The recent 30% drop in Bitcoin has not shaken Grayscale Research, which contends that this decline aligns with historical trends and is not likely to signal the onset of an extended downturn.

Summary

- Grayscale Research highlights that Bitcoin’s latest 30% pullback is typical for a bull market and does not indicate the beginning of a severe, multi-year decline.

- In November, privacy-centric tokens outperformed, while new XRP and Dogecoin exchange-traded products entered the market in response to the expanding U.S. crypto ETP landscape.

- Potential Fed rate cuts and bipartisan crypto legislation could boost crypto markets into 2026, even as valuations lag behind improving fundamentals.

In a recent report released on December 1, the asset management firm expressed optimism that Bitcoin (BTC) would reach new heights next year, despite mixed indicators in the short term.

This pullback marks the ninth significant decline since the current bull market began and is consistent with Bitcoin’s established market behavior. Since 2010, the cryptocurrency has experienced approximately 50 pullbacks of 10% or more, averaging around a 30% decline from its peak to trough.

“Investors in Bitcoin have benefitted from holding onto their assets, although they have endured challenging drawdowns along the journey,” the report stated. The most recent decline, occurring from early October through November, saw a low of 32%.

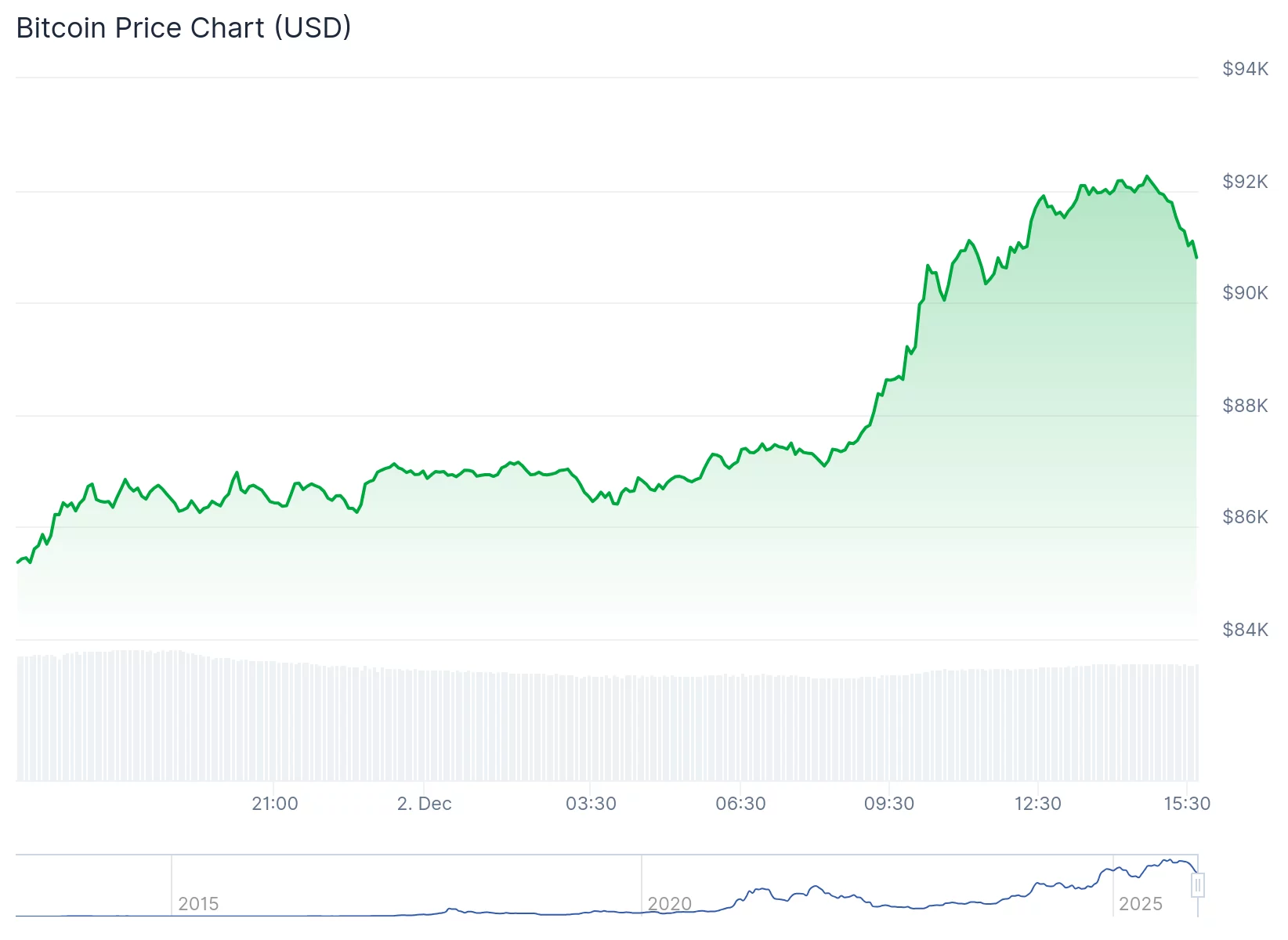

Currently, Bitcoin has risen over 6%, trading around the $90,000 mark. See the details below:

Grayscale refutes ‘four-year cycle’ doom narrative

Although Bitcoin’s halving cycle has typically corresponded with extended price patterns, Grayscale challenges the common assumption that a downturn is imminent in 2026. The firm noted that this cycle is distinct: it lacks a parabolic blow-off top, features greater institutional involvement through exchange-traded products and digital asset treasuries, and benefits from a favorable macroeconomic environment.

Signs of a potential short-term bottom are emerging, according to the company, which cited heavily skewed put options and digital asset treasuries trading below their net asset values—signs of reduced speculative excess.

Privacy tokens outperform amid AI sector decline

