This past weekend, the price of Bitcoin surged past $92,000, rebounding from a low of around $88,000. It peaked at $92,203 within a week.

Analysts from Bernstein contend that the recent shifts in prices indicate a fundamental change in Bitcoin’s market cycle. In a communication to their clients, the firm noted that the traditional four-year cycle, which has typically seen peaks every four years, appears to be disrupted.

Bernstein believes Bitcoin is entering a prolonged bull cycle, driven by ongoing institutional purchases that counterbalance retail sales.

Even with a correction of approximately 30%, outflows from ETFs have been minimal, staying below 5%.

The bank has raised its price target for 2026 to $150,000, expecting the cycle might peak in 2027, potentially reaching around $200,000. Bernstein continues to project a long-term target of about $1 million per BTC by 2033.

On another note, Wall Street bank JPMorgan maintains a bullish outlook for the coming year. Their analysts uphold a gold-linked, volatility-adjusted BTC target of $170,000 within the next six to twelve months, taking into account price variations and mining costs.

Strategy and the Bitcoin price

Strategy (MSTR), the leading corporate Bitcoin holder, plays a pivotal role in institutional market dynamics. The firm owns about 660,624 BTC, with an enterprise-value-to-Bitcoin holdings ratio (mNAV) of 1.13.

JPMorgan suggests that this ratio exceeding 1.0 is “promising,” indicating that Strategy is less likely to be compelled to sell its holdings.

Additionally, Strategy has set up a reserve of $1.44 billion in U.S. dollars to manage dividend payouts and interest obligations for at least the next 12 months, with intentions to extend this to 24 months. Bernstein has kept its Outperform rating on MicroStrategy but revised its price target down from $600 to $450, in light of the recent market correction.

Today, Strategy announced the acquisition of 10,624 BTC last week for approximately $963 million, resulting in an average purchase price of $90,615 per coin. This raises its total holdings to 660,624 BTC, with an average acquisition cost of $74,696 per bitcoin. The current market value is around $60.5 billion, reflecting unrealized gains of nearly $11 billion.

This marks Strategy’s largest buying spree to date as market volatility subsided. Its shares experienced a 3% rise in early trading on Monday, rebounding from a low near $155 on December 1, although they still sit more than 50% below their six-month high.

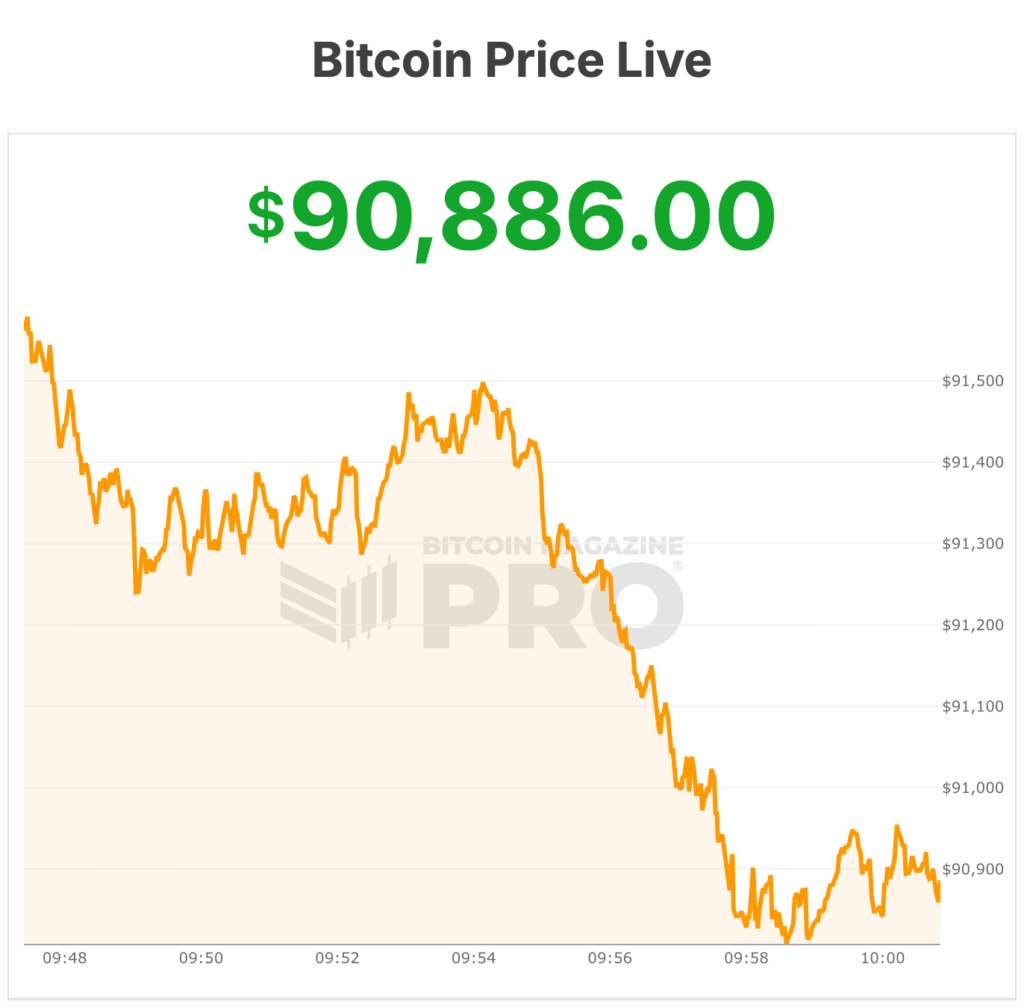

Currently, the Bitcoin price stands at $90,886, having increased by 3% in the last 24 hours, accompanied by a trading volume of $46 billion.

The market capitalization of the cryptocurrency has reached $1.82 trillion, with a circulating supply of 19.96 million BTC and a capped maximum supply of 21 million.