On Monday, Bitcoin (BTC) fell beneath $86,000, further intensifying a liquidity imbalance as smaller investors continued to buy during dips. In contrast, larger holders are capitalizing on this demand to exit their positions, maintaining consistent downward pressure.

Key highlights:

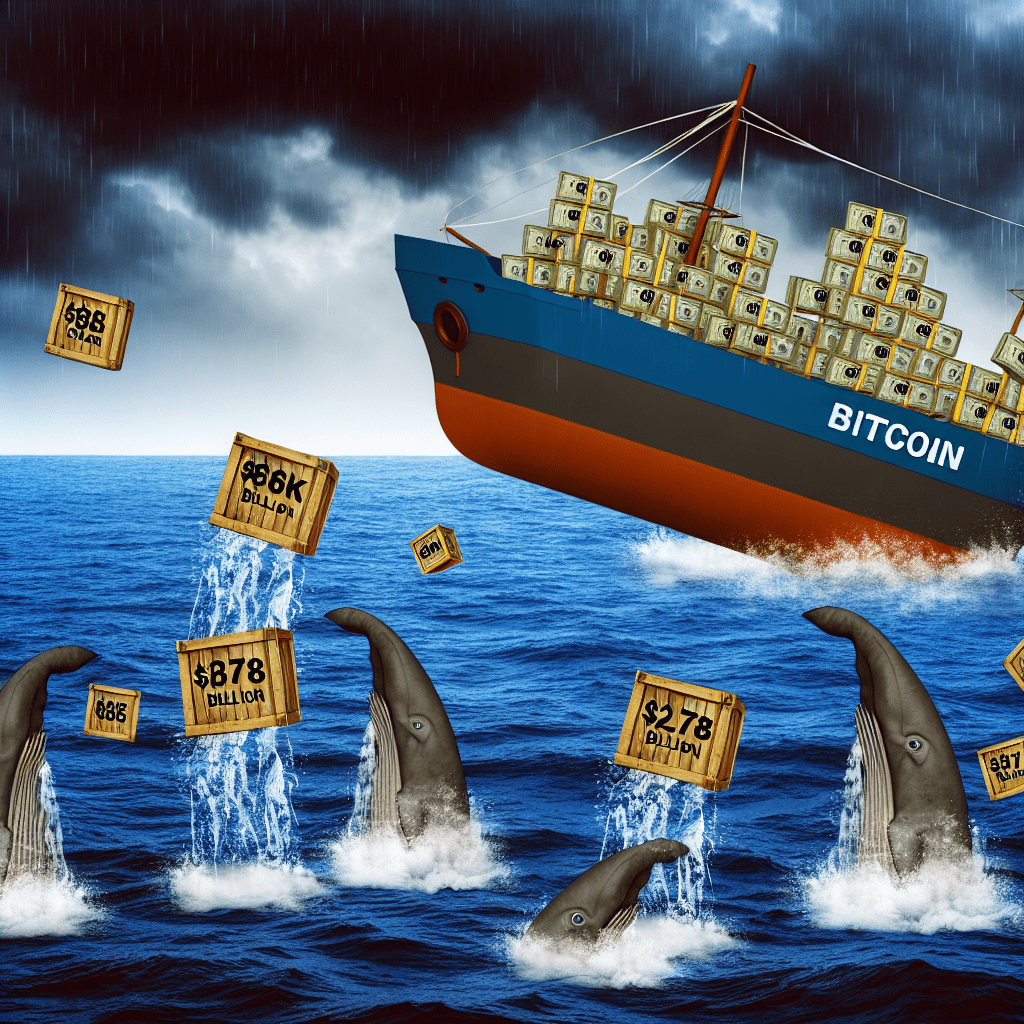

Retail and mid-sized Bitcoin wallets accumulated $474 million in total buy-side volume, while whales offloaded $2.78 billion in the same timeframe.

Short-term BTC holders have been selling at a loss, indicating capitulation, yet a reversal has not been established.

Bitcoin may revisit quarterly lows at $80,600 after invalidating its short-term bullish trend.

Whales dominate the sell-side as retail bets on a bottom

Order flow data from Hyblock Capital showed a significant difference in behavior among participant categories. Retail traders or wallets ($0–$10,000) have accumulated a cumulative volume delta of $169 million, continuously bidding during the downtrend. Mid-sized participants ($1,000–$100,000) also created a $305 million net spot position as they sought to anticipate a recovery.

However, whale wallets ($100,000–$10 million) remain the dominant influence, showing a negative $2.78 billion in cumulative volume delta. The combined purchasing power of retail and mid-sized traders is inadequate to counteract large-scale institutional distribution.

This leads to a liquidity mismatch, where smaller players view sub-$100,000 prices as a bargain, whereas larger holders see it as a chance to lessen exposure.

Meanwhile, on-chain analyst Axel Adler Jr noted that the short-term holder spent output profit-ratio (seven-day SMA) dropped below 1, currently at around 0.99. This signifies that coins held for less than 155 days are, on average, being sold at a loss.

Historically, these conditions have coincided with local capitulation phases, marked by peak selling pressure. However, Adler emphasized that such stress alone does not confirm a trend reversal. A sustainable recovery can only begin when SOPR reclaims and remains above 1, indicating that demand is beginning to absorb supply.

Related: Bitcoin experiences ‘pure manipulation’ as the US sell-off liquidates $200M in just one hour

Bitcoin poised to revisit lower liquidity targets

From a technical perspective, Bitcoin’s structure has further deteriorated. BTC’s price has declined from a rising wedge pattern, sweeping the monthly VWAP (volume-weighted average price) and then executing a bearish break of structure (BOS) beneath $87,600.

With the short-term bullish trend negated, BTC is now confronting downside targets near previous liquidity pools or external liquidity.

The immediate targets are set at the $83,800 swing low, with a deeper retracement toward the $80,600 quarterly lows possible if selling pressure continues. Currently, both order flow and on-chain indicators suggest that patience is necessary before confirming a lasting bottom.

Related: Bitcoin parabola breakdown raises chances for an 80% correction: Veteran trader

This article does not constitute investment advice or recommendations. Every investment and trading action carries risks, and readers should conduct their own research before making any decision. While we aim to deliver accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any content in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be responsible for any losses or damages arising from reliance on this information.

This article does not constitute investment advice or recommendations. Every investment and trading action carries risks, and readers should conduct their own research before making any decision. While we aim to deliver accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any content in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be responsible for any losses or damages arising from reliance on this information.