A recent Bitwise report suggests that Bitcoin might outshine all major assets over the next decade, projecting an impressive 28% annual growth rate. The firm attributes this potential surge to heightened institutional interest, limited supply, and increasing worries about the devaluation of fiat currencies.

Summary

- Bitwise anticipates Bitcoin could achieve a 28.3% annual growth rate over the next decade, potentially hitting $1.3 million per BTC by 2035.

- Key growth factors include institutional demand estimated between $1-5 trillion, 94.8% of the total 21 million BTC already in circulation, and a significant rise in U.S. debt, which escalated by $13 trillion over five years.

- With a low correlation of 0.21 to equities, these conditions position Bitcoin as a robust long-term store of value.

According to a fresh report from Bitwise Asset Management, Bitcoin (BTC) appears poised for substantial growth, potentially surpassing every major asset worldwide over the next decade with a projected compound annual growth rate of 28.3%.

In its 24-page analysis, Bitwise identifies “three primary factors” as the foundation for its outlook, emphasizing institutional demand, limited availability, and escalating concerns regarding fiat currency devaluation.

The first contributing factor is institutional demand, which arises from Bitcoin’s unique adoption dynamics. Unlike other emerging assets that initially attracted institutional interest, Bitcoin’s ascent was predominantly fueled by retail investors. Bitwise notes that nearly 95% of Bitcoin that will ever exist has already been acquired, primarily by retail investors, leaving institutions with minimal exposure.

As institutions begin to invest in the largest cryptocurrency by market capitalization, the market could witness a surge in demand.

“The World Bank estimates institutional investors hold about $100 trillion in total assets. We believe these investors will allocate between 1% and 5% of their portfolios to Bitcoin over the next decade, requiring them to purchase $1 trillion to $5 trillion worth of Bitcoin.”

Bitwise

In contrast, Bitcoin ETPs currently manage $170 billion, a mere fraction of the $1 trillion to $5 trillion expected to be purchased by institutions in the upcoming decade.

Scarcity of Supply

Adding to Bitcoin’s appeal is its strict scarcity. The crypto community widely understands that its total supply is capped at 21 million BTC, with 94.8% already in circulation. New BTC is produced at a diminishing rate, with annual issuance projected to drop from 0.8% today to just 0.2% by 2032. Unlike gold or oil, Bitcoin’s supply cannot be increased to satisfy escalating demand, rendering it highly inelastic.

Bitwise highlights that the intersection of substantial institutional demand and a limited, inelastic supply offers a “simple economics-driven rationale for our thesis.”

Lastly, Bitwise points out the rising apprehension surrounding the devaluation of fiat currencies. The U.S. federal debt has surged by $13 trillion over the past five years, reaching $36.2 trillion, while annual interest payments now total $952 billion, making them the fourth-largest expenditure in the federal budget. As interest rates climb above anticipated GDP growth, the strain on conventional currencies is escalating.

“The combination of institutional demand, limited supply, and increasing worries about fiat debasement allows Bitcoin investors to capitalize as Bitcoin gains a larger share of the store-of-value market, which is also expanding.”

Bitwise

Valuation Model

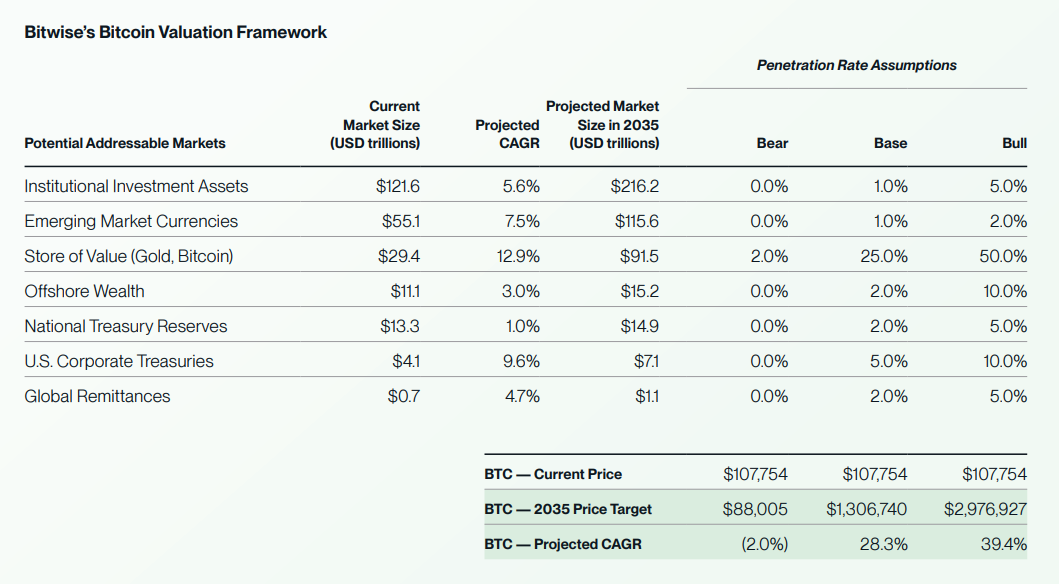

To forecast Bitcoin’s future price, Bitwise employs a Total Addressable Market approach, assessing the potential market sizes Bitcoin can penetrate and its expected market share. This encompasses non-sovereign stores of value like gold, corporate and national reserves, offshore wealth, and global remittances.

Based on conservative estimates, Bitwise forecasts a Bitcoin price of $1,306,740 by 2035, representing a 28.3% compound annual growth rate from current levels. The bear and bull scenarios span from $88,005 to nearly $3 million per BTC. The firm emphasizes that these predictions are not guarantees but rather a framework for understanding market opportunities.

Bitwise also articulates Bitcoin’s value succinctly: it offers a service—the capability to digitally store wealth without reliance on banks or governments. The firm suggests that as more individuals seek this service, Bitcoin’s value increases. Conversely, if demand for this service wanes, Bitcoin’s value diminishes. If there were no interest in this service, the report asserts that Bitcoin’s value would be zero.

The Four-Year Cycle is Obsolete

Bitcoin’s minimal correlation with other assets adds an additional layer of attraction for investors. Over the last decade, its average correlation to U.S. equities has been just 0.21, rarely exceeding 0.50 in the short term, which contradicts prevalent media narratives. Historically, even during significant equity declines, Bitcoin has rebound more swiftly, underscoring its potential as a diversifying asset.

The combination of scarcity, institutional interest, hedging potential, and low correlation renders Bitcoin an appealing long-term portfolio asset. However, Bitwise analysts warn that the traditional four-year cycle may no longer be applicable, as past market influencers lose their potency.