This week, the digital asset market has exhibited lackluster performance, with numerous tokens losing much of their gains from July. The global cryptocurrency market capitalization has declined by 4% over the last seven days, indicating a decrease in bullish momentum and a more cautious outlook among traders.

Nevertheless, despite the general downturn, on-chain data indicates that crypto whales have been actively adding to their holdings of certain altcoins. This analysis explores some of these altcoins.

Arbitrum (ARB)

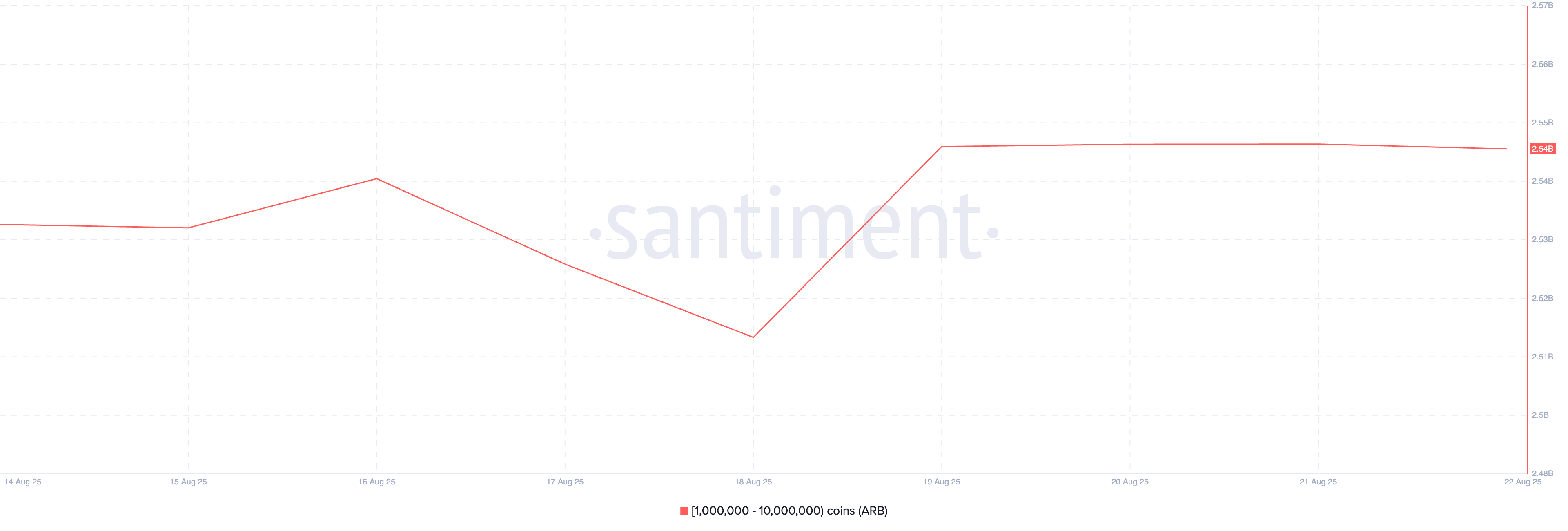

The layer-2 altcoin ARB has experienced an increase in accumulation by crypto whales this week. According to Santiment, whales holding between 1 million and 10 million tokens have acquired 10 million ARB in the past week, raising their total holdings to 2.45 billion tokens as of now.

For token TA and market updates: Interested in more insights? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This trend could enhance confidence among smaller investors and stimulate increased retail participation. As retail demand rises in tandem with whale activity, it may generate the momentum necessary to propel ARB out of its sideways trend.

If demand increases, ARB aims for a breakout above the resistance at $0.52, potentially reaching towards $0.57.

Conversely, if sell-offs persist, it might decline to $0.45.

Chainlink (LINK)

