On Tuesday, Bitcoin reached a three-week peak before retracting, drawing keen attention from traders and analysts.

Related Reading

Data from TradingView shows that the Bitcoin price peaked at $94,600 late in the day—marking its highest point since November 25—before settling at around $92,450 as of this report.

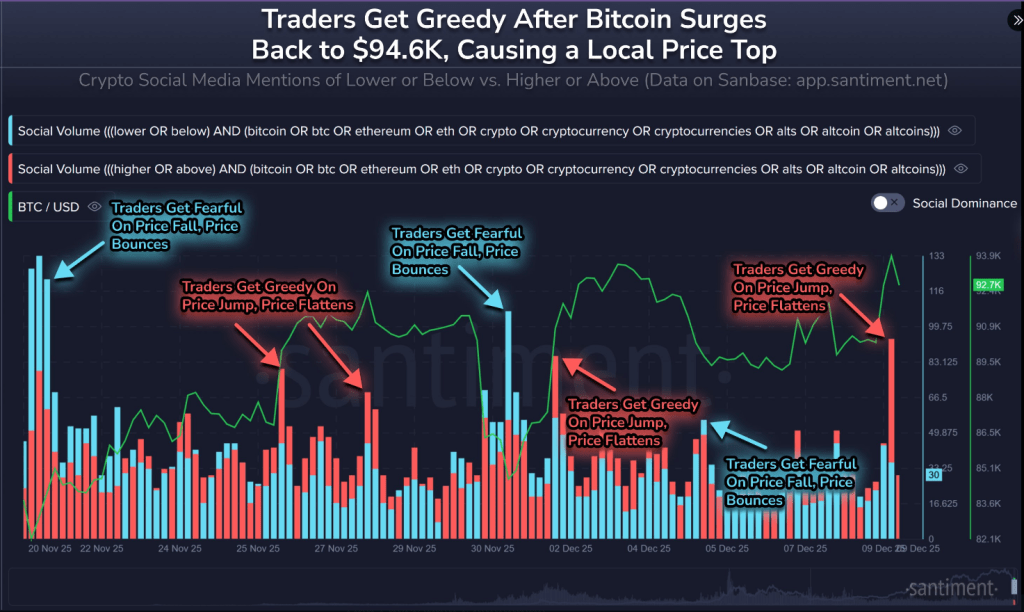

Santiment, a firm specializing in blockchain analytics, noted a surge in social media discussions calling for “higher” and “above” during the price spike, despite mixed market reactions.

Bitcoin: Trader Excitement and Doubts

Reports indicate that the spike attracted significant retail interest, leading to a flurry of social media posts advocating for increased buying.

However, some market observers have raised questions about the authenticity of the surge. A prominent long-term investor known as “NoLimit” informed his 53,000 X followers that the $94,000 increase appeared manipulated: large purchases condensed into a brief time frame, shallow order books, with minimal follow-through.

🤑 Bitcoin enjoyed a much needed rebound back to $94.6K today, reinvigorating traders, causing them to FOMO back in and expect higher prices. According to our social data scraping X, Reddit, Telegram, & other data, calls for “higher” & “above” exploded.

🟦 High bars indicate… pic.twitter.com/o3U3yWkwkk

— Santiment (@santimentfeed) December 9, 2025

This behavior, he suggested, is a tactic used by larger traders to induce short-term fear of missing out, allowing them to capitalize on rising prices.

Santiment also pointed out an interesting trend: smaller traders tend to jump in after price spikes, often ending up on the losing side of the market movements.

Following the high, volatility increased, as prices dipped by a couple of thousand dollars within hours. Analysts emphasize that the depth of exchange orders and the timing of large transactions are crucial, especially when liquidity is low.

Fed Decision Could Alter Momentum

This week’s meeting of the US central bank is a significant wildcard. Market indicators on CME Group futures suggest an 88% likelihood of a 0.25% rate cut, a factor many traders believe contributed to the recent rally. However, some analysts caution that any indication of reluctance regarding future cuts could reduce risk appetite.

Apart from US policy, the anticipated interest rate decision by the Bank of Japan next week is also under scrutiny, as a tighter monetary stance could increase yields and draw capital back to Japan, constricting global liquidity. Such shifts can adversely impact riskier assets across various markets.

Liquidity, Institutions, and the Bigger Picture

In the meantime, long-term holders have reduced their supply following a 36% correction from the all-time high, with some addresses now resembling holdings seen in March.

Jessica Gonzales, an analyst mentioned in recent reports, observed that the M2 money supply stands at approximately $22.3 trillion and stablecoin reserves remain high, indicating the presence of capital, albeit unevenly distributed across markets.

Institutional movements are also noteworthy: major players like BlackRock have increased their exposure to crypto, potentially introducing a more stable buying base—or simply redistributing risk.

Related Reading

What Traders Should Monitor

Short-term traders are advised to keep an eye on order-book depth, clusters of large trades, and the market’s reaction to any Federal Reserve updates regarding future cuts.

Several observers have highlighted the upcoming 25 days as particularly critical, as volatility in liquidity and regulatory updates could quickly change the prevailing narrative. Should a genuine broad-based demand emerge, prices might rise swiftly; conversely, if the Fed suggests caution, the opposite effect could occur.

Featured image from Gemini, chart from TradingView