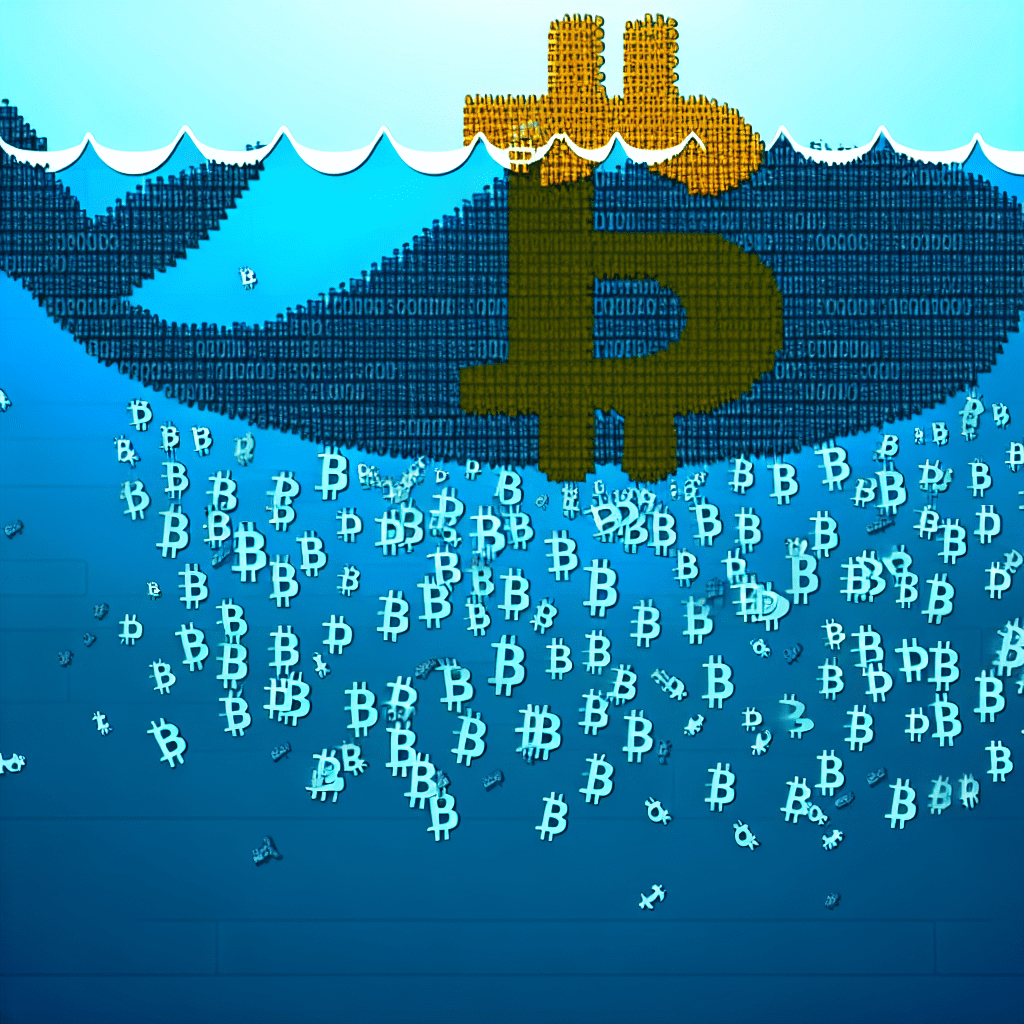

Claims that Bitcoin whales are undergoing a significant reaccumulation phase have been largely exaggerated, indicating that the structure of the digital asset market remains largely unchanged, according to on-chain data from CryptoQuant.

Julio Moreno, head of research at CryptoQuant, mentioned that the common narrative stating that large holders are actively purchasing Bitcoin (BTC) is misleading. Much of the publicly available data regarding “whale accumulation” is skewed due to exchange-related activity rather than authentic investor behavior.

Cryptocurrency exchanges frequently consolidate funds from numerous smaller wallets into fewer larger ones for operational and regulatory purposes. This practice artificially inflates the number of wallets holding substantial balances, causing on-chain trackers to incorrectly interpret the activity as whale accumulation.

After filtering out these distortions related to exchanges, the data reveals that large holders are actually distributing Bitcoin instead of accumulating it, according to Moreno.

This leads to a continued decline in overall whale balances. Holdings among addresses containing between 100 and 1,000 BTC are also decreasing, hinting at ongoing outflows from exchange-traded funds (ETFs).

This information is crucial as Bitcoin whales significantly influence the market, with large transactions often triggering price movements and volatile periods. Nonetheless, the market structure has evolved since early 2024 due to the launch of US spot Bitcoin ETFs, which have become major holders of the digital asset.

Source: Bithumb flags $200M in dormant crypto assets across 2.6M inactive accounts

A silver lining: Long-term holders turn to accumulation

While discussions continue about whether Bitcoin whales are reaccumulating, other on-chain data indicate a more positive shift among a closely monitored group: long-term holders.

Matthew Sigel, head of digital assets research at VanEck, noted that Bitcoin’s long-term holders have become net accumulators over the past 30 days, following what he described as the cohort’s most significant selling event since 2019.

This shift suggests that one of the main sources of recent selling pressure for Bitcoin may be diminishing, at least temporarily.

Although Bitcoin’s price action has not yet demonstrated a sustained recovery, the asset has also steered clear of retesting its sub-$80,000 low from November. At the time of writing, Bitcoin was trading slightly above $90,000.

Source: Crypto’s 2026 investment playbook: Bitcoin, stablecoin infrastructure, tokenized assets