Sure! Here’s the rewritten content with the HTML tags intact:

On Thursday, the crypto market experienced a downturn, even as the Dow Jones Industrial Average reached a new all-time high, highlighting a pronounced shift by investors moving from tech to stocks more sensitive to economic fluctuations following the Federal Reserve’s recent interest rate adjustment.

Summary

- Despite the Dow’s record ascent, crypto saw declines, with both Bitcoin and Ethereum part of a widespread selloff.

- Investors shifted away from major tech and AI stocks after discouraging earnings reports from Oracle.

- Notably, Bitcoin and Ethereum ETFs continued to attract significant inflows, indicating ongoing institutional interest.

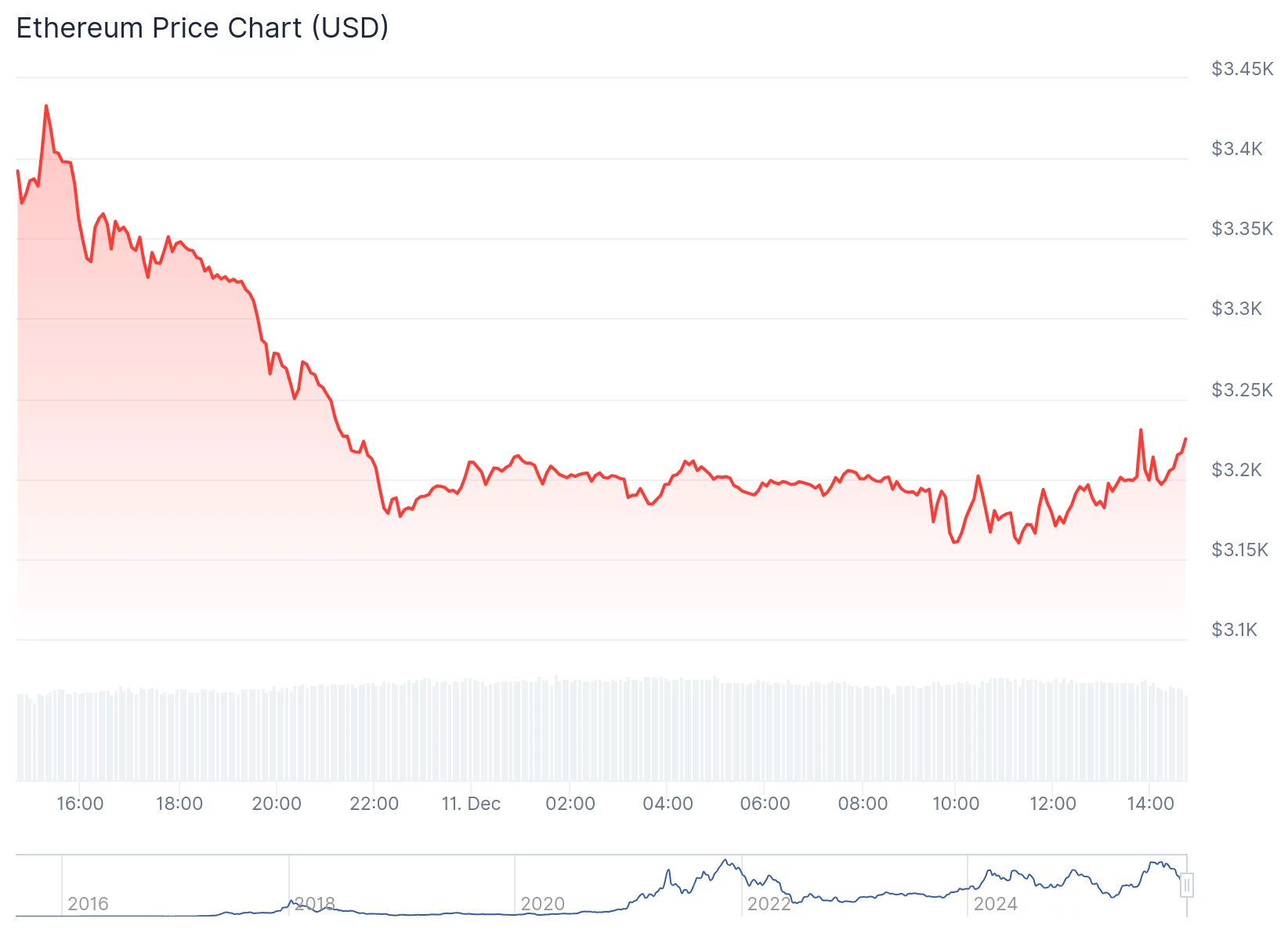

Bitcoin was trading just above $91,000, reflecting a drop of about 1.5%, while Ethereum fell nearly 5%, hovering around $3,200.

The declines reflected a broader downturn in digital assets, with the total crypto market capitalization slipping 2.3% to around $3.2 trillion. A report indicated that 97 out of the top 100 tokens were witnessing price declines.

In spite of the market slump, Bitcoin and Ethereum ETFs continued to garner new inflows, pointing to persistent institutional demand. As per data compiled on Thursday, Dec. 10:

- Spot Bitcoin ETFs saw net inflows amounting to $224 million.

- Ethereum ETFs recorded a net inflow of $57.6 million.

- Spot XRP ETFs attracted $954 million since Canary Capital’s launch in November.

