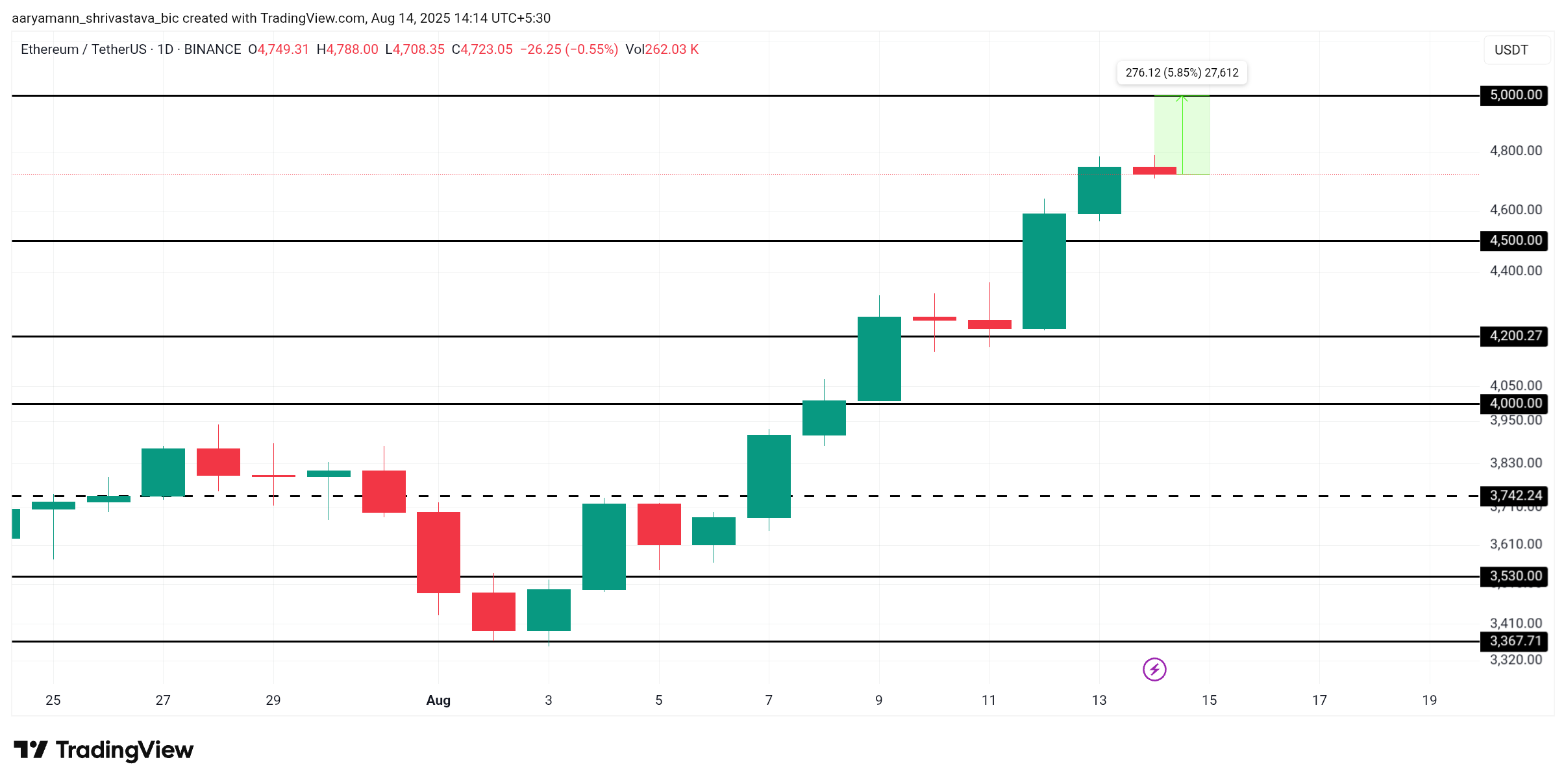

Ethereum has been climbing steadily since the beginning of the month, gaining strength as market momentum builds. At the time of writing, ETH is trading near $4,477, just shy of the $4,500 resistance.

Despite failing to break past this barrier, investor sentiment suggests that the altcoin king may be gearing toward a run to $5,000.

Ethereum Investors Are Bullish

Ethereum’s sentiment index is currently below 2.00, a level that has historically indicated elevated fear, uncertainty, and doubt among retail investors. When traders lean heavily into FUD, the price often moves in the opposite direction, catching skeptics off guard. This pattern has repeatedly proven to be a contrarian indicator.

