Bitcoin remains close to the $112,500 mark, as market volatility lingers in the wake of last week’s notable crash. On-chain data reveals that short-term holders (STHs) are under considerable strain, showing evident signs of distress. The STH realized price, which tracks the average entry cost of recent purchasers, suggests that many traders continue to respond emotionally to changing prices. The recent liquidation event appears to have significantly affected market sentiment— even a minor pullback yesterday triggered another wave of panic selling.

Related Reading

While some traders capitulate, others are taking advantage of the situation. A well-known Bitcoin OG whale, noted for shorting BTC and ETH just before the crash, has reportedly exited this position, securing over $197 million in profits. This action signifies the conclusion of one of the year’s most successful short trades.

With Bitcoin stabilizing within a narrow range, the market remains divided between fear-fueled sellers and opportunistic players looking to position themselves for the next significant move. The upcoming days may reveal whether BTC can establish stability or will experience renewed selling pressures from anxious short-term holders.

Bitcoin Whale Moves Prompt Speculation

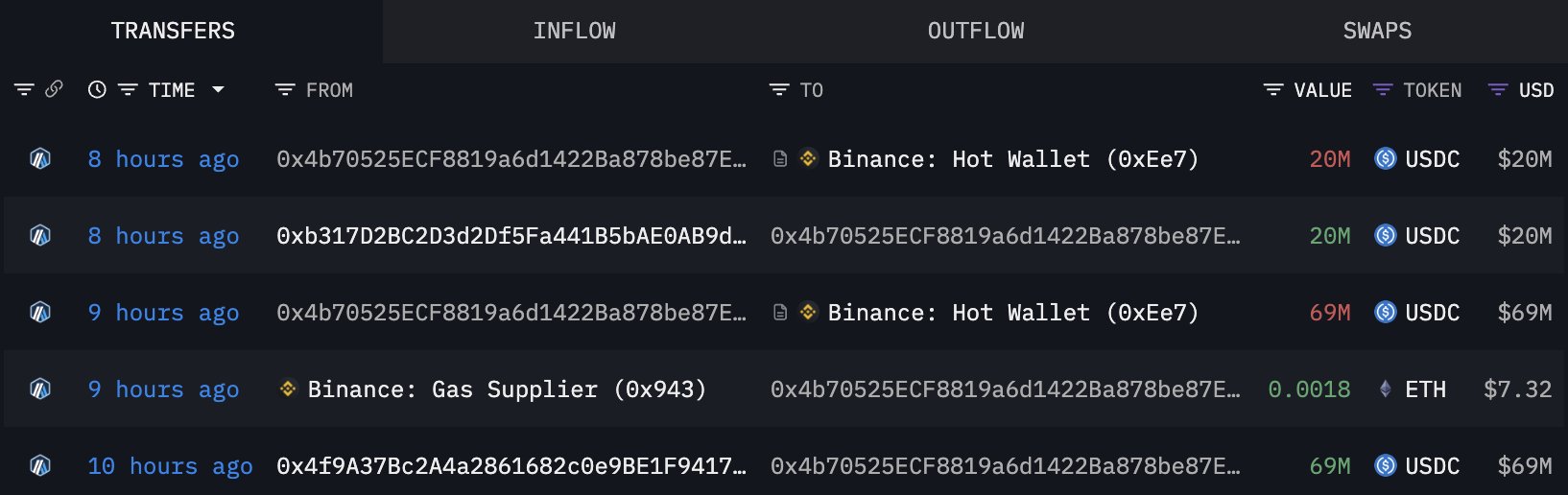

Lookonchain has monitored a series of high-stakes maneuvers from the trader identified as BitcoinOG (1011short), one of the market’s most scrutinized whales at present. The trader reportedly closed all BTC short positions on Hyperliquid, attaining more than $197 million in profit over two wallets following last week’s crash.

Hours later, the same wallet transferred $89 million USDC to Binance, instantly igniting speculation that the trader might be gearing up to reopen short positions. Coincidentally, Bitcoin’s open interest on Binance surged by $510 million shortly after the transfer, adding credence to theories that the whale could be a driving force behind this movement.

While no direct relationship has been substantiated, analysts are divided on whether this indicates another round of aggressive shorting or merely capital repositioning. Some speculate the whale may be anticipating further declines after Bitcoin’s inability to remain above $115K, while others suggest the funds could be allocated for market-neutral strategies such as hedging or arbitrage.

Nonetheless, the timing has left many traders unsettled. The market remains tenuous, and the whale’s actions — whether deliberate or coincidental — could impact short-term sentiment as Bitcoin struggles to hold support near the $110K region.

Related Reading

BTC Consolidates Below Key Level

Bitcoin continues to encounter selling pressure as it trades around $112,500, sitting just above its short-term support zone. The daily chart illustrates that BTC is caught between the 50-day moving average (near $115,000) and the 200-day moving average (around $108,000), indicating a market lacking decisiveness. The repeated rejections near $117,500—a level that has functioned as both support and resistance throughout the year—validate it as a crucial supply zone.

Recent attempts to bounce back have been feeble, with diminishing volume and momentum indicators suggesting consolidation rather than a robust reversal. Bulls are having difficulty taking control after the abrupt sell-off that briefly pushed BTC down to $103K, and failure to maintain levels above $110K could expose lower liquidity zones around $107K and $105K.

Related Reading

Conversely, holding above this range would stabilize market sentiment, enabling BTC to establish a foundation for a potential retest of the $115K–$118K region. For now, price movements remain cautious—bounded within ranges and responsive to broader risk sentiment. Traders are keenly observing for a breakout above $115K or a definitive drop below $110K to confirm the next significant directional shift following last week’s volatility.

Featured image from ChatGPT, chart from TradingView.com