Although substantial investments and a clear demand for yield exist, many Bitcoin holders have yet to engage with BTCFi due to its perceived complexity and unfamiliarity. Without more straightforward products and enhanced communication, BTCFi risks remaining a niche market for insiders and failing to achieve mainstream acceptance.

Summary

- A significant number of Bitcoin holders remain untouched by BTCFi, despite strong investment and evident demand for yield and liquidity.

- The issue lies in the fact that current platforms cater primarily to crypto insiders, leaving everyday BTC users either bewildered or unaware of these offerings.

- Unless BTCFi simplifies its approach and improves communication, it may continue to be a niche sector rather than appealing to the broader Bitcoin audience, warns GoMining.

While venture capital and media enthusiasm suggest that Bitcoin DeFi — commonly referred to as BTCFi — is thriving, Bitcoin users narrate a different scenario. A recent GoMining survey shared with crypto.news reveals that nearly 80% of BTC holders have never utilized BTCFi, exposing a disconnect between the industry’s aspirations and actual user adoption.

Comparable to decentralized finance (DeFi) on Ethereum, BTCFi aims to provide tools and platforms that allow users to engage with BTC in financial activities beyond mere buying and holding. For instance, users can use BTC for lending, access synthetic Bitcoin assets, or bridge them through cross-chain methods to interact with different networks.

Institutional investment also appears to be rising. Data from Maestro, a Bitcoin-focused infrastructure provider, indicates that BTCFi venture capital reached $175 million across 32 funding rounds in the first half of 2025, with 20 of those deals targeting DeFi, custody, or consumer applications within the BTCFi domain.

For crypto natives only

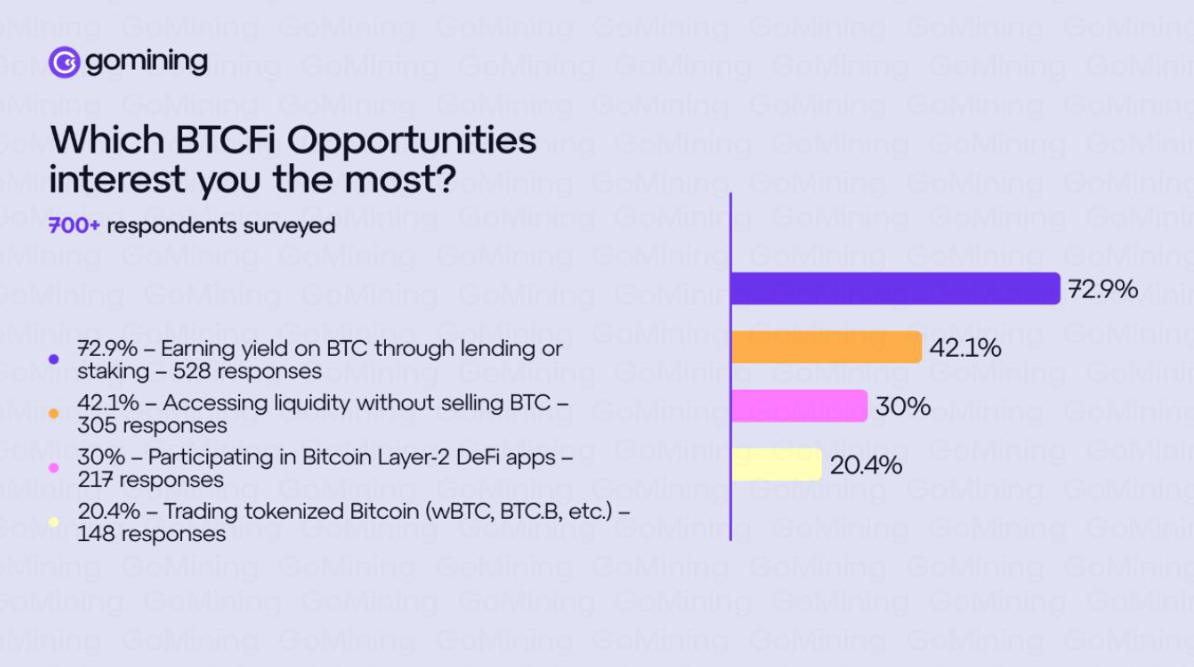

According to GoMining’s survey of over 700 respondents from North America and Europe, around 77% of Bitcoin holders have never engaged with BTCFi. The firm suggests that there is demand, as the survey indicates that 73% of Bitcoin holders seek to earn yield on their assets while 42% wish to obtain liquidity without liquidating their holdings.

