Bitcoin (BTC) is currently maintaining a level around $117,500, reflecting an increase of approximately 6.1% over the last two weeks. Recent insights from Binance indicate that the support for BTC’s current price is primarily coming from retail investors, with larger holders, or whales, noticeably absent.

Bitcoin Steady at $117,500 with Strong Retail Participation

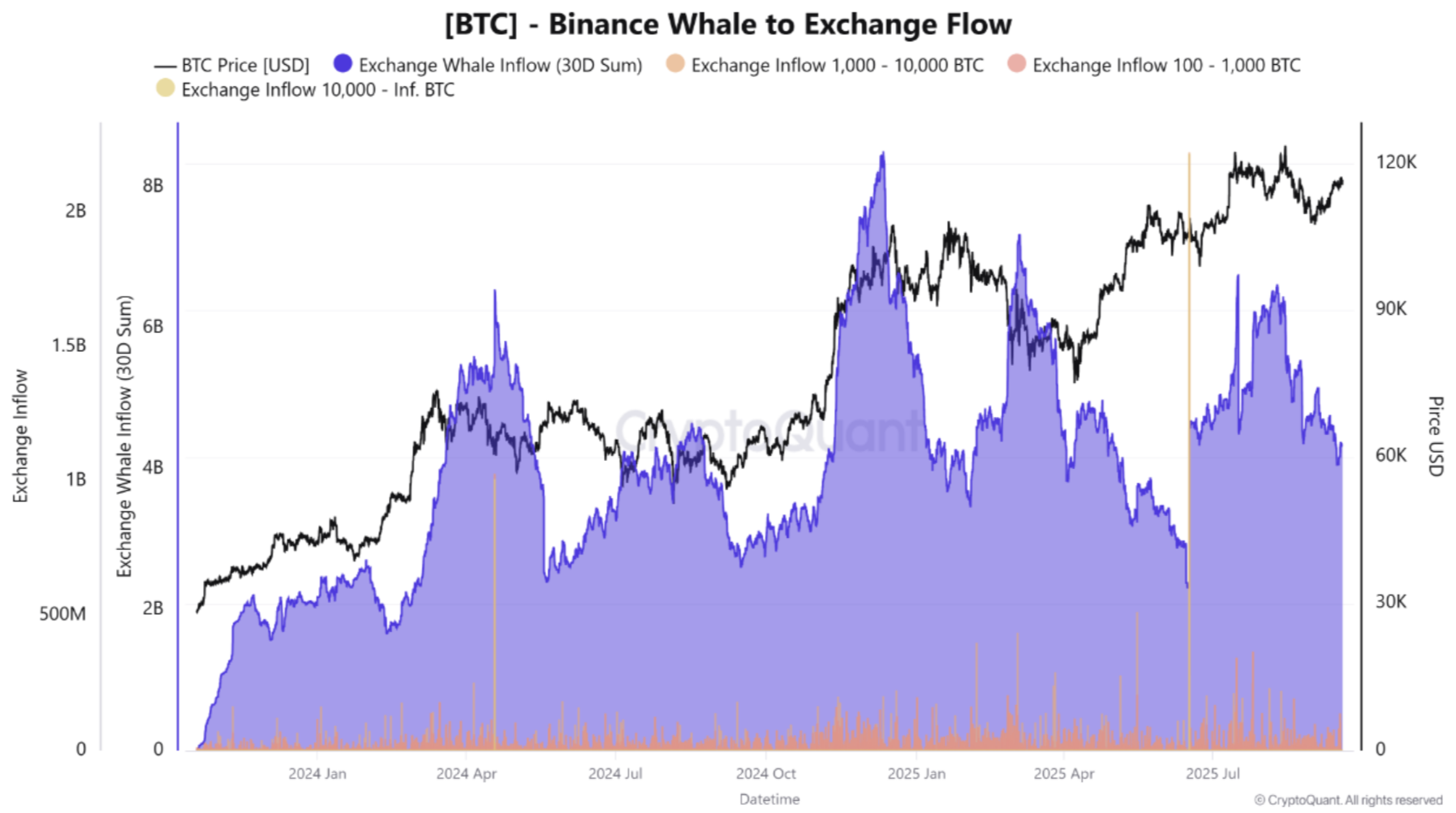

As noted in a CryptoQuant Quicktake article by contributor Arab Chain, Bitcoin is hovering near the $117,500 mark, buoyed by significant inflows from retail investors. Interestingly, the complete lack of substantial whale inflows suggests that the market is predominantly driven by individual investors rather than large wallet transactions.

Related Reading

Inflows in the 0 to 0.001 BTC range recorded about 97,000 BTC, while inflows from the 0.001 to 0.01 BTC category reached nearly 719,000 BTC.

The data indicates that the current rally in Bitcoin is principally supported by retail investors. This demographic tends to engage in numerous smaller transactions, which signals that the market dynamics are being influenced by individual contributors. Arab Chain highlighted:

The statistics show that the majority of inflows come from small to medium-sized transactions, reinforcing the idea that retail activity is predominant in Bitcoin trading. This liquidity, despite being on a smaller scale, has helped stabilize the market at its present levels.

Importantly, there has been little to no pressure from whales during the current market uptrend. Specifically, there have been no notable inflows exceeding 100 BTC, which reduces the potential for a sharp price correction in the short term.

In summary, the current market situation suggests that Bitcoin is in a state of stability, largely attributed to increased retail investor engagement. This scenario may facilitate a gradual approach toward the crucial $120,000 resistance level.

It is advisable to monitor any whale movements that could swiftly change the market landscape. A sudden influx from whales could instigate a quick price retracement, akin to past market peaks.

Analysts Split on BTC Price Trends

As Bitcoin trades about 5.4% below its all-time high (ATH), indicators suggest that the leading cryptocurrency may be poised for a new upward trend. For instance, BTC managed to surpass the mid-term holder breakeven point, decreasing the chances of a prompt sell-off.

Related Reading

Recent favorable developments, such as a 25 basis point reduction in interest rates by the US Federal Reserve (Fed), may renew interest in the crypto market. In this context, crypto entrepreneur Arthur Hayes has recently reaffirmed his bold forecast of $1 million for BTC.

Conversely, gold advocate Peter Schiff suggests that BTC may have already reached its peak for the current market cycle. At the time of reporting, BTC stands at $117,523, reflecting a 1.8% increase over the last 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com