Reports indicate that Bitcoin’s outlook for 2026 is highly polarized as traders conclude the year. The cryptocurrency was trading at $87,520 at the time of this publication, marking an 8% decline since January 1. The market sentiment has been notably weak, with the Crypto Fear & Greed Index dropping to 20 on December 26, representing a two-week period categorized as “extreme fear.”

Related Reading

Analysts Divided On Market Trends

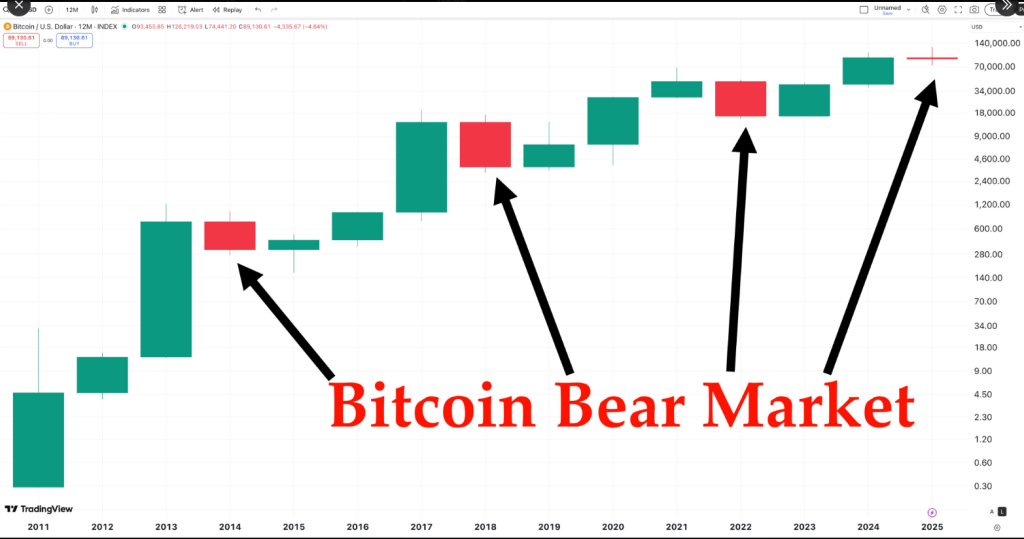

According to posts on X, Jan3 founder Samson Mow asserts that 2025 was a bear market, suggesting that Bitcoin could be transitioning into a bull run expected to last until 2035.

PlanC, another prominent analyst, highlighted that Bitcoin has never experienced two consecutive yearly losses and suggested that enduring 2025 would mean surviving the bear phase. These comments have circulated widely in the industry, igniting fresh discussions.

2025 was the bear market. https://t.co/1ganX0YSbI

— Samson Mow (@Excellion) December 26, 2025

Prominent Predictions Remain Optimistic

Several key figures still anticipate significant price increases. Geoff Kendrick from Standard Chartered and Gautam Chhugani from Bernstein each predict Bitcoin could reach $150,000 in 2026.

Charles Hoskinson, the founder of Cardano, forecasts a price of $250,000 by 2026, citing limited supply and increasing institutional demand as primary factors.

Arthur Hayes and Tom Lee have also set ambitious targets recently, with $250,000 mentioned as a likely possibility by year-end.

Market Sentiment And Data

Reports indicate that sentiment indicators have not bolstered bullish momentum. The fear index, which reached 20 on December 26, has lingered in “extreme fear” territory for several days.

Simultaneously, Bitcoin’s current price is below many previous expectations. Observers note that the coin is under pressure, despite a number of optimistic forecasts.

Bears Present Significant Downside Scenarios

Mike McGlone, senior commodity strategist at Bloomberg Intelligence, anticipates a decline of approximately 60% from the historical peak above $126,000 by 2026.

Jurrien Timmer from Fidelity cautioned that 2026 may be a “year off,” with potential prices dipping towards $65,000. These perspectives heavily rely on historical downturns and broader economic challenges.

Such views carry significance as substantial drops have been observed in the past, although historical patterns do not guarantee future performance.

Divergent Projections Overview

The range of predictions is quite broad. Some analysts expect around $150,000, which would indicate approximately 74% upside from a specified $86,000 mark.

Others forecast $250,000, while bearish scenarios suggest prices could plummet to $65,000 or even lower from the peak of $126,000.

This disparity highlights how different assumptions about supply, institutional demand, and economic conditions can lead to vastly different price estimations.

Related Reading

Traders and asset managers will closely monitor inflows into regulated products, corporate treasury transactions, and shifts in on-chain demand. While headlines and bold predictions stir conversation, actual market flows will likely influence short-term movements.

Volatility is expected to persist, and the stark contrast in forecasts suggests that both rapid surges and abrupt declines could occur in 2026.

Featured image from Pexels, chart from TradingView