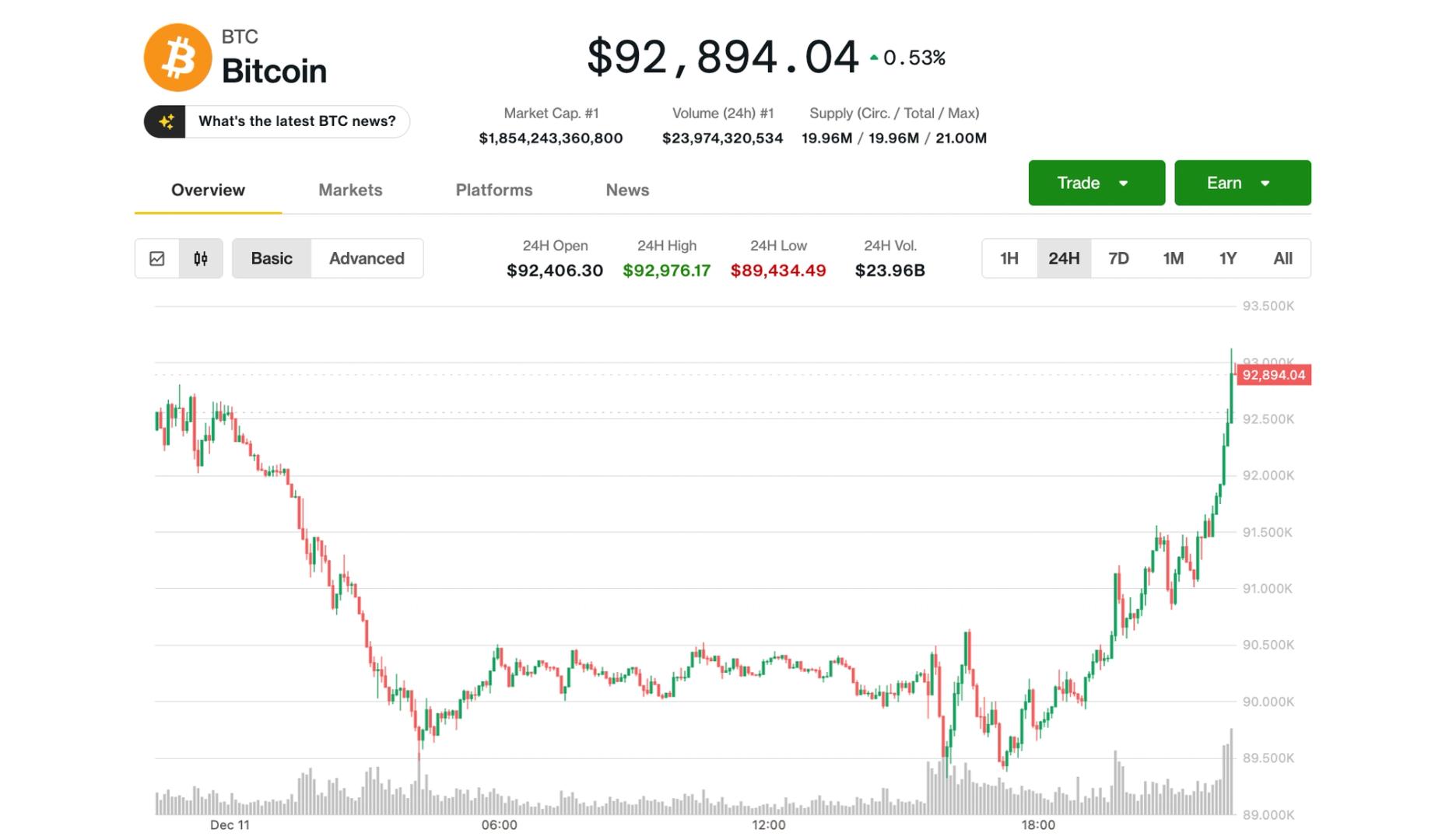

Bitcoin rose back to $93,000 on Thursday as traders processed the Fed’s decision, although altcoins largely lagged behind.

After dipping to $89,000 post-Federal Reserve’s rate cut and a lower opening for U.S. stocks, Bitcoin recently recorded a price of $93,000, showing a slight increase over the past 24 hours.

Most altcoins retained their early losses, with Cardano’s ADA and Avalanche’s AVAX (AVAX) experiencing drops of 6%-7%. Ether fell 3% on the day, yet remained above $3,200.

Bitcoin’s late-day surge echoed a similar trend in U.S. stocks, with the Nasdaq closing down merely 0.25% after earlier being down by 1.5%. The S&P 500 ended the day slightly positive while the DJIA increased by 1.3%.

Precious metals made headlines with silver soaring 5% to a new all-time record of $64 per ounce, while gold rose over 1% approaching $4,300. This surge was aided by the U.S. dollar index (DXY) slipping to its lowest since mid-October.

Crypto exchange Gemini stood out among cryptocurrency stocks, jumping over 30% following news of receiving regulatory approval to launch prediction markets in the U.S.

Crypto diverges from equities

Jasper De Maere, desk strategist at trading firm Wintermute, pointed out that Thursday’s movements highlighted the increasing separation of crypto from equities, particularly in response to macro factors.

“Only 18% of the past year’s sessions saw BTC outperform the Nasdaq on macro days,” he remarked. “Yesterday adhered to that trend: equities surged while crypto declined, indicating that the rate cut was completely factored in, and marginal easing no longer offers support.”

De Maere mentioned that initial signals of stagflation concerns are surfacing for the first half of 2026, suggesting that markets are starting to shift focus from Fed policy to U.S. cryptocurrency regulation as the next significant influence.

Bitcoin sell pressure waning

Analytics firm Swissblock noted that the downward force on Bitcoin is diminishing, as the market stabilizes although it is not completely out of danger.

“The second wave of selling is less intense than the first, and the selling pressure is not escalating,” the firm shared in an X post. “There are indications of stabilization… yet no firm confirmation.”