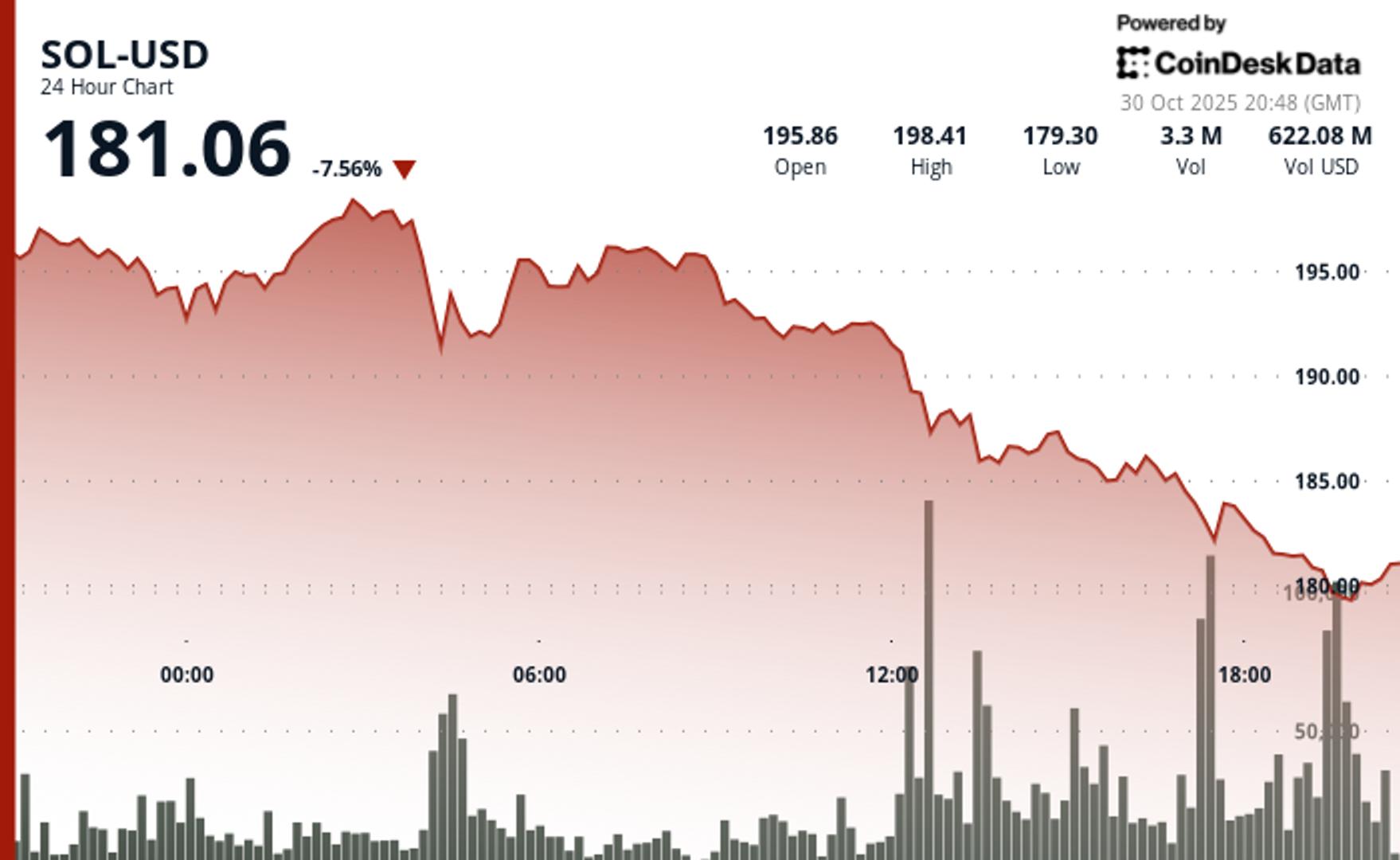

Solana experienced an 8% drop on Thursday, continuing its downward trend this week, despite the long-awaited launch of the first Solana ETFs based on spot pricing in the U.S.

This decrease has pushed the price below $180, wiping out its gains over the past year and leaving it down 4% for 2025. For SOL investors, the situation feels particularly tough as both BTC and ETH have maintained year-over-year increases of over 40%, even amidst their recent price struggles.

The Bitwise Solana Staking ETF (BSOL), which debuted on Tuesday, amassed $116 million in net inflows in the initial two sessions, in addition to $223 million in seed investments, according to data from Farside Investors. In contrast, the Grayscale Solana Trust (GSOL), which transitioned from a closed-end fund to an ETF on Wednesday, saw a meager inflow of $1.4 million.

While Bitwise’s robust capital influx was promising, it wasn’t sufficient to support SOL, which faced a 12% decline from its peaks on Monday.

Investor sentiment may have been impacted by a significant on-chain transfer reported by blockchain analyst Lookonchain. Data revealed that Jump Crypto, a leading trading firm in the crypto space, moved 1.1 million SOL (approximately $205 million) to Galaxy Digital, simultaneously acquiring around 2,455 BTC (worth about $265 million), hinting that Jump might be reallocating from SOL to BTC.