Bitcoin traders entered 2026 with optimism, making option bets anticipating a price surge into six figures.

Since at least Friday, there has been a significant rise in investor interest regarding the $100,000 strike January expiry call option available on Deribit, the leading crypto options exchange by volume and open interest.

A call option grants the buyer the right, but not the requirement, to acquire the underlying asset at a specified price at a later date. The $100,000 call option indicates a wager that bitcoin’s value will exceed that threshold on or before the expiry date of the contract.

“Flow continues to be driven by rolls, with a notable rise in interest for the 30 Jan 100k calls,” stated Jasper De Maere, desk strategist at Wintermute.

In just the past 24 hours, the count of active or open contracts for this specific option has increased by 420 BTC, according to Amberdata. This represents a nominal growth in open interest of $38.80 million, leading all January calls across the entire Deribit platform, where each options contract equates to one BTC.

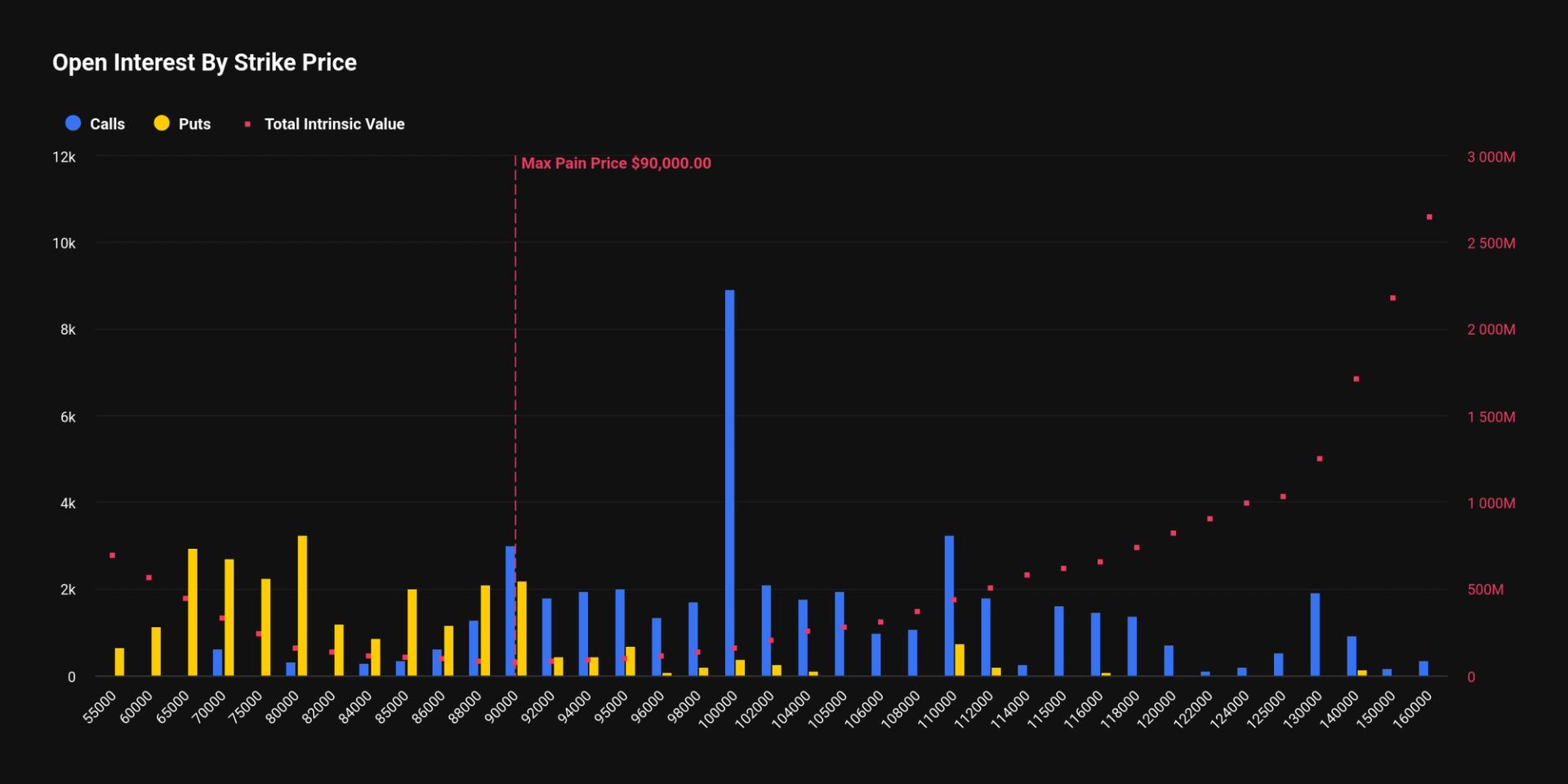

The option recently featured a total nominal open interest of $1.45 billion, with January expiry alone contributing $828 million, as reported by Deribit Metrics.

This positioning reflects the bullish outlook that characterized much of 2025, when traders pursued call options with strikes between $100,000 and $140,000.

Interest for these bullish options could further escalate if BTC’s price surge surpasses $94,000, as noted by QCP Capital. The cryptocurrency has experienced approximately a 5% rise in the first five days of the year, briefly reaching over $93,000 early Monday.

“Following the [December] expiry, positioning has transitioned. BTC perpetual funding on Deribit has climbed above 30%, indicating that dealers are currently short gamma to the upside. This behavior was observed as spot prices exceeded 90k, activating hedging flows into perpetuals and near-dated calls,” QCP Capital remarked last week.

“A sustained uptick above 94k could amplify this trend,” the firm added.