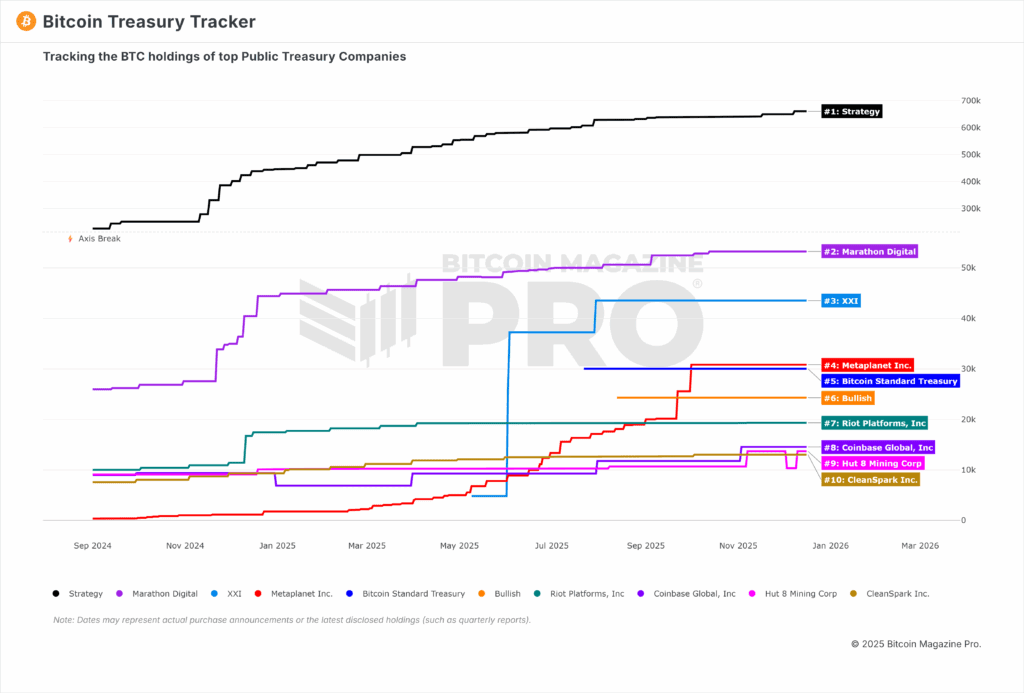

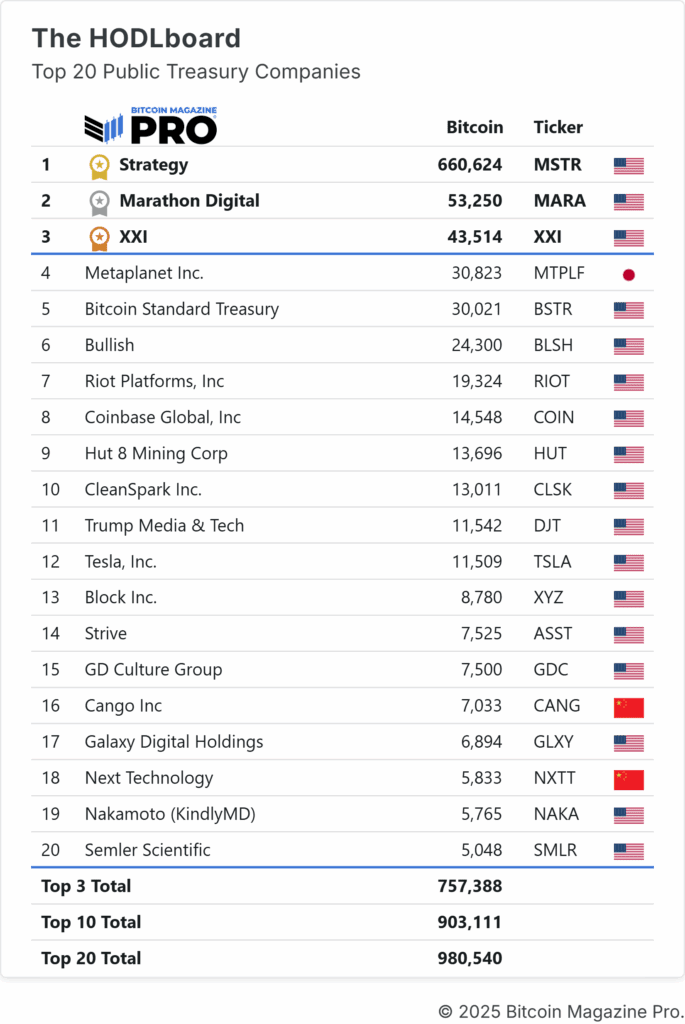

Companies holding Bitcoin treasuries have faced significant challenges due to the lackluster price performance of Bitcoin in 2025. Publicly listed entities with substantial BTC holdings are bearing the brunt, particularly leaders like (Micro)Strategy, who have engaged in aggressive accumulation despite various challenges—yet many are currently valued below their net asset value, presenting a unique opportunity for bold strategic investors.

The Landscape of Bitcoin Treasury Companies

Not all Bitcoin treasury companies are alike. Strategy is distinguished as the leader in the field, often referred to as the “Bitcoin of treasury companies.” The company has upheld its accumulation strategy despite market pressures, recently revealing a $1.44 billion USD reserve designated for covering dividends and debt without necessitating Bitcoin sales.

This financial cushion theoretically eradicates the need for excessive share issuance or urgent BTC liquidation, a crucial advantage over weaker competitors. Many may encounter pressures from shareholders, potentially leading to forced selling as stock prices drop, which could inadvertently create opportunities for resilient firms like MSTR.

Valuation Trends of Bitcoin Treasury Companies

The most intriguing element in the current valuations of treasury companies is that they are trading below net asset value per share. Essentially, investors can buy a dollar’s worth of Bitcoin for less than a dollar via treasury company stocks. This represents an arbitrage opportunity, albeit one fraught with higher volatility and company-specific risks.

Currently, Strategy trades at a net asset value premium of under 1, meaning its market cap is lower than the value of its Bitcoin reserves alone. In an optimal scenario, if Bitcoin regains its prior peak around $126,000, Strategy would continue accumulating towards 700,000 BTC, and the market attributes a modest 1.5x to 1.75x net asset value premium, Strategy’s stock could near the $500 mark per share.