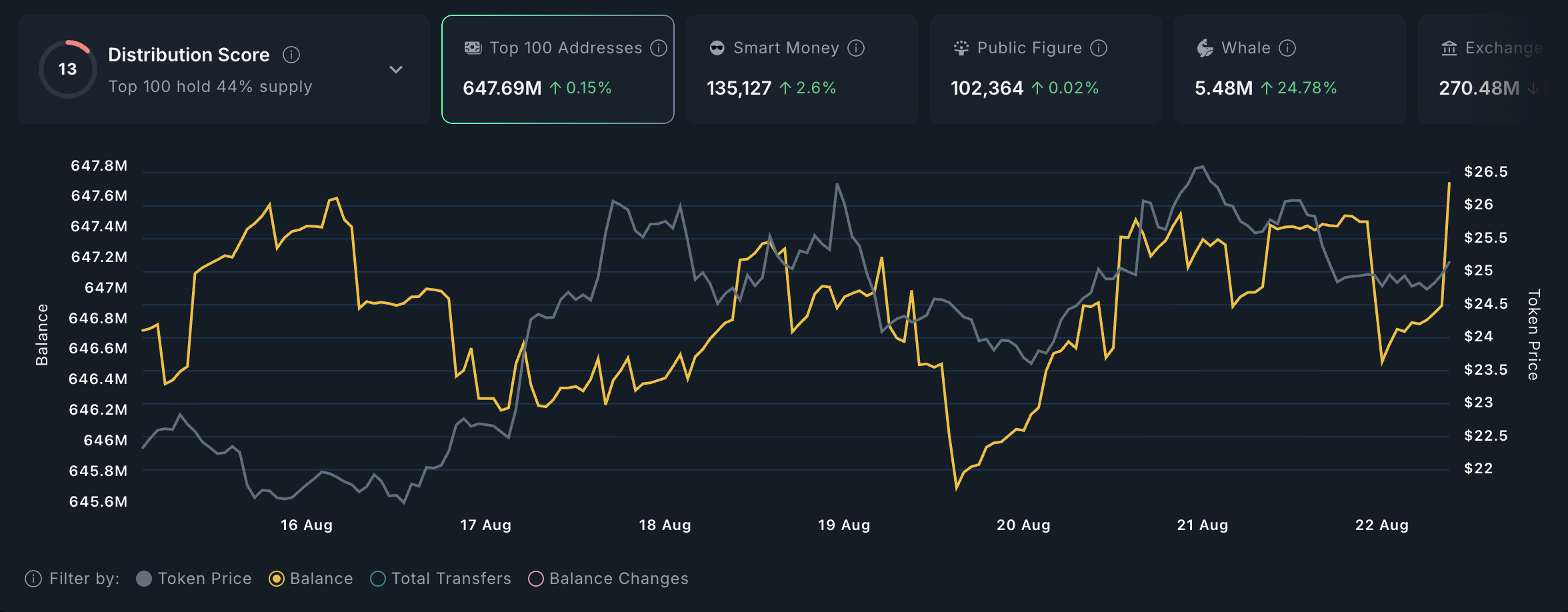

LINK, the native token of the Chainlink oracle network, is among the altcoins that crypto whales have accumulated this week. On-chain data from Nansen indicates a 25% increase in holdings among high-value wallets holding over $1 million in LINK.

This uptick in whale activity signals increasing confidence in the token’s short-term outlook. Should accumulation continue, LINK may rally towards $26.89.

If demand wanes and whales start to reduce their exposure, the token could drop to around $23.48.

Cardano (ADA)

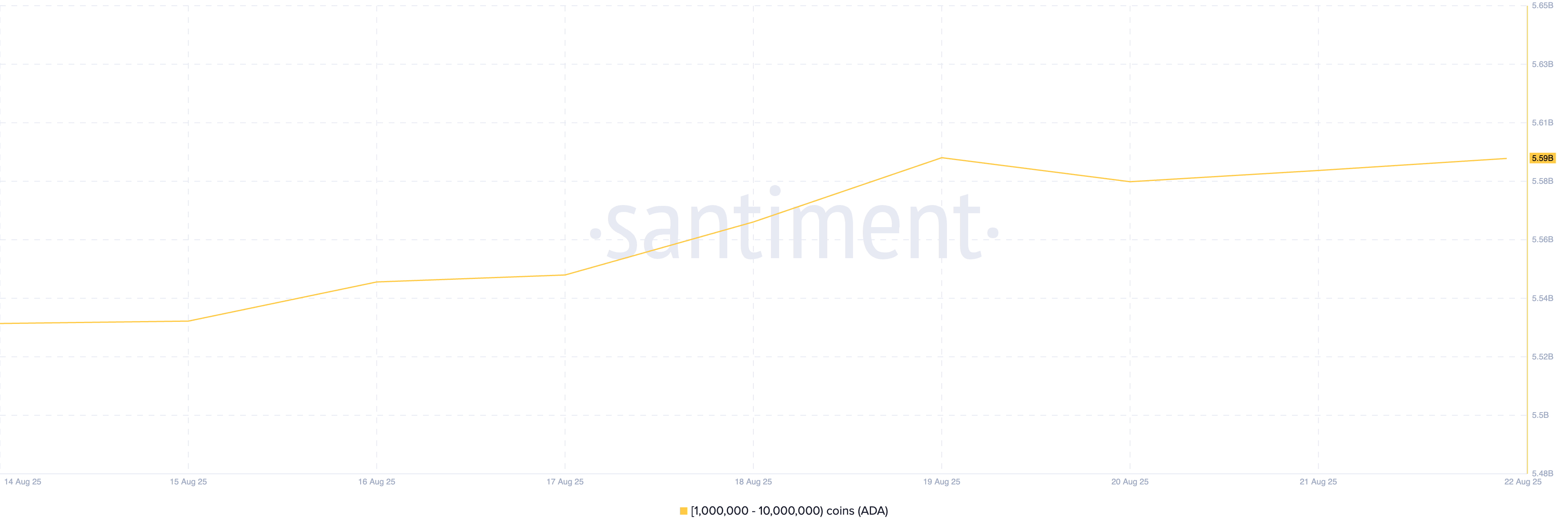

The layer-1 coin ADA has also experienced strategic accumulation by crypto whales this week, despite the general market decline. On-chain data reveals that whales holding between 1 million and 10 million coins purchased 60 million ADA coins during the week in question.

