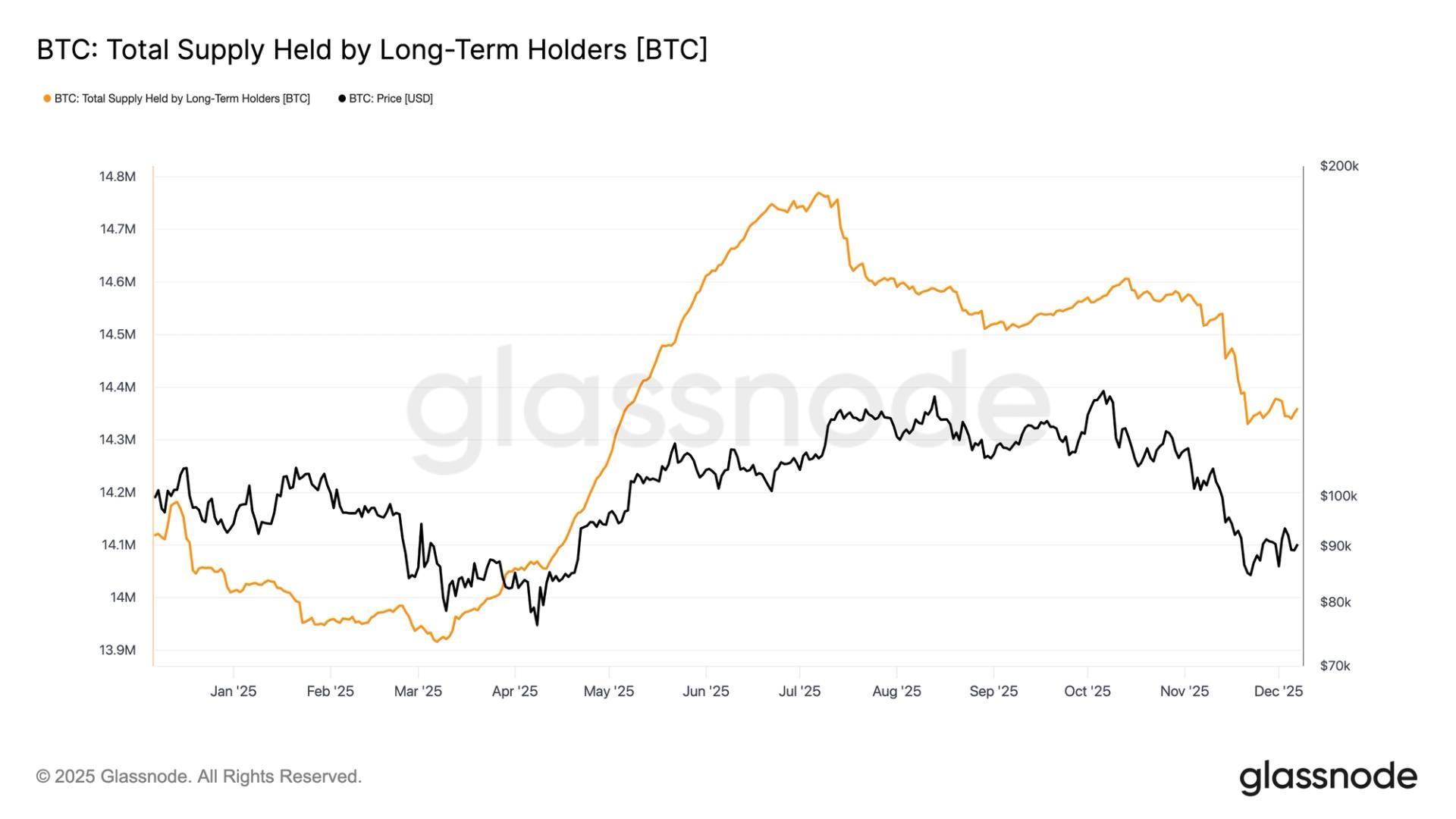

On November 21, the long-term holder (LTH) supply hit a cyclical low, coinciding with bitcoin’s price hitting around $80,000. With bitcoin now back up to $90,000—about 15% above that low—data indicates that the majority of sell pressure driven by spot trading has subsided following a 36% peak-to-trough correction.

This trend has emerged as a significant narrative for 2025, as consistent spot selling has been the primary factor behind bitcoin’s largely flat trading year-to-date.

Long-term holders are defined as individuals or entities that have retained their coins for at least 155 days. As coins transition from short-term holders to this group, the long-term holder supply naturally rises.

The recent stabilization and initial upturn suggest that the distribution wave from these more experienced holders is significantly decreasing, consequently lowering structural sell pressure within the market.

Since the summer, long-term holders have cut their holdings from 14,769,512 BTC in July to 14,330,128 BTC in November.

The last two lows in long-term holder supply occurred in April 2024 and March 2025. The April 2024 drop followed bitcoin’s peak at $73,000, indicating that long-term holders were selling into strength. The March 2025 low came during the correction prompted by concerns over Trump tariffs, which saw bitcoin bottoming in April at roughly $76,000.

Historically, long-term holder supply experiences sharp declines during retail-driven mania phases associated with cycle peaks, most prominently in 2017 and 2021.

This cycle, however, appears distinct. Rather than a dramatic blow-off top followed by aggressive selling, the trend has been more gradual, displaying steadier rises and falls. This suggests that market structure and holder behavior have evolved, challenging the traditional four-year cycle model due to different on-chain behaviors.