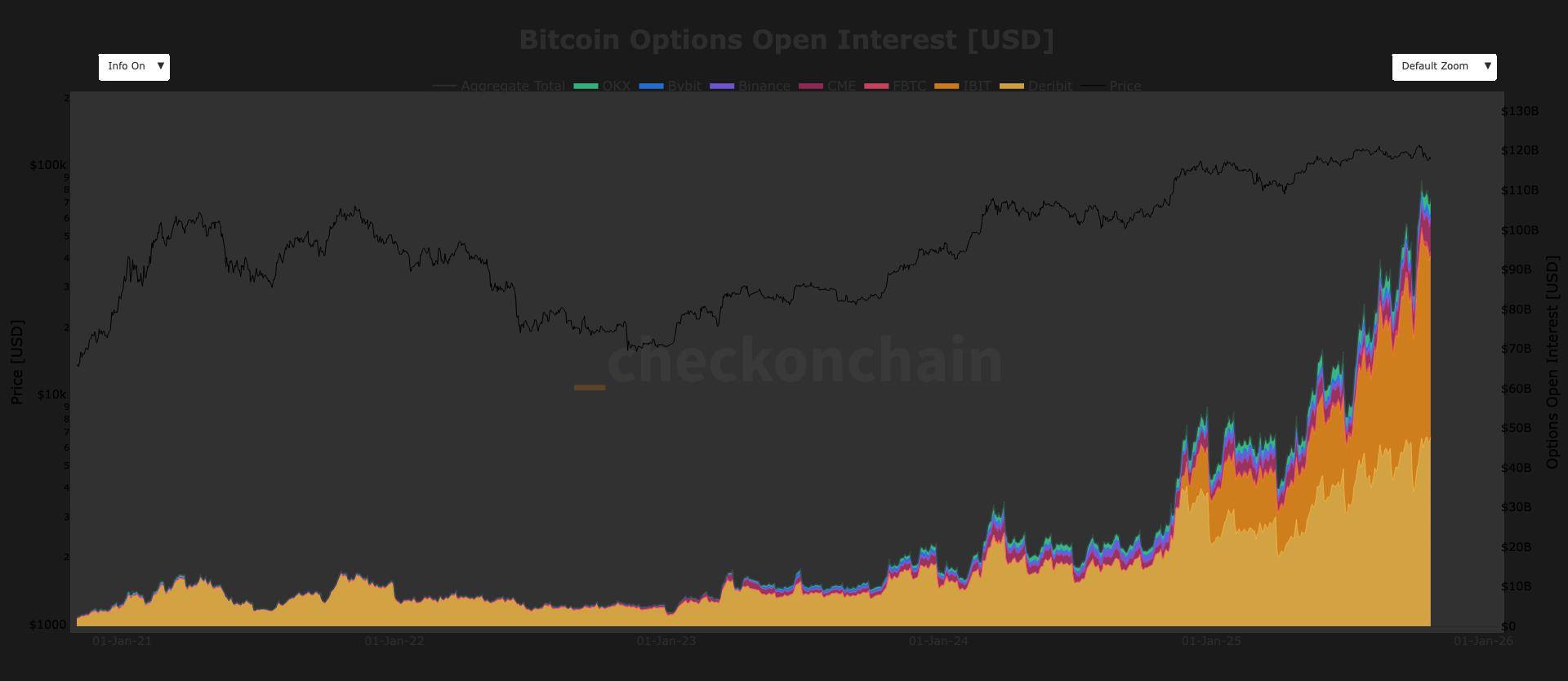

The options open interest (OOI) market has expanded to approximately $40 billion more than the futures open interest (FOI), representing one of the largest disparities observed, according to data from CheckonChain.

OOI indicates the total number of outstanding options contracts yet to be settled, while FOI shows the total value of open futures positions across various exchanges.

The options market fulfills several roles, including hedging, delta-neutral strategies, volatility trading, and structured product creation. Conversely, a large futures market usually indicates higher leverage in the system, which can exacerbate liquidations during market turmoil, such as the significant cryptocurrency sell-off seen two weeks ago.

As evidence of this, bitcoin’s price only dipped about 18% from its all-time high to the recent low of $103,000, which is a typical pullback for this bull market cycle. In earlier cycles, such conditions might have triggered a much steeper downturn.

According to CheckonChain, the current OOI is around $108 billion, just shy of its all-time high of $112 billion, while FOI stands at $68 billion—considerably lower than its peak of $91 billion. The ongoing growth of OOI throughout 2025 has widened the gap between the two, primarily due to the leverage liquidation event that wiped out more than $20 billion in FOI.

A robust options market, especially one focused on regulated platforms, typically promotes more sophisticated hedging practices and decreases overall market volatility, indicating an ongoing maturation in bitcoin’s financial cycle.

An important factor contributing to lowered volatility was the introduction of options trading on BlackRock’s iShares Bitcoin Trust (IBIT) in November 2024. IBIT has quickly established itself as the leading bitcoin options platform, surpassing Deribit.

As OOI begins to dominate the market over FOI, this structural change could influence the current cycle by compressing volatility.

A larger options market might help mitigate downside risks during bearish phases, although it could potentially result in less dramatic price surges during bullish spells.