By Francisco Rodrigues (All times ET unless indicated otherwise)

Global markets are at a standstill as investors await the Federal Reserve’s latest policy update, set to occur later today. It is widely expected that the Fed will lower interest rates by 25 basis points. Attention will focus on Chair Jerome Powell for indications of future policy directions.

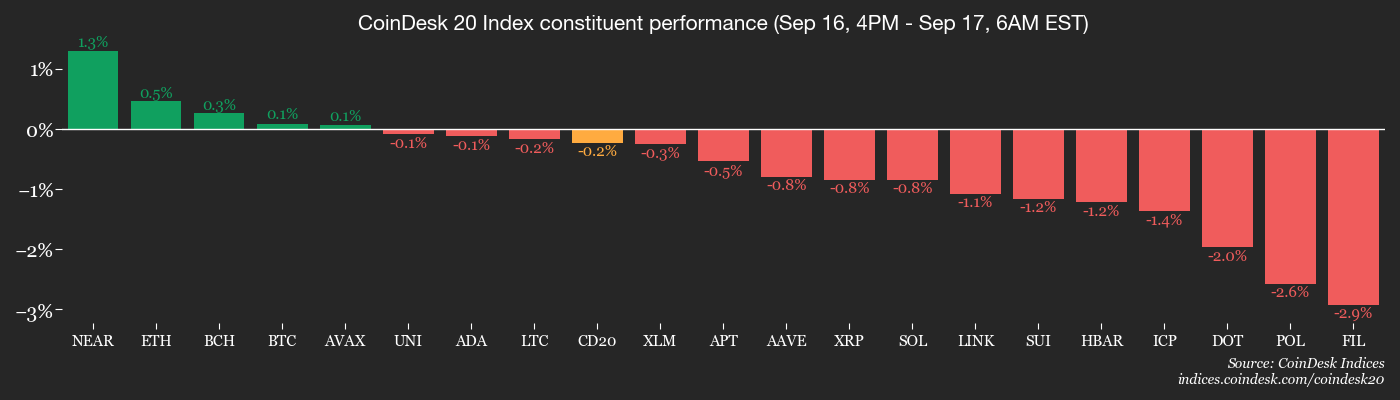

The cryptocurrency market reflects this caution. In the past 24 hours, the CoinDesk 20 (CD20) index remains mostly unchanged, up by a mere 0.2%, while bitcoin (BTC) has risen about 1%. Gold, which surged to an all-time high of $3,700 this week, has dropped 0.5%. Meanwhile, the U.S. dollar index has gained less than 0.2%.

Equity markets show similar stagnation. U.S. stocks declined in yesterday’s trading, whereas European equities see minor advancements. The FTSE All-World Index has risen less than 0.1% today.

That’s the current climate. Looking at a broader timeline, cryptocurrencies are lagging behind stocks.

In the last 30 days, the FTSE All-World Index has increased by 2.78%, while the CoinDesk 20 has added 2.6%, and BTC has gained 1.6%. These movements indicate caution even ahead of a rate cut that would typically enhance the attractiveness of risk assets.

Currently, investors are pricing in six interest rate reductions: three for this year and another three for the next.

“Market expectations are positioned in a Goldilocks range: six cuts represent a middle ground between caution and aggression,” analysts at QCP Capital noted in a report.

“Any deviation in the dot plot, however, could disrupt this balance, forcing investors to recalibrate around the risk of tighter-than-expected conditions or a Fed that struggles to respond effectively to slowing growth,” the analysts added.

The real test for markets will come during Powell’s press conference. A balanced communication is likely to bolster risk assets further, while any hesitation could cause investors to rethink their positions.

Notwithstanding the uncertainty, demand for spot crypto ETFs remains strong. This week, net inflows for spot BTC ETFs reached approximately $550 million, with spot ether ETFs bringing in nearly $300 million. Stay vigilant!

What to Watch

- Crypto

- No major events scheduled.

- Macro

- Sept. 17, 9:45 a.m.: Canada benchmark interest rate decision Est. 2.5%, followed by a press conference.

- Sept. 17, 2 p.m.: Fed decision on U.S. interest rates, including updated dot plot projections. Est. 25 bps cut to 4.00%-4.25%, followed by a press conference.

- Sept. 17, 5:30 p.m.: Brazil benchmark interest rate decision Est. 15%.

