Bitcoin’s behavior surrounding announcements from the US Federal Reserve has emerged as one of the most consistent market trends this year. Following every FOMC update, the largest cryptocurrency in the world has exhibited a marked downward movement, highlighting its increasing correlation with shifting interest-rate expectations and broader macroeconomic sentiment.

Implications of Future FOMC Meetings for Bitcoin

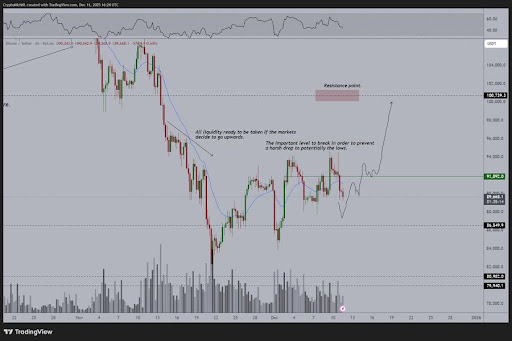

In an X post, analyst CryptoMichNL noted that the Federal Reserve (FED) is adjusting its 2021 liquidity settings toward a more accommodating stance for 2025. However, this shift may not have an immediate effect on the markets, as such adjustments typically require time to manifest. Consequently, Bitcoin has declined after each Federal Open Market Committee (FOMC) meeting in 2025, with these movements primarily designed to liquidate long positions through significant liquidations.

The analyst suggests that the actual market movements and direction should materialize in the next 1-2 weeks, offering a clearer perspective as we approach 2026. The bullish trend remains untouched, and the current thesis holds true. Nonetheless, BTC should not dip below recent lows during the FOMC flush. Ideally, it should breach the $92,000 resistance zone to test the $100,000 mark.

Bitcoin continues to navigate a volatile pattern, influenced by thin order books and rapid movements in both directions. CryptoMichNL has also emphasized the potential for a new upward breakout for BTC in the coming days to weeks. Despite the fluctuations, BTC has consistently demonstrated higher lows, indicating the formation of an upward structure.

According to CryptoMichNL, as long as the price remains above recent lows, the significant market correction appears to be contrived rather than organic, suggesting that a return to normalcy is likely.

Why Bitcoin’s Market Structure Stays Intact Amid Significant Pullbacks

Bitcoin continues to follow the established cycle. Full-time crypto trader and investor Daan Crypto Trades pointed out that the initial bounce occurred right off the 0.382 Fibonacci retracement level, calculated from the entire cycle’s movement. Realistically, this represents the lowest price point without compromising the overall weekly market structure.

Daan further suggests that the invalidation lies within the higher-timeframe perspective, and the November lows would become a challenging zone for bulls. As the year draws to a close, much of the four-year cycle selling pressure is expected to lessen. Meanwhile, Q1 2026 is poised to be critical, potentially clarifying the future trajectory of the BTC cycle.