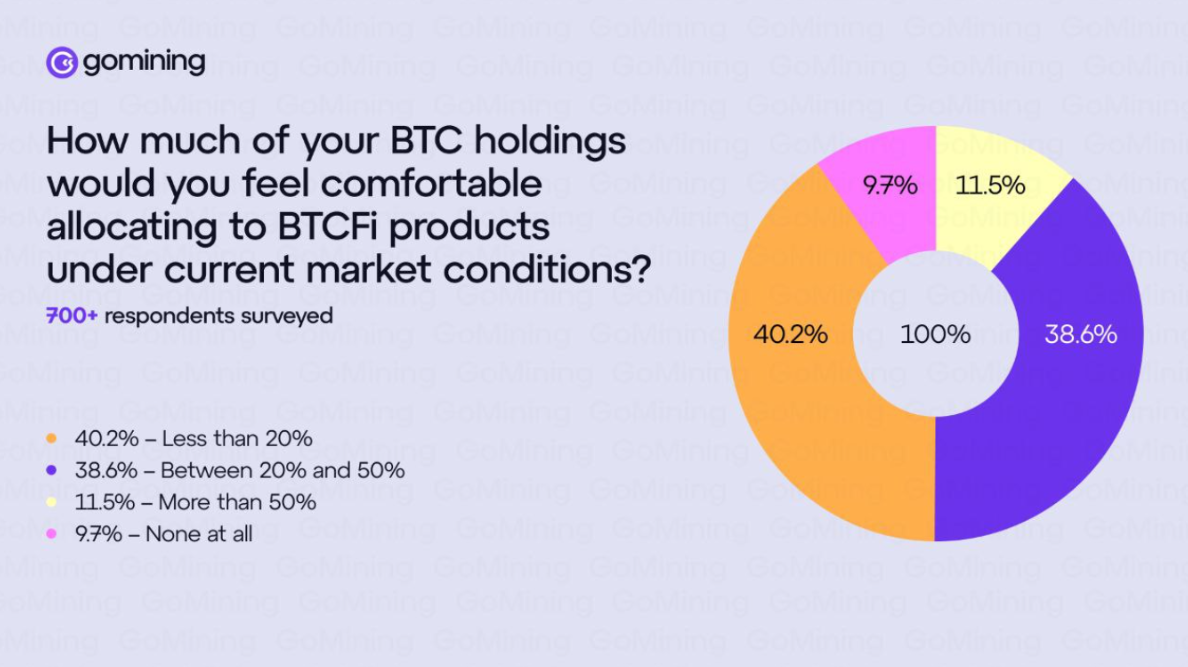

Adoption seems to be hindered by issues of trust and complexity. Over 40% of participants reported they would allocate less than 20% of their Bitcoin to BTCFi offerings, a cautious approach linked to confusion and security concerns.

Mark Zalan, CEO of GoMining, stated that the findings align with the company’s observations, noting an “enormous appetite for these opportunities, but the industry has crafted products aimed at crypto veterans, not average Bitcoin enthusiasts.”

Lack of awareness

A significant challenge facing BTCFi is a lack of awareness. Nearly two-thirds of participants — about 65% — could not identify a single BTCFi initiative. Zalan expresses that this indicates a failure in outreach.

“This isn’t a failure of Bitcoin holders to keep up. The BTCFi industry must communicate more effectively with its target market. When two-thirds of potential users can’t name a single project in your space, it’s evident that education can help resolve the adoption challenge.”

Mark Zalan

GoMining’s results imply that BTCFi has primarily been engaging with insiders rather than the larger community of Bitcoin participants.

Not like DeFi

One reason for this disconnect could be that BTCFi has drawn heavily from Ethereum’s DeFi framework. However, Bitcoin users often have differing preferences, typically favoring custodial wallets and regulated exchange-traded funds over self-custody and intricate protocols.

Zalan elaborated that Bitcoin holders “aren’t Ethereum users,” adding that Coinbase and Bitcoin ETFs have succeeded “because they emphasized accessibility.” In essence, while demand exists, platforms need to be more straightforward, secure, and user-friendly.

The survey underscores a sector with both potential and hurdles. Bitcoin holders clearly desire yield and liquidity options but are hesitant to engage with BTCFi platforms due to trust issues, complexity, and low brand visibility.

This dichotomy presents both challenges and opportunities. If BTCFi platforms invest in clear messaging and uncomplicated onboarding processes, they may capture a larger audience among Bitcoin holders. However, if they fail to adapt, BTCFi risks remaining an exclusive domain for crypto insiders, missing the millions of Bitcoin holders it aspires to impact.