While Ethereum (ETH) was unable to surpass the $5,000 threshold on August 24, after a pullback from an all-time high (ATH) of $4,956, the second-largest cryptocurrency by market capitalization seems poised to reach that target soon, spurred by a surge in new contract activity.

Significant Growth in Ethereum Contract Activity – Will the Price Follow Suit?

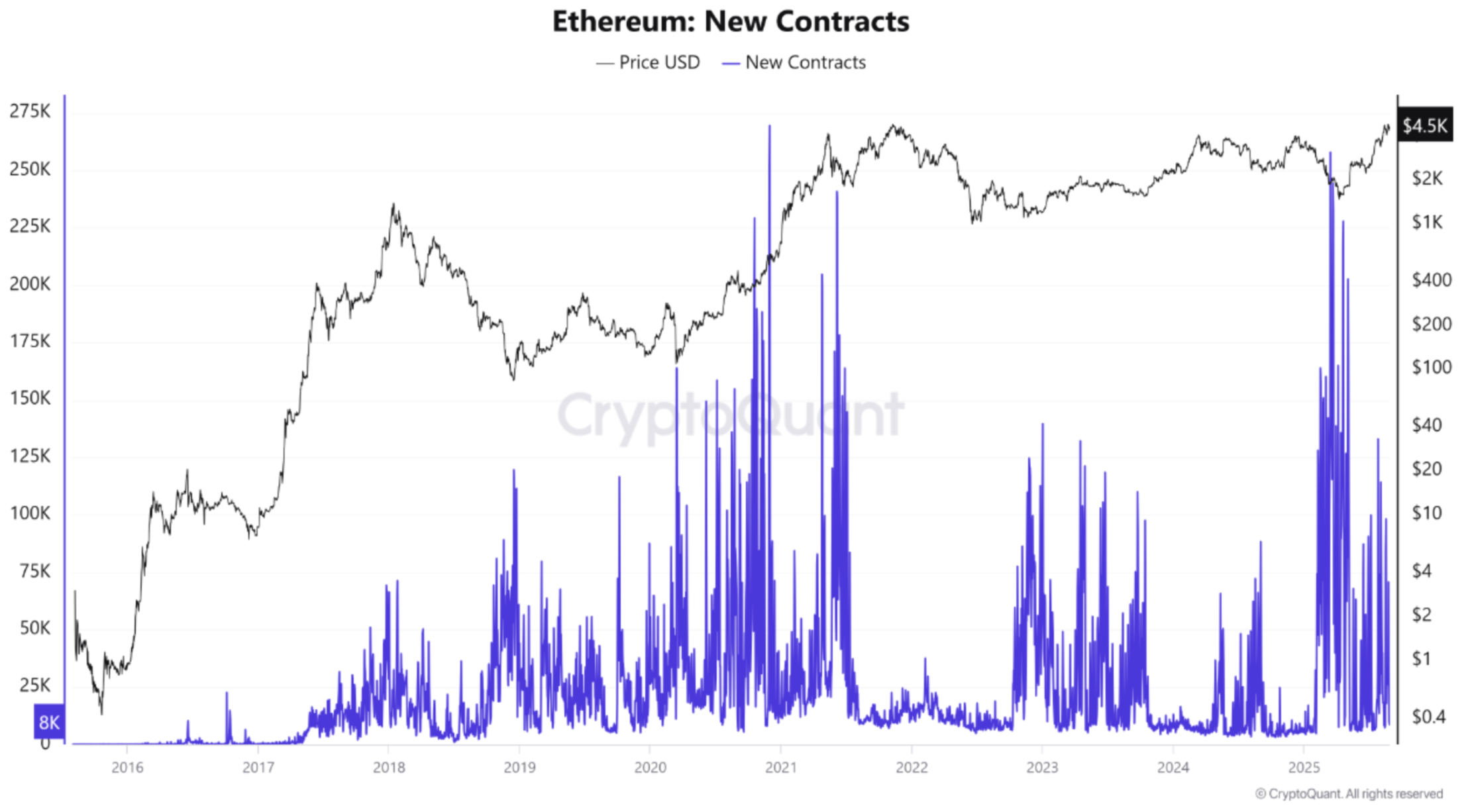

According to a CryptoQuant Quicktake by contributor PelinayPA, a notable rebound in Ethereum contracts may occur in 2024 and 2025. This year alone, new contracts have dramatically increased as ETH’s price exceeded $4,500.

The CryptoQuant analyst noted that during the 2016-17 market cycle, there was minimal new contract activity. Despite this lack of engagement, ETH’s price began a robust uptrend.

Related Reading

Conversely, following the 2018 bull market, ETH experienced a price decline despite an increase in new contracts. The relationship between new contract growth and price revealed that usage growth couldn’t counteract the collapse of the speculative bubble around digital assets.

Meanwhile, during the 2020-21 bull market, there was a significant rise in Ethereum contract creation, driven by the decentralized finance (DeFi) and non-fungible tokens (NFT) phenomena. This heightened network activity acted as a critical motivator for ETH’s price surge.

In contrast, during the 2022 bear market, both the number of contracts and ETH’s price decreased. The prices and network engagement were adversely affected by decreasing developer interest and user demand during this market cycle.

These examples illustrate that, over the long term, an increase in contract creation reflects growing confidence and adoption within Ethereum’s ecosystem, positively influencing ETH’s price.

Nonetheless, abrupt spikes in contract creation do not always translate into immediate price increases. This was evident in the price corrections noted during both the 2018 and 2021 market cycles.

What Do Current Trends Suggest?

In her assessment, PelinayPA indicated that the recent surge in new Ethereum contracts represents a resurgence in network activity, largely fueled by DeFi, NFT, and institutional support. If this trend persists, it may lead to the next ETH bull run.

Related Reading

Regarding long-term implications, the analyst noted that ongoing growth in new contracts highlights Ethereum’s rapidly evolving real-world applications, significantly supporting ETH’s price. However, contract spikes driven by hype can cause short-term price fluctuations.

Recent forecasts suggest potential for further Ethereum growth. For instance, Fundstrat co-founder Tom Lee predicted that ETH could rise to $5,500 “within the next couple of weeks.”

Similarly, Standard Chartered’s head of digital assets research, Geoffrey Kendrick, projected that ETH might reach $7,500 by the end of the year. Currently, ETH is trading at $4,582, having decreased by 0.2% in the last 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com