Sure! Here’s the rewritten content while keeping the HTML tags intact:

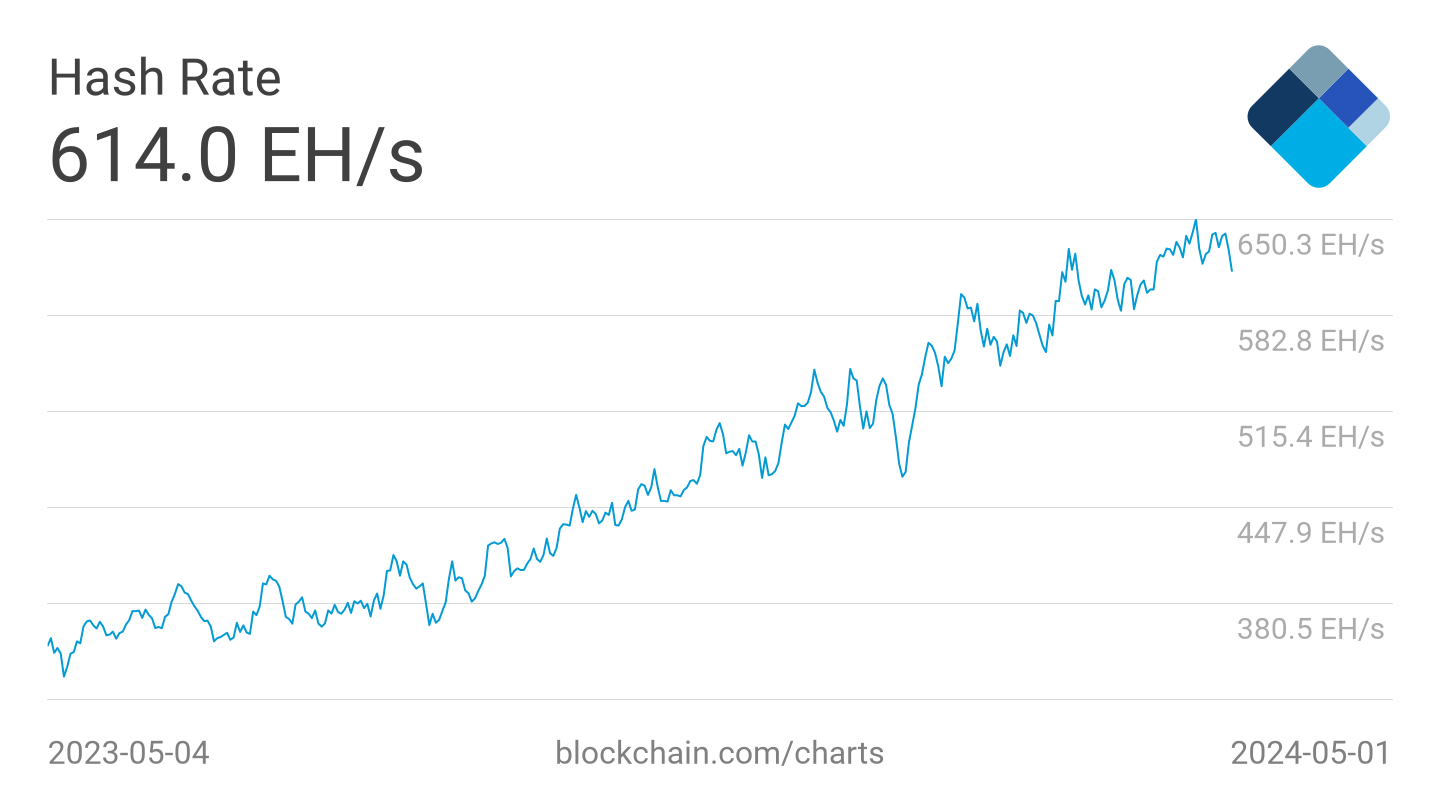

On September 23, Bitcoin achieved a new record hashrate of 1,073 EH/s. In the past month, raw computational power increased by about 21%.

