Strategy chair Michael Saylor indicated that his firm might increase its Bitcoin holdings just as the market experienced another dip on Sunday, creating tension among traders and sparking new discussions about the causes behind the downturn.

Related Reading

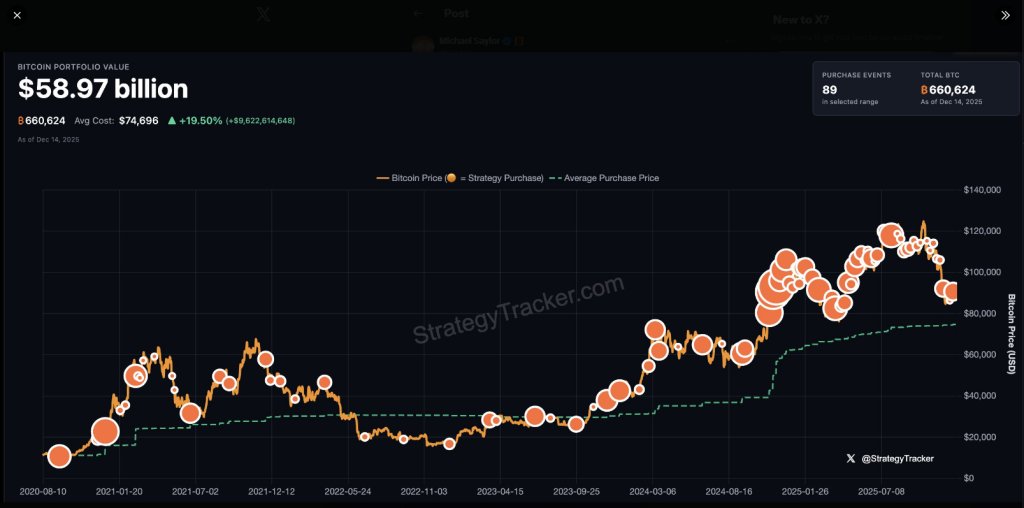

Back To More Orange Dots

In a post on X, Saylor shared a chart featuring the caption “Back to More Orange Dots,” which investors interpret as a signal for additional buying activity.

As per reports monitored by SaylorTracker, Strategy acquired 10,624 BTC on December 12 — marking its largest purchase since late July.

The firm’s total Bitcoin holdings now stand at approximately 660,624 BTC, currently valued at around $58.5 billion, with an average purchase price of $74,696 per coin.

₿ack to More Orange Dots. pic.twitter.com/rBi1aagDVO

— Michael Saylor (@saylor) December 14, 2025

Sunday Wick, Low Liquidity

Bitcoin briefly plunged to a two-week low around $87,750 during late Sunday trading, before recovering to above $89,000 by the time of this writing.

Traders noted a recurring trend: quick drops over weekends when market liquidity is sparse. While Ether displayed relative strength, major altcoins lagged behind, as trading participants adjusted their positions ahead of a busy week of US data releases and central bank decisions.

Analysts Eye Bank Of Japan

Market commentary suggests that some participants attribute the selling pressure to expectations surrounding the Bank Of Japan.

An analyst known as NoLimit remarked that people are underestimating the potential impact of the bank’s actions on crypto markets.

Justin d’Anethan, head of research at Arctic Digital, characterized the movement toward $88,000 as feeling like a defeat, linking it to concerns over a possible unwinding of carry trades influenced by Japanese interest rate expectations.

Markets May Have Priced It In

Sykodelic, another market observer, contended that Japan’s measures are largely already accounted for in market pricing. “Markets are proactive; they adjust in anticipation of events rather than react to them,” they stated.

This perspective suggests that the recent decline is not driven by a new shock but rather part of normal market fluctuations: macro funds lessening their positions, short-term traders securing profits, and buyers entering the market at lower price points.

Related Reading

This push-and-pull dynamic clarifies why Bitcoin continues to experience sharp drops amid low liquidity without decisively breaking through key support levels.

At the same time, the ongoing tension between long-term holders—such as companies like Strategy—and short-term macro movements is influencing price trends.

There are currently no indications of widespread liquidations or a funding crisis, suggesting that the price declines are calculated rather than chaotic.

Featured image from Australian Farmers, chart from TradingView