Transitioning from Weakness to Strength: The Future of Bitcoin Treasury Companies

Analyzing Strategy’s performance during the last Bitcoin bear market and comparing it to the current cycle shows a striking correlation. The pattern indicates that current price levels may offer reasonable support, unless an extreme final drop fueled by Bitcoin weakness creates grounds for significantly lower values.

As weaker treasury firms grapple with forced selling, a case for consolidation arises, suggesting that Strategy and similarly positioned entities could acquire Bitcoin at a discount from distressed sellers, further consolidating their holdings among the most committed accumulators. This pattern reflects Bitcoin’s own evolution, where weaker hands sell while stronger ones accumulate, resulting in more concentrated ownership among dedicated investors.

Conclusion: Finding Opportunity in Bitcoin Treasury Companies

Although Bitcoin treasury companies have largely yielded unsatisfactory returns in 2025, this situation has carved out a substantial opportunity for disciplined investors. At prevailing valuations, Strategy effectively offers one dollar of Bitcoin for about 90 cents, a bargain that grows even more appealing if Bitcoin undergoes one final capitulation. The combination of this potential scenario alongside Strategy’s favorable position creates an asymmetric risk-reward profile deserving of small, strategically sized allocations within aggressive investment portfolios.

For more data, charts, and expert insights into bitcoin price trends, check out BitcoinMagazinePro.com. Subscribe to Bitcoin Magazine Pro on YouTube for additional expert market analysis and insights!

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Always conduct your own research before making any investment decisions.