- Earnings (Estimates based on FactSet data)

- No earnings scheduled.

Token Events

- Governance votes & proposals

- MantleDAO is voting on maintaining the 2025-2026 budget at $52 million USDc and 200 million MNT. Voting concludes on Sept. 18.

- Sept. 17, 6 a.m.: DYdX will host an Analyst Call.

- Unlocks

- Sept. 17: ZKsync (ZK) will unlock 3.61% of its circulating supply, valued at $10.54 million.

- Token Launches

- Sept. 18: Deadline to convert MKR to SKY before the Delayed Upgrade Penalty takes effect.

Conferences

- Day 2 of 2: Real-World Asset Summit (New York)

- Sept. 17: The Bitcoin Treasuries NYC Unconference (New York)

- Day 1 of 3: AIBC 2025 (Tokyo, Japan)

Token Talk

By Oliver Knight

- Bitcoin (BTC) remains stubborn, trading within a narrow range and rising slightly to $116,000 in the past 24 hours but lacks the momentum necessary for a breakout.

- Altcoins are taking advantage of the subdued volatility, with several experiencing spikes that have led to bitcoin dominance slipping to an eight-month low of 57%, per CoinMarketCap.

- Dominance is a key indicator to evaluate if capital is moving into bitcoin or more speculative altcoins, which appears to be the current trend.

- Another positive sign for altcoins is that the average crypto token RSI, or relative strength index, stands at 45.47. This indicates that altcoins are nearing “oversold” conditions rather than “overbought,” suggesting that many tokens are poised for potential upward movement.

- Notably, bitcoin’s dominance dipped to 33% in 2017 and 40% in 2021, indicating that altcoins could still have room for growth.

- A lot hinges on bitcoin’s performance if it approaches its record high of $124,000. A breakout on strong volume could lead to a capital shift back to the most significant cryptocurrency as investors seek to capitalize on a possible cycle peak, with personalities like Eric Trump predicting $175,000 by year-end.

Derivatives Positioning

- BTC futures open interest across key platforms has risen to $32 billion over the past week.

- Simultaneously, the three-month annualized basis has begun to compress again to around 6-7% across Binance, OKX, and Deribit, making the carry trade only slightly profitable.

- While the increase in OI points to rising activity and engagement in the market, the narrowing basis suggests that directional conviction, particularly on the bullish end, is diminishing, with traders hesitant to pay a premium for future exposure.

- Options data portrays a mixed picture of market sentiment.

- Although the BTC Implied Volatility Term Structure chart indicates an upward slope, signaling that the market anticipates higher long-term volatility compared to short-term, other metrics reveal a more immediate bearish outlook.

- Specifically, the 25 delta skew chart shows either a flat or slightly negative skew for shorter-term options (1-week, 1-month), indicating that traders are paying a premium for puts over calls to protect against potential declines.

- This short-term bearish sentiment contrasts with the 24-hour put-call volume chart, which reveals a higher volume of calls than puts, indicating that most options traders over the last day were positioning for a price increase.

- Funding rate APRs across significant perpetual swap venues have recently experienced some uptick, with BTC annualized funding currently at 17%.

- If this upward trend persists and is echoed by other venues, funding rates would suggest a growing conviction in a directional, bullish bet on prices.

Market Movements

- BTC is down 0.22% from 4 p.m. ET Wednesday at $116,637.44 (24hrs: +1.01%)

- ETH is flat at $4,498.24 (24hrs: +0.00%)

- CoinDesk 20 has dropped 0.58% at 4,272.21 (24hrs: +0.1%)

- Ether CESR Composite Staking Rate is down 2 bps at 2.86%

- BTC funding rate is at 0.0077% (8.4589% annualized) on Binance

- DXY is up 0.14% at 96.76

- Gold futures are down 0.52% at $3,705.60

- Silver futures have decreased 2.14% at $42.00

- Nikkei 225 closed down 0.25% at 44,790.38

- Hang Seng closed up 1.78% at 26,908.39

- FTSE is up 0.20% at 9,213.65

- Euro Stoxx 50 has risen 0.11% at 5,377.98

- DJIA closed on Tuesday down 0.27% at 45,757.90

- S&P 500 ended down 0.13% at 6,606.76

- Nasdaq Composite remained unchanged at 22,333.96

- S&P/TSX Composite closed down 0.39% at 29,315.23

- S&P 40 Latin America rose 0.52% at 2,919.60

- U.S. 10-Year Treasury rate is down 1 bps at 4.016%

- E-mini S&P 500 futures remain steady at 6,669.00

- E-mini Nasdaq-100 futures are unchanged at 24,525.25

- E-mini Dow Jones Industrial Average Index is steady at 46,146.00

Bitcoin Stats

- BTC Dominance: 58.3% (unchanged)