In the last quarter, this growth was approximately 70%. Over the past year, the increase has been staggering, reaching around 675%.

Hashrate was once primarily a topic for miners and technical enthusiasts. Now, it resembles a capital expenditure scoreboard for a tradable industry.

Let’s quickly clarify: What exactly is hashrate, and why should those outside of mining care?

Hashrate represents the total computational power directed at Bitcoin’s proof-of-work, indicating how difficult it would be to override the network and alter the ledger. Higher hashrate increases the cost and reduces the feasibility of an attack. However, the more compelling aspect is not merely “safety”; it reflects the industry’s scale behind it.

A zetahash does not materialize without years dedicated to setting up facilities, installing transformers, unloading container loads of machinery, and securing energy contracts capable of powering entire communities. Every uptick signifies investment and engineering manifesting in reality.

Mechanically, the protocol maintains steady block production by adjusting difficulty every 2016 blocks, akin to a treadmill that speeds up as runners improve. When hashrate spikes, as seen in September, the treadmill accelerates in subsequent epochs, tightening margins.

This feedback loop drives business dynamics: machines come online, blocks are produced too rapidly, difficulty adjusts, and unit economics compress until only the most efficient miners maintain their advantage. The protocol is neutral; it doesn’t negotiate. Miners must meet their energy price and efficiency targets or risk being sidelined.

The latest figure recorded a new peak of approximately 1,073 EH/s. In the past month alone, around 184 EH/s were added at the peak of this surge, a jump that would have represented the entire network not long ago.

Year-to-date, hashrate has risen by approximately 36%. Each psychological milestone has been crossed with a consistent rhythm: 1 EH/s in early 2016, 10 EH/s by late 2017, 100 EH/s by late 2019, 500 EH/s in late 2023, and now entering the four-comma range. These milestones signal advancements in industrial capacity: new-generation ASICs, denser racks, improved firmware, and cheaper energy.

Focusing on “why hashrate matters beyond mining” can lead to misguided perspectives. It is critically important for mining since public miners now occupy a central role in this sector. Companies like MARA, RIOT, CLSK, CORZ, IREN, CIFR, and others are not simply trading proxies for Bitcoin; they operate firms linked to this intricate process.

When hashrate rises more rapidly than price, difficulty pursues it, compressing hashprice. This dynamic becomes evident during earnings calls: factors such as fleet age and watts per terahash start to matter significantly more than sophisticated treasury strategies.

Operators with energy costs below $0.04-$0.05/kWh, alongside efficient immersion or high-utilization air-cooled sites, manage these adjustments without sacrificing margins. Meanwhile, others experience rising breakeven points.

The narrative surrounding equity markets is straightforward, yet the execution is challenging.

The scale of the situation has transformed into a genuine infrastructure challenge: lead times for substations, transmission constraints, connection queues, and local political issues regarding load placement. This is why the hashrate chart resembles a blueprint of effective execution.

A network that has just surpassed one zetahash epitomizes an industry filled with tangible assets globally, concentrated in areas with low energy costs and supportive local governments. The stock market reflects that differentiation.

Firms with modern fleets and accessible megawatts seize opportunities during a market upswing; others risk dilution, consolidation, or being quietly sidelined when the next difficulty adjustment occurs.

The industry often feels inclined to interpret hashrate spikes as indicators of price movements.

However, a more insightful narrative is that price reflects market sentiment while hashrate demonstrates commitment. Mining rigs don’t spontaneously materialize due to positive social sentiment. The activity logged indicates months of capital expenditure already allocated and additional months of delivery awaited.

If spot prices stagnate, difficulty will continue to drive firms towards efficiency. Should prices rise concurrently, we can expect to see public companies surge as operational leverage turns favorable.

The recent month’s +20% and the quarter’s +70% are not only substantial; they are also rapid. The largest single 30-day gain in this surge occurred in mid-September, serving as a reminder that deployment rhythms are now irregular, with containers arriving in bursts and power coming online in segments, influenced by grid conditions.

This rhythm will determine the leaderboard in the upcoming epochs.

A narrative can be fabricated. However, delivered power cannot be faked.