Certainly! Here’s the rewritten content while retaining the HTML tags:

Deep out-of-the-money (OTM) bitcoin put options are catching attention in longer-term expirations, as traders seize inexpensive chances for substantial payoffs if BTC experiences high volatility.

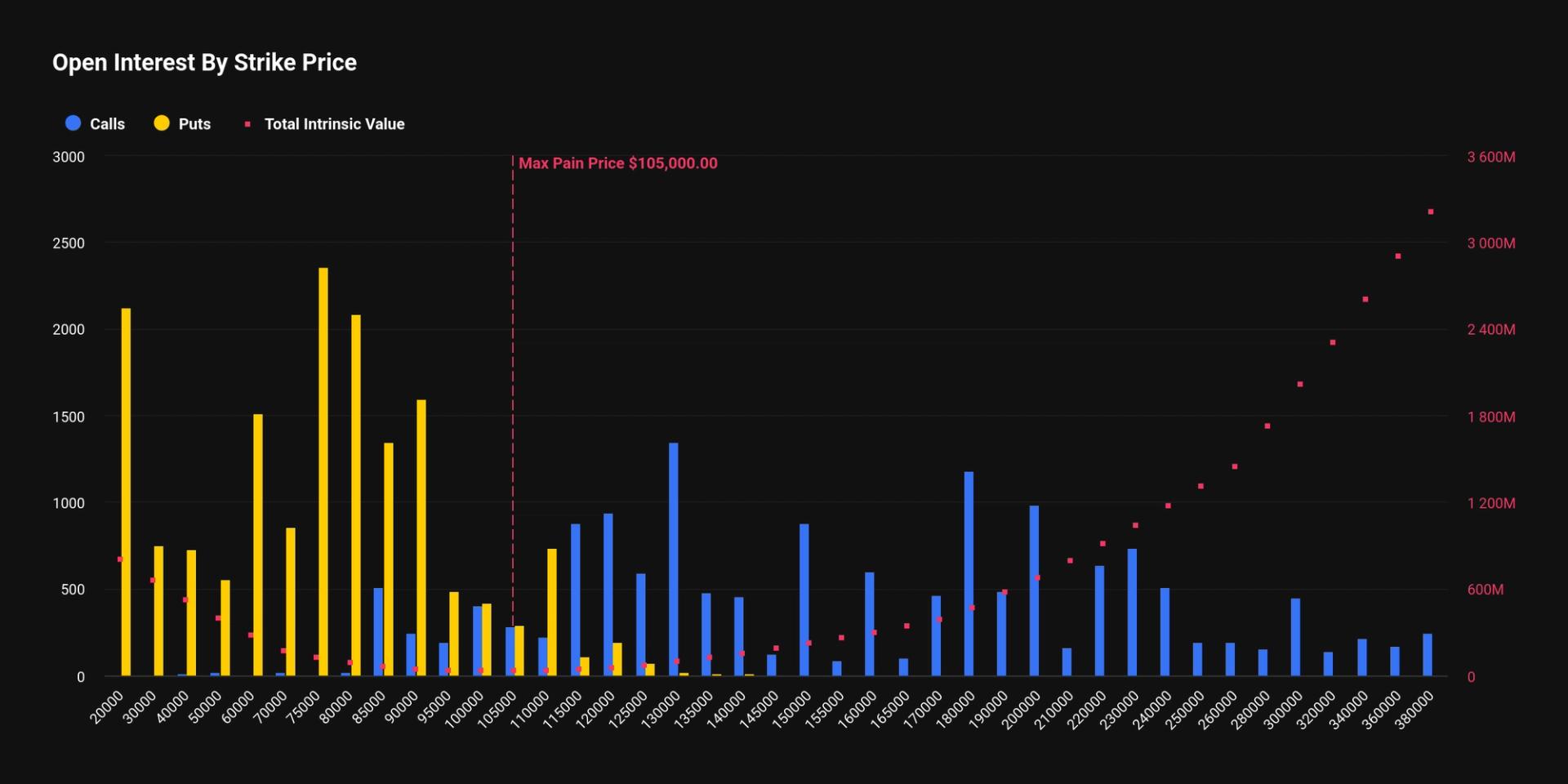

On the prominent crypto options platform Deribit, the $20,000 strike put ranks as the second most sought-after among the June 2026 expiry options, with a notable open interest of over $191 million.

Notional open interest reflects the dollar value of active contracts. Put options priced below the current market rate of BTC are designated as OTM, typically cheaper than those at or above the spot price.

The June expiry also records notable activity in other OTM puts at $30,000, $40,000, $60,000, and $75,000 strikes.

While activity in deep OTM puts often indicates traders preparing for a downturn, the situation here is different; the exchange also shows engagement in higher-strike calls exceeding $200,000.

These transactions convey a positive outlook on long-term volatility at a low cost, rather than a definitive bet on price movement, according to Deribit’s Global Head of Retail, Sidrah Fariq. They can be likened to affordable lottery tickets for a potential surge in volatility over the next six months.

“There are about 2,117 open positions on the $20K bitcoin put for the June expiry. We’ve also noted significant trades in the $30,000 put and $230,000 call strikes. The combination of these far OTM options suggests not a directional strategy but rather deep wing trades that professionals employ to transact long-dated volatility at a low cost and manage tail risk,” Fariq told CoinDesk.

She clarified that this is primarily volatility positioning, not price positioning, as the $20,000 put or the $230,000 call are substantially distanced from the spot price to serve as a mere protective hedge. As of the latest update, BTC was trading around $90,500, according to CoinDesk data.

Holders of both OTM calls and puts could benefit from asymmetric returns stemming from extreme volatility or significant price fluctuations in either direction. However, if the markets remain stagnant, these options rapidly depreciate in value.

Options are derivative contracts providing the buyer with the right to purchase or sell the underlying asset at a set price at a future date. A put option grants the right to sell, indicating a bearish stance on the market, whereas a call option allows buying rights.

The crypto options market, which includes BlackRock’s IBIT ETF, has matured into a complex arena where institutions and large investors play intricate strategies, managing risks while capitalizing on price movements, time decay, and volatility variations.

Overall, the mood in the options market leans bearish, as BTC puts continue to trade at a premium over calls across all maturities, reflecting ongoing call overwriting strategies intended to enhance yield on existing spot holdings, as per Amberdata’s options risk reversals.