On-chain data indicates that Bitcoin short-term holder whales are currently experiencing their highest unrealized gains of the cycle following the recent market rally.

Bitcoin Short-Term Holder Whales Are Boasting $10.1 Billion In Earnings

According to a recent post by CryptoQuant analyst Maartunn on X, profits for Bitcoin short-term holder whales have surged to the highest levels seen this cycle. Short-term holders (STHs) typically refer to BTC investors who acquired the cryptocurrency in the last 155 days. These holders are often viewed as the market’s “weak hands,” prone to panic during volatility.

For this discussion, the focus isn’t on the entire STH group but rather on a specific subset: the whales. Defined as entities possessing over 1,000 tokens in their wallets, STH whales are those who entered the market in the recent five months.

Bitcoin is currently trading at unprecedented price levels, meaning most STHs (except those who purchased at the weekend peak above $125,000) would be realizing profits. A useful indicator to assess their gains is the Unrealized P&L, which gauges the net unrealized profit or loss held by Bitcoin investors at present.

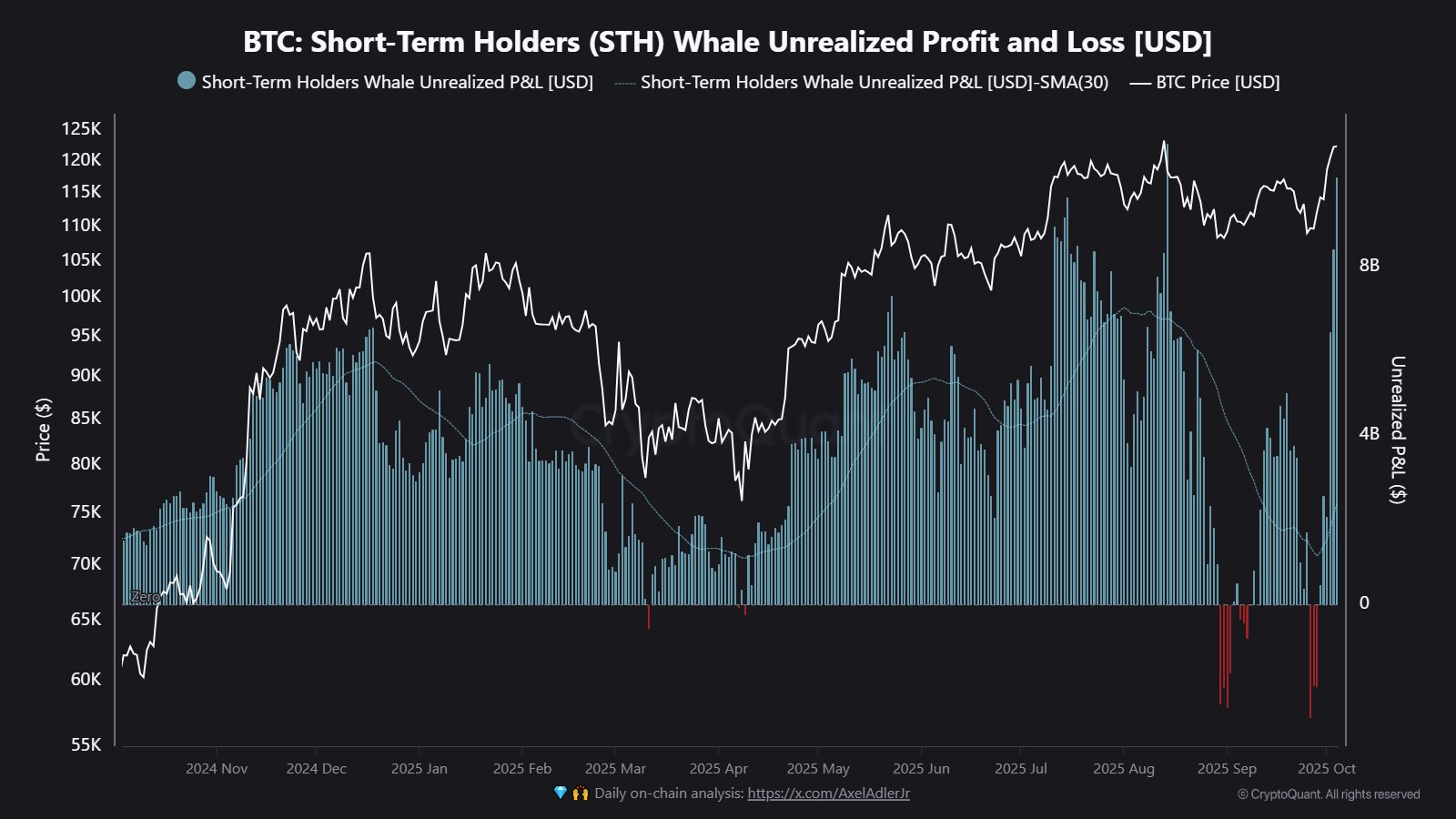

Below is a chart shared by Maartunn that illustrates the trend of this indicator for Bitcoin STH whales throughout the past year.