Traditional markets present a contrasting scenario

The 30-stock Dow surged by 600 points, a gain of 1.3%. According to CNBC, this represents a record peak.

Market participants exited high-growth tech stocks following disappointing earnings from Oracle, raising concerns about the pace at which companies might capitalize on their substantial artificial intelligence (AI) investments.

Oracle’s extensive debt, exceeding $100 billion for data-center growth, considerably impacted sentiment and negatively affected other AI-related stocks, including Nvidia, Broadcom, AMD, and CoreWeave.

This shift in investor sentiment overshadowed the momentum from the previous session when the S&P 500 nearly hit its own record following the Fed’s third interest rate cut of the year, bringing the benchmark range to 3.5%–3.75% while signaling no future hikes.

Decreased borrowing costs propelled small-cap stocks, leading the Russell 2000 (up 1.3% at last check) to achieve a new intraday record, having closed at a record high the prior day.

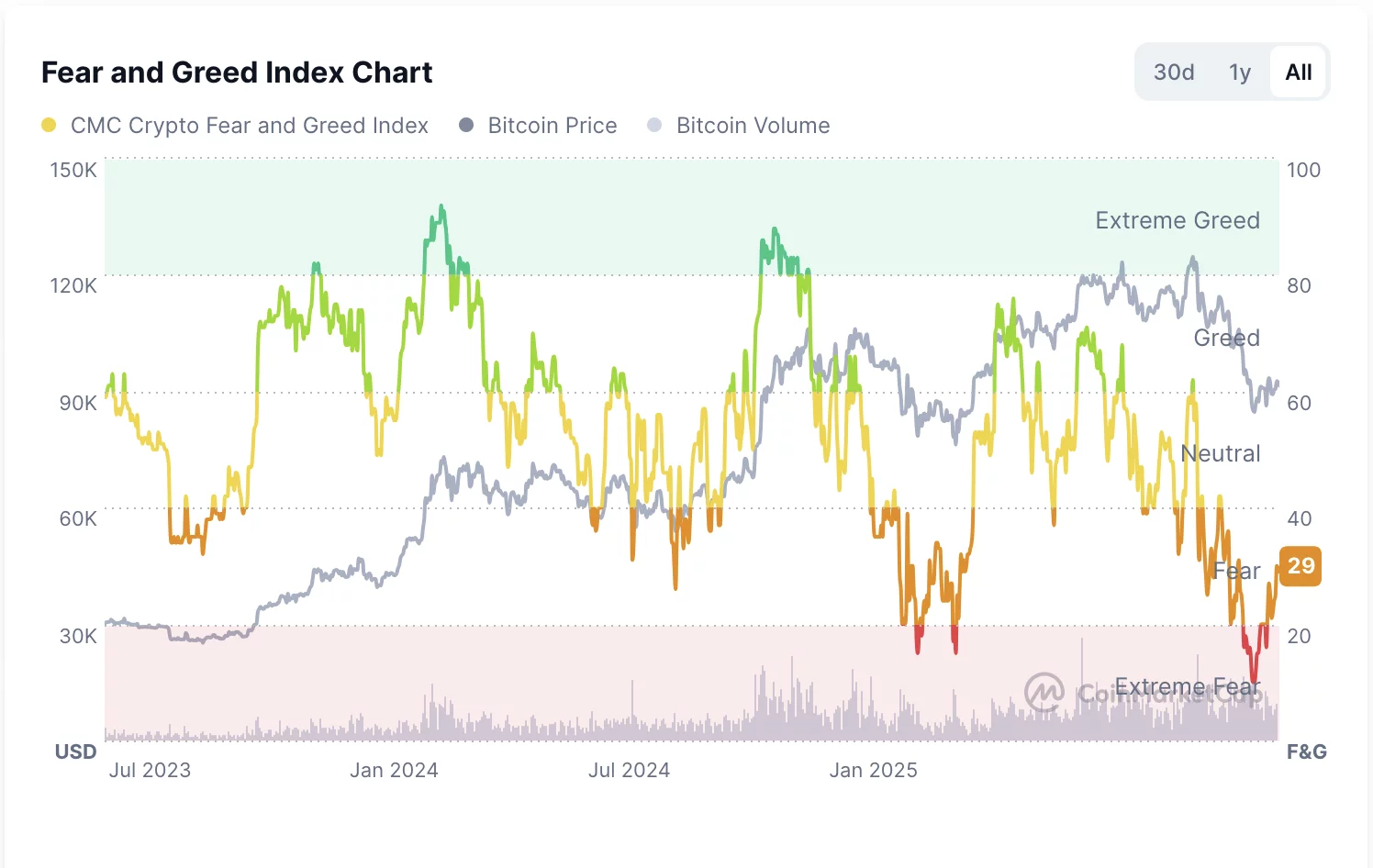

In the crypto realm, mood remains tenuous: the crypto fear and greed index slipped from 30 to 29, firmly remaining in the “fear” zone as more macroeconomic signals and government actions loom following recent administrative upheaval.

Looking Ahead

Despite rising uncertainties, the ETF inflows indicate that major investors are not abandoning crypto but rather preparing for a turbulent market landscape.

Whether a potential Santa Claus rally can lift the S&P 500 over 7,000 by year-end remains to be seen. As for 2026, experts anticipate various challenges, including a transition in Fed leadership and the midterm elections.