Hedera (HBAR) has surged over 40% in the last three months. However, its recent activity indicates that these gains may be in jeopardy.

In the past 24 hours, HBAR’s price has fallen by more than 4%, extending its month-long losing streak to over 11%. With sellers in command, HBAR finds itself in a critical zone, where the only potential support emerges from an improbable source.

Diminishing Interest Fuels Sellers’ Dominance

Examining on-chain data reveals why buyers have retreated. Hedera’s social dominance, which measures its discussion frequency across crypto platforms, has plummeted.

On July 13, it was at 2.417%, but by late August, it declined to just 0.515% — representing a drop of nearly 80%. This loss of interest corresponds with feeble buying flows.

For instance, net flows to exchanges surged sharply over the last month. On July 21, buying pressure was measured at -46.48 million tokens, whereas by August 25, it improved only to -12.24 million.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This indicates a 73% decrease in buying pressure, showing that sellers maintain the upper hand. The absence of buyer confidence helps explain why any slight bounce has been met with selling, keeping HBAR’s price on a steady downward trend.

Derivatives Positioning Is Bearish, Yet an Unexpected Ally

This weakness isn’t confined to spot trading; the derivatives markets exhibit a similar pattern. On platforms like Bitget, open positions are heavily biased towards shorts.

Short leverage reaches $103.97 million, compared to just $34.78 million in long positions — almost 200% more shorts than longs.

This imbalance is distinctly bearish. However, it may also create an unlikely opportunity.

If HBAR’s price begins to rise due to broader market movements, the substantial concentration of shorts between $0.23 and $0.26 could trigger liquidations.

In simple terms, traders betting against HBAR might be compelled to swiftly buy back their positions, potentially driving the price up in a short squeeze. Although sentiment remains negative, this disparity presents the only discernible catalyst for a rebound.

Nonetheless, if the price declines further, even modest long positions could face liquidation risks, driving HBAR’s price down.

Hedera (HBAR) Price on a Precipice

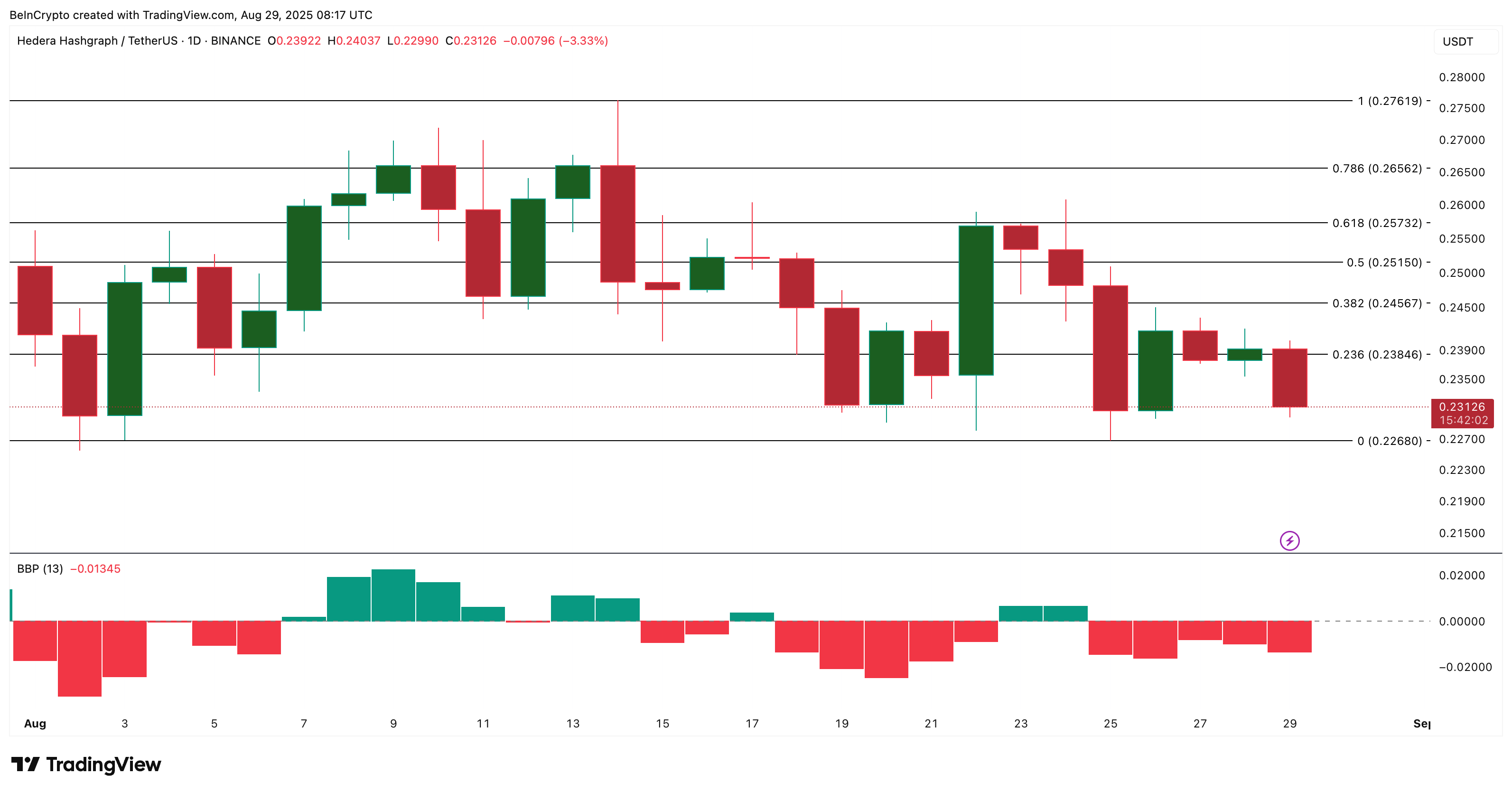

At the time of writing, HBAR is priced at approximately $0.231. Falling below $0.23 could lead to a further decline towards $0.22, especially with the Bull-Bear Power (BBP) indicator shifting strongly into negative territory.

The Bull-Bear Power indicator assesses the balance between buyers and sellers by comparing a token’s highest price over a defined period with its average price. A positive value suggests buyers are pushing prices upwards, while a negative value indicates sellers dominate.

If $0.226 breaks, new local lows could be on the horizon for HBAR’s price. However, if a squeeze occurs, the initial rebound zone lies just above $0.26. Clearing this area would create room for a more significant move, but until then, sellers remain in controlling position.

Without a short squeeze, HBAR is at risk of hitting new local lows despite its impressive gains over the last three months.

Disclaimer

In accordance with the Trust Project guidelines, this price analysis article is intended for informational purposes only and should not be interpreted as financial or investment advice. BeInCrypto strives for accurate and impartial reporting, but market conditions can change without warning. Always perform your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.