Financial markets are on edge as Jerome Powell prepares for his appearance at Jackson Hole, Wyoming. This is likely his last keynote address as Federal Reserve (Fed) Chair.

For over a decade, Powell’s remarks have influenced global markets, and Friday’s speech is expected to follow suit. Investors in cryptocurrency and stock markets are looking for indications of a potential September rate cut, as well as any significant changes in the Fed’s approach that could shape Powell’s legacy.

Powell’s Final Address at Jackson Hole Could Define His Legacy

The Jackson Hole Economic Symposium has historically been a platform for Fed chairs to indicate strategic shifts, earning it the nickname “Oscars of Monetary Policy.”

“…a single line from Powell can move stocks, bonds, and Bitcoin internationally,” noted analyst Bull Theory.

Recent events echo this influence, with Powell’s 2021 speech offering reassurance through dovish signals, while his hawkish stance in 2022 triggered selloffs in equities and crypto.

Last year’s commentary elicited mixed reactions, but in 2025, expectations are heightened, given that this could be Powell’s last appearance at the venue.

Economists suggest that Powell might take this opportunity, in addition to discussing rate cuts, to propose significant changes to the central bank’s dual mandate regarding inflation and employment.

The resulting reforms could extend beyond his tenure and shape monetary policy for future years.

“Jerome Powell will deliver his final Jackson Hole speech this Friday. While investors will be eager for hints of a rate cut next month, Powell might outline broader changes to the central bank’s dual mandate — which could define part of his legacy,” reported Yahoo Finance.

Internally, opinions within the Fed are split. Cleveland Fed President Beth Hammack stated she wouldn’t endorse a cut “if the meeting were tomorrow,” citing persistent inflation signals.

Kansas City Fed’s Jeffrey Schmid echoed this caution, though both acknowledged the need for open-mindedness ahead of September’s meeting.

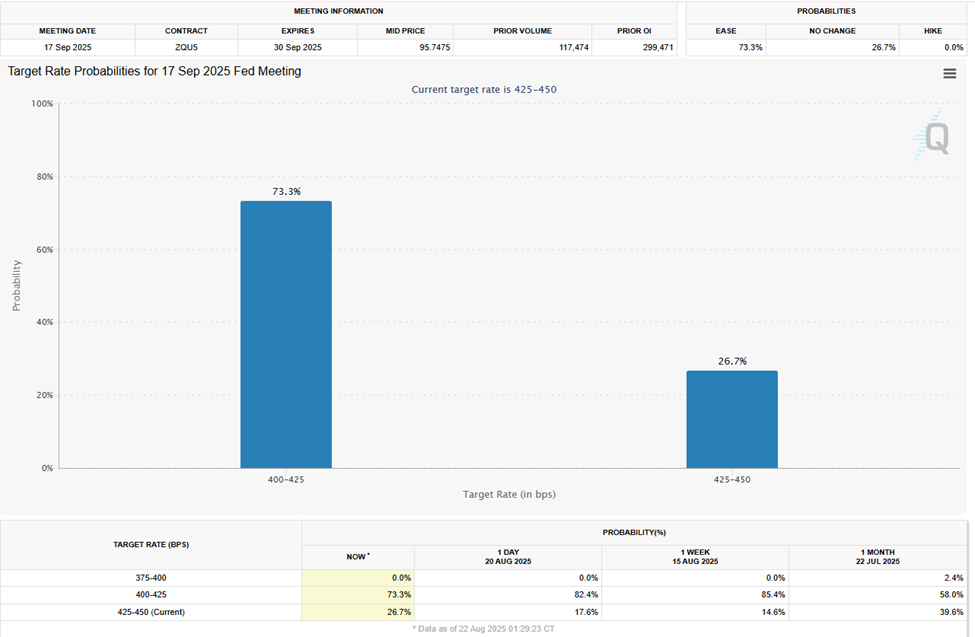

Conversely, Fed governors Michelle Bowman and Christopher Waller have shown a more dovish stance. Still, market assessments currently indicate a 73.3% likelihood of a 0.25% cut, though uncertainty remains high.

Powell is also anticipated to formally phase out the average inflation targeting policy initiated in 2020, which allowed for temporary overshoots above the 2% inflation target to rectify past undershooting.

Central banks have utilized monetary policy for years to sustain inflation at or below the 2% target, while governments continue striving to control debts to maintain economic stability.

BeInCrypto has covered how the termination of the 2% inflation target could positively influence crypto.

Macro Uncertainty Meets Crypto and Stock Market Risk

Reports indicate that investors are actively hedging against risk in the SPY and Tesla markets.

Apart from traditional markets, Powell’s statements may once again be crucial for Bitcoin. In 2021, a dovish narrative at Jackson Hole triggered what some termed the Bitcoin Supercycle.

Crypto analyst Remington noted that conditions could be even more favorable this year, citing three prior Fed cuts and a market ready for renewed capital influx.

“Bitcoin is poised for another growth surge and will consolidate at higher levels,” he asserted.

According to the analyst, this capital may also flow into altcoins, possibly generating significant returns for low-market-cap tokens. However, caution is expressed by others, including Nic Puckrin, founder of Coin Bureau.

“…the current macroeconomic instability is more impactful on market declines than crypto-specific elements,” Puckrin commented to BeInCrypto.

He highlighted the effects of mixed inflation data, weak job reports, geopolitical risks, and US political pressures on the Fed as reasons for cautious investor sentiment.

Meanwhile, Bitcoin’s price has fallen below a critical trend line after profit-taking, being traded at $113,144 as of this writing.

For Powell, Jackson Hole represents more than just interest rate decisions; it’s a chance to establish a clearer and more robust policy framework following years of extraordinary turbulence.

For markets, both Wall Street and cryptocurrency, the concern is whether his concluding act will encourage caution or ignite another wave of risk-taking.

The post Could Powell’s Final Jackson Hole Speech Spark a Bitcoin Supercycle? appeared first on BeInCrypto.