Market Share

Monthly inflows into Bitcoin have ranged from $40 billion to $190 billion, elevating the realized market capitalization to a record $1.1 trillion.

Since the low in November 2022, about $730 billion has entered the network—surpassing all previous cycles combined.

Consequently, Bitcoin’s portion of the total crypto market cap increased from 38% in late 2022 to 58% today, according to the report’s findings.

Related Reading

Bitcoin As Settlement Rail

Additionally, another notable statistic has emerged: over the last 90 days, the Bitcoin network facilitated nearly $7 trillion in transfers. This volume exceeded that of major card networks during the same timeframe.

This has led some participants to view Bitcoin not only as a store of value but also as an increasingly significant settlement rail.

Bitcoin Price Action

At the time of this writing, Bitcoin was trading at $93,165, reflecting an increase of 6.5% and nearly 7% in both the daily and weekly timeframes.

Featured image from Unsplash, chart from TradingView