For context, Ethereum faced extreme greed from traders on June 16, 2025, and again on July 30, 2025. Both instances triggered price corrections, as excessive optimism invited selling pressure. In contrast, today’s climate of disbelief and caution comes while ETH continues to set higher prices, suggesting that sentiment-driven skepticism may ironically fuel the rally.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

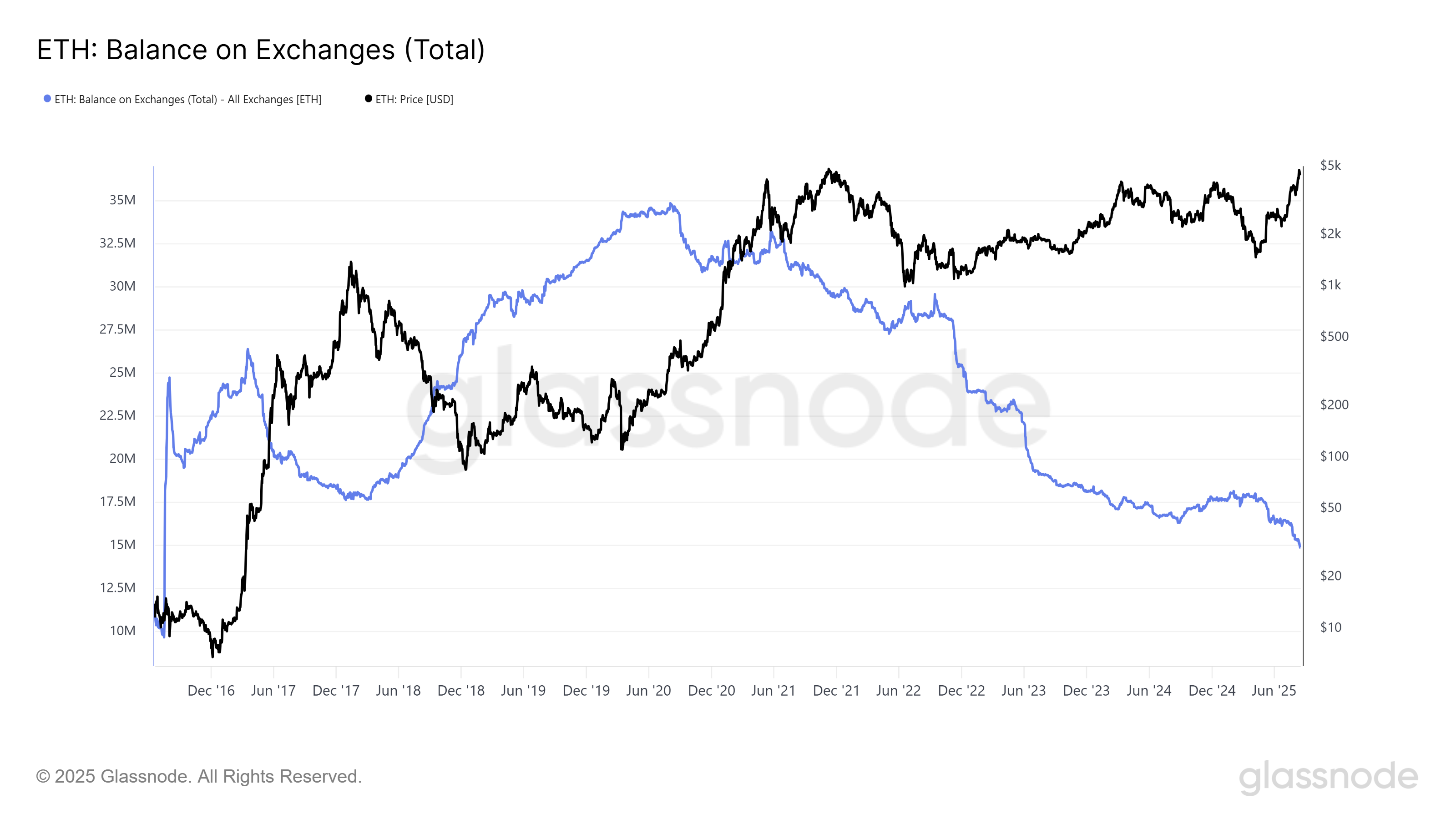

On-chain data highlights a key trend supporting Ethereum’s macro outlook. Exchange balances have dropped to a nine-year low of 14.88 million ETH, signaling that investors are moving their holdings into long-term storage.

Accumulation, while modest, reinforces confidence. Over the past week, about 470,000 ETH worth $211 million have been purchased. Although the pace is not aggressive, the steady inflows underline investor conviction. With supply tightening and demand holding, Ethereum’s bullish momentum could persist, especially if broader market sentiment shifts in its favor.

ETH Price Needs To Reclaim Support

ETH is currently priced at $4,477, positioned just below the $4,500 resistance. The broader indicators, including declining exchange balances and contrarian sentiment signals, suggest a favorable environment for a breakout. These conditions collectively support a bullish case for Ethereum in the near term.

If Ethereum manages to reclaim $4,500 as support, the uptrend could accelerate. This move would help the cryptocurrency push through the next resistance at $4,749, paving the way for a test of the $5,000 mark.

However, risks remain if investor sentiment shifts suddenly. Should holders decide to secure profits, ETH could slide toward $4,200 or even $4,000. Such a decline would weaken the bullish thesis, opening the door to consolidation instead of continuation of the current uptrend.

The post Ethereum Price Aims at $5,000 As Exchange Balance Falls To 9-Year Low appeared first on BeInCrypto.