In November, crypto markets were sharply divided by sector outside of Bitcoin. Privacy coins, such as Zcash and Monero, led the growth. Future sustainability of this trend remains uncertain.

On Tuesday, Zcash’s price fell by 24%, with analysts cautioning about further declines while affirming that long-term trends and the privacy thesis remain strong.

Privacy initiatives associated with Ethereum also gained traction: Vitalik Buterin presented a new privacy framework at Devcon, and Aztec debuted its Ignition Chain.

Conversely, Grayscale’s Artificial Intelligence Crypto Sector dropped 25%, despite the rising adoption of certain AI-linked technologies.

Near Protocol’s (NEAR) “Intents” product—which streamlines cross-chain transactions and enhances Zcash’s utility—has seen a significant uptick in usage. Similarly, Coinbase’s new x402 open payments protocol surged from 50,000 to over 2 million daily transactions in November.

The landscape for crypto exchange-traded products grew further in November, as the first XRP and Dogecoin ETPs commenced trading following U.S. regulators approving new generic listing standards.

Lower rates and bipartisan legislation could spark 2026 growth

Grayscale noted that macroeconomic conditions could provide significant support leading up to the year-end. A possible interest-rate cut during the Federal Reserve’s December 10 meeting—and indications of further easing in the coming year—could weaken the U.S. dollar and elevate demand for assets like Bitcoin and gold.

Speculation surrounds National Economic Council Director Kevin Hassett as a leading candidate to succeed Fed Chair Jerome Powell, reinforcing expectations for lower rates. Hassett previously referred to the Fed’s September rate cut as “a good first step” toward “much lower rates.”

Continued bipartisan progress regarding crypto market-structure legislation in Congress could also act as a catalyst. The Senate Agriculture Committee released a bipartisan draft bill in November. If crypto does not become a contentious issue ahead of the 2026 midterms, the legislation could reshape institutional involvement.

Despite short-term fluctuations, Grayscale is adamant that long-term holders will reap the most significant rewards. “Eventually, fundamentals and valuations will align,” the firm pointed out, “and we remain optimistic about the outlook towards year-end and into 2026.”