Recent months have seen significant challenges in the crypto market, with both Bitcoin and Ethereum dropping below key support levels. Bitcoin fell beneath $110,000, while Ethereum also dipped below $4,000. This decline resulted in billions in liquidations, pushing the Fear and Greed Index into a state of fear.

Despite this, data from the on-chain analytics platform Sentora (formerly IntoTheBlock) indicates that accumulation is taking place quietly. Even with the price drops, outflows for both cryptocurrencies from exchanges have remained notably negative.

Related Reading

Key Weekly Metrics

A prolonged decline from the previous week saw Bitcoin’s price drop below $110,000, driven by heightened selling pressure and liquidations of leveraged positions. Yet, amid this sharp downward movement, on-chain data reveals an intriguing trend developing beneath the surface of the volatility. According to data shared by Sentora, over $5.75 billion worth of BTC left centralized exchanges during the week.

Although this outflow may seem modest compared to periods of intense bullish activity, it reflects lingering investor confidence, particularly among those potentially seizing the opportunity to buy the dip.

Ethereum experienced even more significant price movements in the same timeframe, with the leading altcoin breaking below the critical $4,000 support level and briefly testing lower ranges around $3,850. Nonetheless, despite the steepness of this decline, the exchange flow data indicates that the bearish trend did not deter accumulation activity across the network.

During the week, over $3.08 billion worth of ETH exited exchanges, demonstrating a continued enthusiasm among investors to accumulate Ethereum steadily, even while facing short-term losses and market pressures.

Despite negative price performance, exchange outflows remained strong for both ETH and BTC, indicating accumulation across the market pic.twitter.com/eAqZTk6Vof

— Sentora (previously IntoTheBlock) (@SentoraHQ) September 26, 2025

Outflows Drive Exchange Balances To Multi-Year Lows

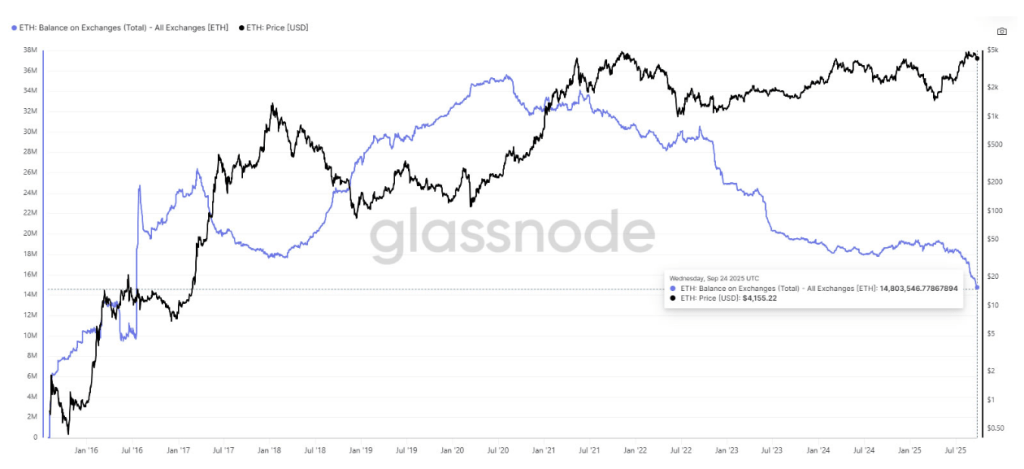

Notably, last week’s Ethereum outflows align with a significant trend observed in recent months. Data indicates that Ethereum’s total supply on exchanges has decreased to only 14.8 million ETH, marking its lowest point since 2016. Much of this supply has been redirected into staking, long-term cold storage, and DeFi protocols, resulting in a substantial reduction of ETH available on trading platforms.

ETH balance on exchanges. Source: Glassnode

Information from a CryptoQuant Quicktake post by contributor CryptoOnchain further reinforces the trend of significant outflows. Between August and September 2025, Ethereum’s 50-day Simple Moving Average (SMA) netflow fell below -40,000 ETH per day, the lowest recorded since February 2023. This ongoing negative netflow indicates that investors are consistently moving their ETH off exchanges and into staking, cold storage, or other long-term holding options. “Lower exchange balances equate to reduced short-term supply,” the analyst stated.

Related Reading

As of this writing, Bitcoin was priced at $109,585, while Ethereum stood at $4,011.

Featured image from Unsplash, chart from TradingView