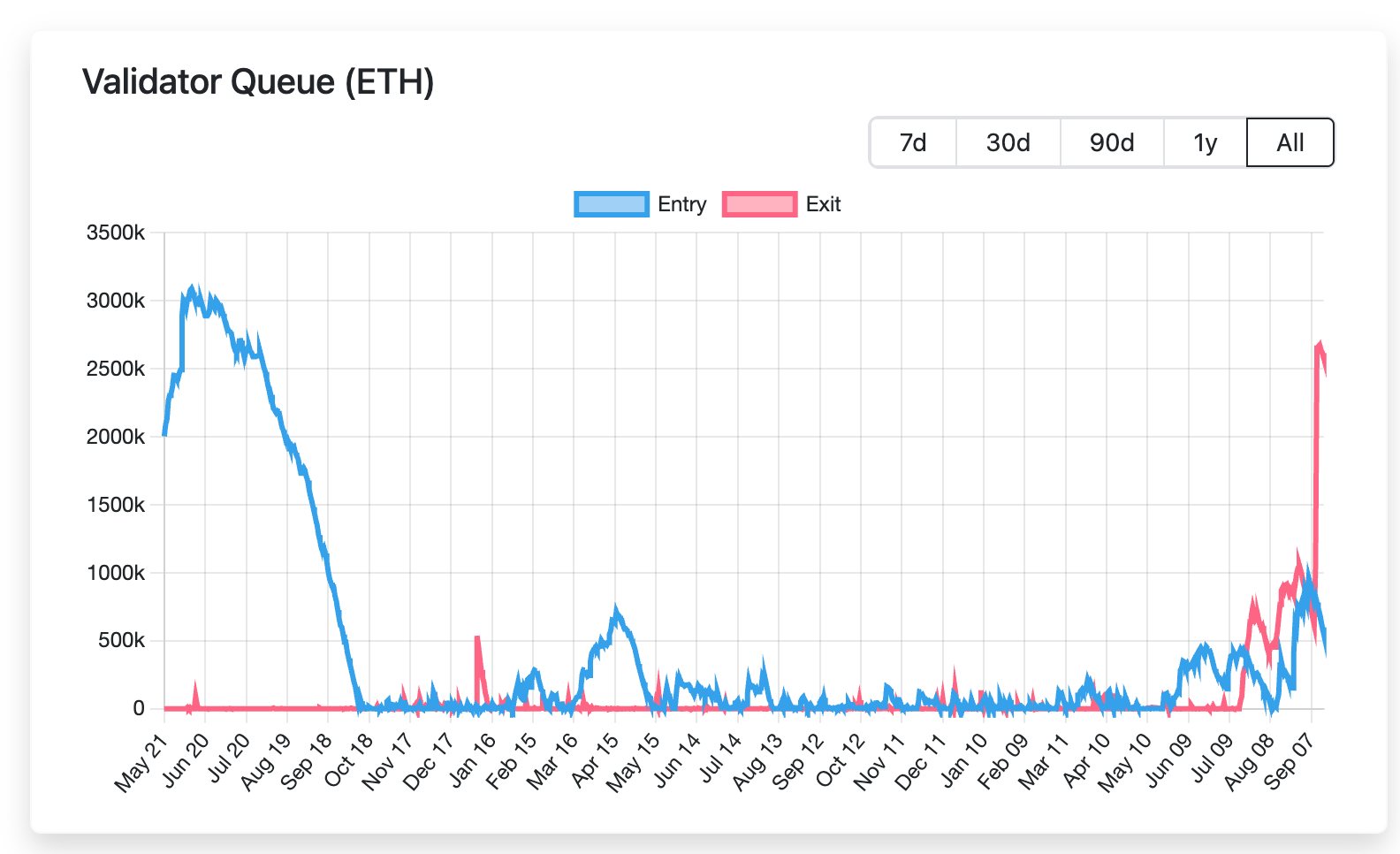

Ethereum’s proof-of-stake system is undergoing its most significant challenge to date. As of mid-September, approximately 2.5 million ETH — valued around $11.25 billion — is queued to exit the validator set, based on validator queue dashboards.

This backlog has extended exit wait times to over 46 days on Monday, the longest recorded in Ethereum’s brief staking history, according to the dashboards show. The previous peak, observed in August, saw the exit queue reach 18 days.

The initial trigger occurred on Sept. 9, when Kiln, a prominent infrastructure provider, decided to exit all of its validators as a precautionary measure. This decision, prompted by recent security incidents such as the NPM supply-chain attack and the SwissBorg breach, caused around 1.6 million ETH to enter the queue simultaneously. Though these incidents are unrelated to Ethereum’s staking protocol, they significantly shook confidence, leading Kiln to pause operations and illustrating how events in the wider crypto landscape can impact Ethereum’s validator dynamics.

In a blog post from staking provider Figment, Senior Analyst Benjamin Thalman highlighted that the current buildup in the exit queue isn’t solely due to security concerns. Following an over 160% increase in ETH value since April, some stakers are opting to take profits. Additionally, institutional investors are reevaluating their portfolio exposure.

Meanwhile, the number of validators entering the Ethereum staking ecosystem has been steadily increasing. The SEC’s May statement clarifying that staking is not classified as a security has reignited interest in staking. Anticipation over ETH ETF approvals is another influence, as funds gear up for regulated methods to capture staking yields, Thalman noted.

Ethereum’s churn limit, a protocol safeguard that restricts the number of validators entering or exiting within a specific period, is currently set at 256 ETH per epoch (approximately 6.4 minutes). This restriction limits the speed at which validators can join or leave the network and helps maintain stability.

With over 2.5 million ETH queued, stakers on Wednesday face a wait of 44 days before even reaching the cooldown stage.

Thalman believes that a significant portion of the exiting ETH will likely be restaked with new validators. If 75% of the current queue is re-deposited, nearly 2 million ETH could flood the activation queue, resulting in delays for new ETH staking and backlogs on both ends of the validator queue.

The activation queue is currently 13 days; adding the ~2 million ETH from those exiting (35 days) and 4.7 million ETH from ETFs (81 days) would total 129 days. This estimation does not account for any additional ETH holders who may choose to stake and enter the queue, including corporate treasuries,” Thalman wrote in the blog.

The expanding queue reflects a paradox: Ethereum is functioning “as intended,” as Thalman notes, with the demand to both exit and re-enter emphasizing staking’s crucial role in the ecosystem. The network is thus experiencing the growing pains of an evolving, institutionalized system where infrastructure issues, profit cycles, and regulatory changes all intersect in real time.

Read more: Ethereum Staking Queue Overtakes Exits as Fears of a Sell-off Subside