As of the latest update, the HBAR price was trading around $0.240 after rising nearly 3% in the past 24 hours. This recovery follows a challenging month where HBAR fell 16.5%, indicative of a distinct downtrend.

Over the past week, gains exceeded 2%, indicating that the token may be beginning to stabilize. However, both technical and on-chain indicators suggest a more significant shift, with initial signs of a potential bullish reversal starting to appear.

RSI Divergence Points to Buyer Resurgence

The key indicator here is the Relative Strength Index (RSI), which evaluates buying and selling momentum. Typically, when prices decrease, the RSI also trends downwards. However, from August 19 to 25, while HBAR’s price hit a lower low, the RSI showed a higher low.

This discrepancy is known as bullish divergence. It indicates that despite a further drop in price, sellers exhibited weaker pressure than before. Buyers absorbed more selling pressure, preventing momentum from collapsing.

Such divergences often precede trend reversals, implying that HBAR’s price might be nearing the end of its one-month decline. However, this isn’t the only positive indicator present.

For token TA and market updates: Looking for more insights like this? Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here.

Net Flows and Bull-Bear Power Provide Confirmation

Hedera (HBAR) net flows further support this narrative. On August 26, the token saw net inflows of about $3.2 million into exchanges, hinting at selling pressure.

By August 27, this changed to outflows nearing $695,000. This reversal in net flows within a single day signals that buyers are beginning to take control.

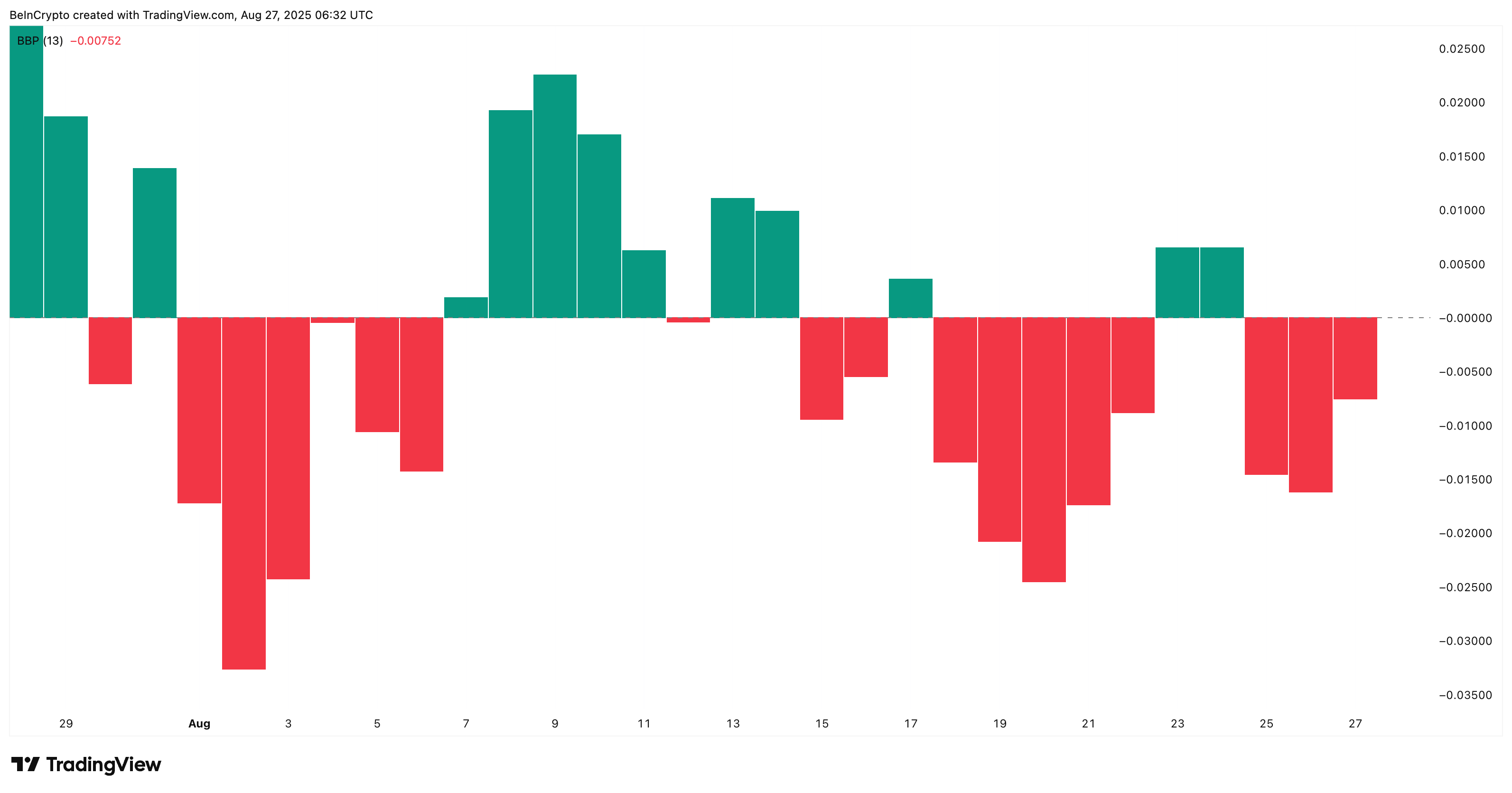

The Bull-Bear Power (BBP) indicator, which assesses the strength of bullish sentiment against bearish pressure, also indicated improvement. Bearish momentum decreased from August 26 to 27, mirroring the declines observed between August 15–16 and August 21–22.

In previous instances, these shifts allowed HBAR bulls to gain temporary control. The current transition appears to be a repetition, providing additional support to the bullish outlook. If HBAR bulls seize control while bullish divergence continues, it could trigger the reversal that Hedera (HBAR) has been anticipating.

HBAR Price Levels Indicate Critical Reversal Areas

The HBAR Price has also successfully flipped a crucial level of $0.239 into support. This is significant, as levels previously viewed as resistance frequently serve as bases when retested.

If the HBAR Price maintains this support, the next targets for upward movement are $0.246 and $0.252. A breakthrough at $0.257 would confirm a trend reversal, while surpassing $0.276 would reinstate complete bullish momentum and conclude the month-long downtrend.

Conversely, if $0.239 fails, the HBAR Price may retreat towards $0.228, jeopardizing the bullish setup.

The post HBAR Price Rebounds as Bullish Divergence Hints at Reversal appeared first on BeInCrypto.