- Ether-bitcoin ratio: 0.0386 (0.15%)

- Hashrate (seven-day moving average): 1,021 EH/s

- Hashprice (spot): $54.43

- Total fees: 4.18 BTC / $483,499

- CME Futures Open Interest: 144,220 BTC

- BTC priced in gold: 31.8 oz.

- BTC vs gold market cap: 8.91%

Technical Analysis

- Bitcoin has increased from $107K to $117K, now trading above all critical daily exponential moving averages.

- Despite this strength, the overall sentiment remains cautious.

- For momentum to persist, bulls will seek a decisive reclaim of the daily order block between $117K and $119K, an area that aligns with the weekly order block formed in early August.

Crypto Equities

- Coinbase Global (COIN): closed on Tuesday at $327.91 (+0.27%), -0.52% at $326.19 in pre-market

- Circle (CRCL): closed at $134.81 (+0.57%), +1.07% at $136.25

- Galaxy Digital (GLXY): closed at $31.83 (+3.44%), -1.35% at $31.40

- Bullish (BLSH): closed at $51.36 (+0.55%), -0.35% at $51.18

- MARA Holdings (MARA): closed at $17.53 (+7.94%), -0.34% at $17.47

- Riot Platforms (RIOT): closed at $17.52 (+5.04%), +0.23% at $17.56

- Core Scientific (CORZ): closed at $16.18 (-0.86%), unchanged in pre-market

- CleanSpark (CLSK): closed at $11.20 (+8.84%), unchanged in pre-market

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $39.86 (+2.92%), -1.15% at $39.40

- Exodus Movement (EXOD): closed at $29.70 (+6.53%), -1.11% at $29.37

Crypto Treasury Companies

- Strategy (MSTR): closed at $335.09 (+2.23%), +0.21% at $335.80

- Semler Scientific (SMLR): closed at $29.11 (+2.54%)

- SharpLink Gaming (SBET): closed at $16.95 (+0.95%), unchanged in pre-market

- Upexi (UPXI): closed at $5.82 (-8.06%), +3.09% at $6

- Lite Strategy (LITS): closed at $2.69 (-7.56%), +10.43% at $3.07

ETF Flows

Spot BTC ETFs

- Daily net flows: $292.3 million

- Cumulative net flows: $57.34 billion

- Total BTC holdings ~1.32 million

Spot ETH ETFs

- Daily net flows: -$61.7 million

- Cumulative net flows: $13.68 billion

- Total ETH holdings ~6.61 million

Source: Farside Investors

While You Were Sleeping

- Metaplanet Establishes U.S. and Japan Subsidiaries, Acquires Bitcoin.jp Domain Name (CoinDesk): The sixth-largest BTC treasury company has formed Bitcoin Japan to operate bitcoin-focused media and U.S.-based Metaplanet Income to generate revenue from bitcoin-related financial products.

- 21Shares Reaches 50 Crypto ETPs in Europe With Launch of AI and Raydium-Focused Products: 21Shares is rolling out two crypto exchange-traded products (ETPs), one targeting decentralized AI protocols and another providing exposure to the token of Solana-based decentralized exchange Raydium.

- Hex Trust Implements Custody and Staking for Lido’s stETH, Expanding Institutional Access to Ethereum Rewards (CoinDesk): The firm’s one-click staking option allows clients to tap into staking rewards and DeFi liquidity tools for stETH without needing to set up their own infrastructure.

- Three Key Objectives Britain Seeks from Trump’s State Visit — Aside from Business Deals (CNBC): The U.K. aims to use Trump’s visit to advance the still-ongoing trade deal, address issues like steel and aluminum tariffs, and secure investments from firms such as BlackRock, Alphabet, and Blackstone.

- UK Regulator Plans to Waive Some Rules for Cryptoasset Providers (Financial Times): The FCA pledges to tailor regulations to address crypto’s unique risks, committing to enforce stricter technology safeguards and resilience while contemplating broader consumer protections for investors.