Reasons to Trust

Stringent editorial standards emphasizing precision, relevance, and neutrality

Developed by industry professionals and thoroughly vetted

Upholding the highest benchmarks in reporting and publication

Stringent editorial standards emphasizing precision, relevance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In an update on August 19 titled “Key Altcoins To Watch Right Now,” crypto analyst Cryptoinsightuk states that conditions are improving for a new rise in altcoins as Bitcoin dominance appears to be lessening. “Recently, I’ve been discussing my long-term belief that Bitcoin dominance will decrease and that altcoins will see the next upward movement,” he remarked, asserting that at present levels across the major assets, “the risk-reward for long positions is quite favorable.”

He grounds the view in an intraday structure that he believes is evident across Bitcoin and several major caps: a range forms, the lows are swept, the highs are swept, prices revert to the lows, and momentum begins to stabilize. Concerning Bitcoin specifically, he points out that “the RSI on the 4-hour chart appears ready to turn upwards,” while acknowledging that short-term direction could still be influenced by the US equity market opening and broader macroeconomic news.

Leading Altcoins to Monitor in Crypto Right Now

Avalanche (AVAX) leads his tactical list. He detailed a limit-bid strategy at $22.75, highlighting a local liquidity zone down to roughly $22.70, while noting that significant liquidity is present above: “There’s a considerable amount of liquidity above us extending all the way up to $27… on the daily… up to around $28.4, even toward $30 for AVAX.” He views the trade as asymmetrical because “if we don’t achieve [the fill], that’s acceptable,” while a surge into the upper liquidity ranges could hasten gains.

Dogecoin (DOGE) stands out as his highest-conviction swing trade. He shared two concurrent long positions—one in a DOGE perpetual and another against USDT—with an average entry near $0.225–$0.227 and moderate leverage on the larger position. The technical analysis, he argued, has progressed through the stop-sweep and retest phases: “We had this range… we swept the lows and… back-tested this… little cluster, bouncing off it as support thus far.”

Related Reading

In the short term, the analyst is monitoring the reclaimed range floor as resistance that needs to flip; beyond that, he sees “much denser” liquidity resting above current prices “up to about 30 cents,” with a broader discussion area in the mid-$0.40s: “There’s liquidity extended all the way up to 47 cents, and once we reach that level, I’ll start to think about possibly reducing my position.”

His longer-term targets reference Fibonacci extensions: “My take profits [are] at the 1.618 fib… reaching all the way towards $1.19,” while emphasizing he would amend position size “based on market conditions at various levels.”

Cryptoinsightuk also pointed out what he called a sentiment-sensitive Fartcoin long held with higher leverage. The investment is deliberately minor due to volatility—“we’re 10x on Fartcoin, risking liquidation if it drops to around 86 cents… liquidation at about 81 cents, I believe”—and intended solely for a rebound back to range highs.

On XRP, the analyst describes a similar range-structure as DOGE and AVAX with an initial target at the upper band. “The primary target would be this top of the range… the structure is similar,” he remarked, observing that his focus remains on reactions as previous highs and visible liquidity get approached.

Cardano also made the list, showcasing visible liquidity around earlier swing highs “up here at this $1–$1.10,” suggesting a first checkpoint around the $1.10 level, with continuation risk skewed to the upside “once that swing high is reached.”

Related Reading

He provided more structural insight on Flare (FLR), highlighting a potentially finished or developing corrective sequence that could initiate a stronger impulse. “This could signal the start of an impulsive move. This could be one, two, three, four, five. This could also form an ABC correction or W-X-Y-Z… triangle… in wave twos… leading to an aggressive wave three,” he commented, framing FLR as an “interesting structure” rather than calling for immediate engagement.

Ethereum, he asserted, is attempting to rectify short-term trend signals, even as a nearby liquidity zone looms below. “ETH is working to break this short-term downtrend… challenging this vital cluster… You can observe… bullish divergences on the hourly chart,” he noted, citing a series of lower lows in price against higher lows in RSI. This constructive micro-setup backs his broader positioning strategy: if Bitcoin ascends to the top of its range and retests all-time highs, “the most dynamic phase of the cycle is likely when price discovery occurs.”

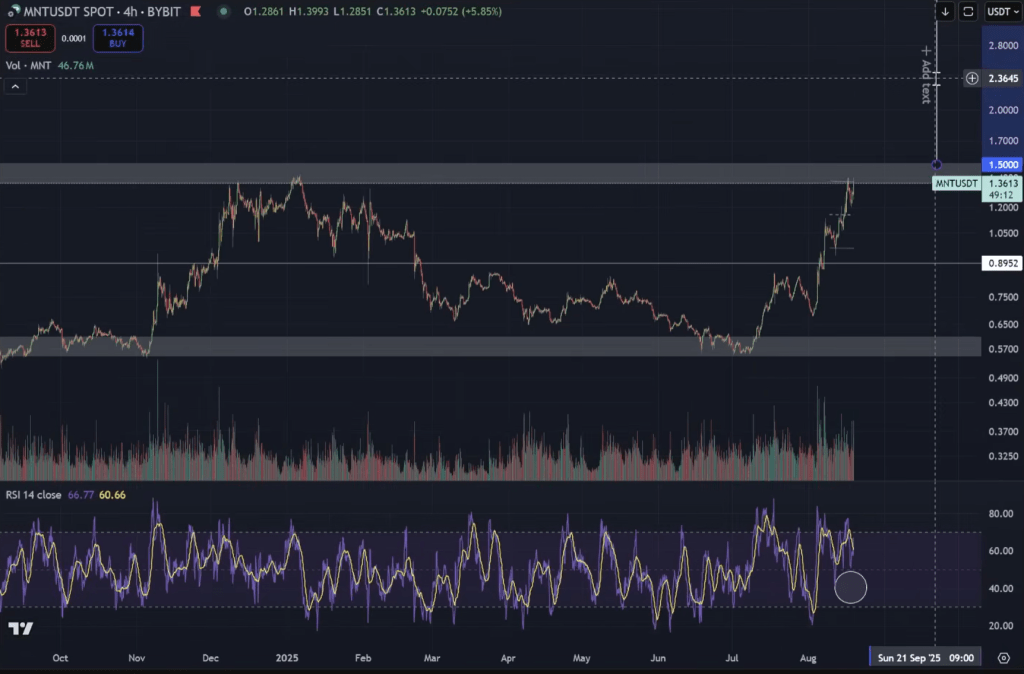

He concluded the watchlist with Mantle (MNT), explaining he has a position and would ponder taking profits near $2 if a distinct range break occurs. “MNT is nearing the upper end of a range… if a range breakout happens, it could lead to a powerful upward move. I’ll consider taking profits close to the $2 mark,” he stated.

At the time of publication, ETH was priced at $4,175.

Featured image generated using DALL.E, chart from TradingView.com