The graph reveals that Bitcoin STH whales were in the red during the cryptocurrency’s drop in late September. However, with the recent asset rally, their Unrealized P&L has notably recovered into positive territory, peaking at $10.1 billion, marking a cycle high for the metric.

Considering the fragile nature of STHs, it’s possible that this substantial profit might encourage some whales to exit the market. It remains to be seen if sufficient demand will continue to absorb any potential profit-taking.

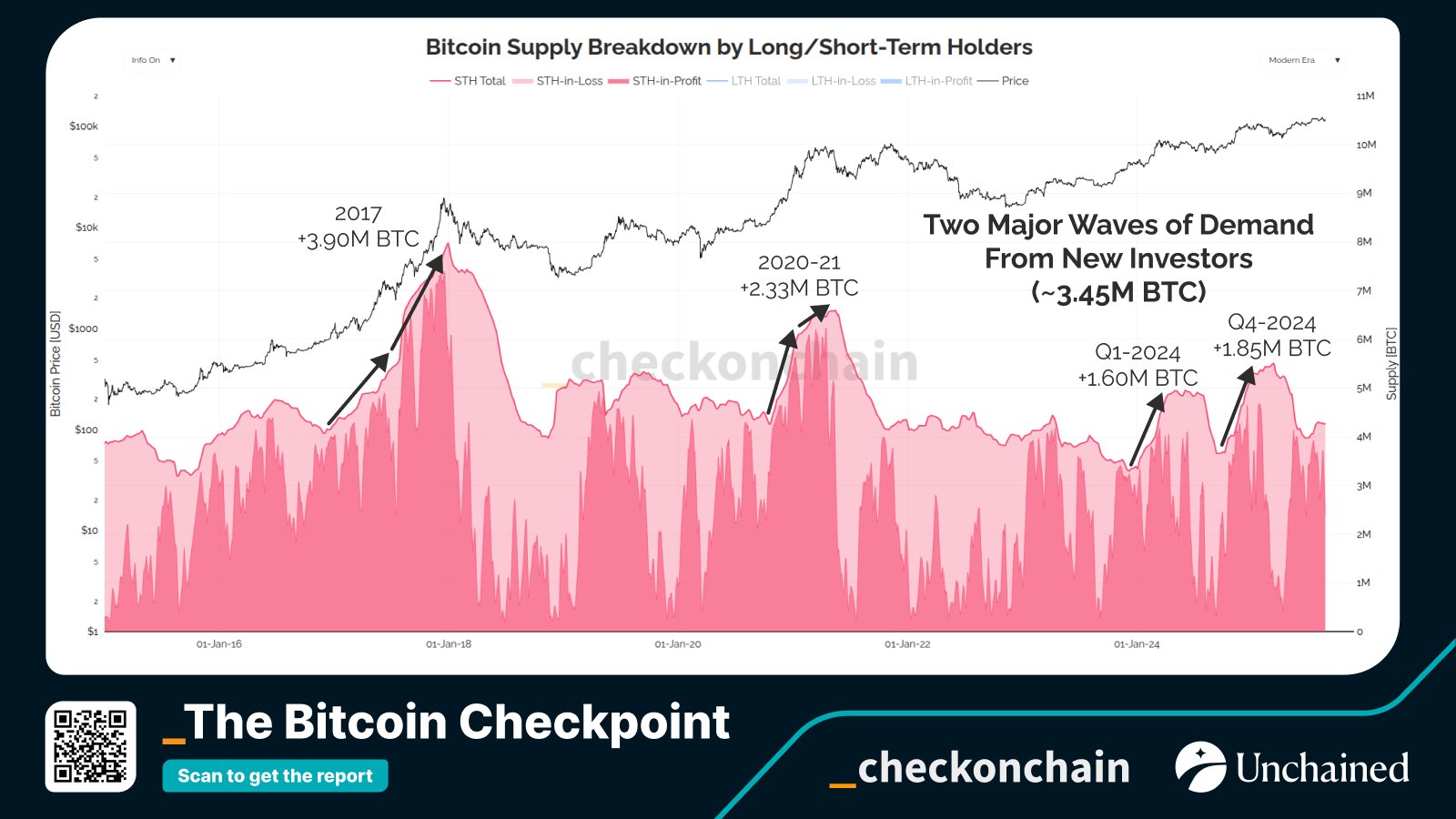

Regarding the STHs, this cycle has witnessed two significant transfers of coins from long-term holders (LTHs) to STHs, as highlighted by on-chain analytics platform Checkonchain in a post on X post.

“3.45M BTC has shifted to Short-Term Holders this cycle, comparable to the scale observed in 2016–17 but at prices 100x higher,” states Checkonchain.

BTC Price

As of this writing, Bitcoin is priced around $124,600, reflecting an increase of approximately 11% over the last week.