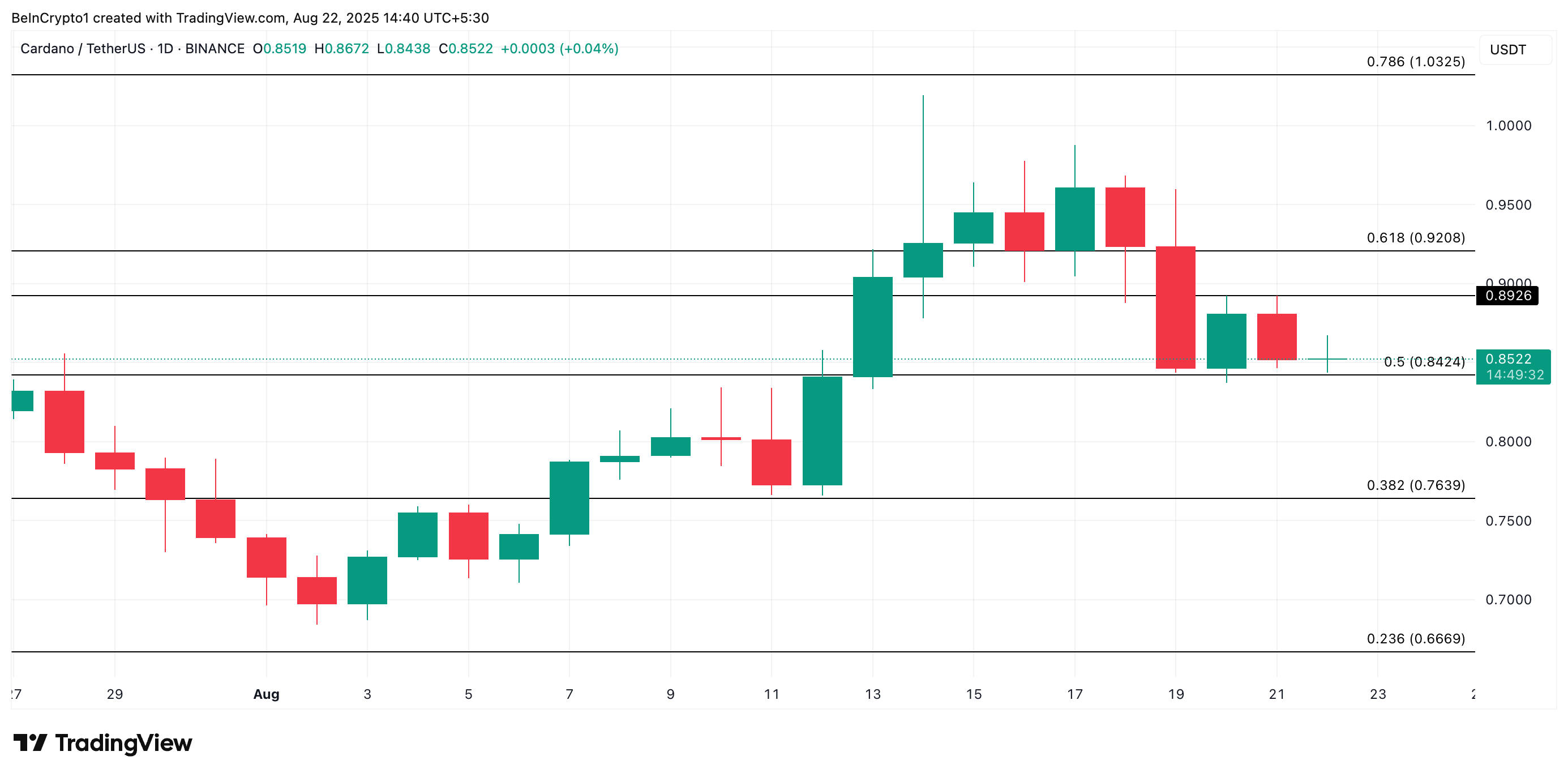

While the overall market’s lackluster performance has kept ADA within a range in recent days, should whale accumulation increase, its price could challenge the resistance at $0.89 and attempt to surpass it.

On the flip side, if accumulation decreases, the price of the L1 could fall to $0.84.

The post Crypto Whales Bought These Altcoins in the Third Week of August 2025 appeared first on BeInCrypto.