Spot Bitcoin and Ethereum exchange-traded funds (ETFs) in the United States experienced a significant reversal last week, losing over $1.7 billion.

This change occurred amid price volatility for Bitcoin and Ethereum, both of which declined by more than 8% during the reporting period.

Sponsored

Sponsored

Bitcoin and Ethereum ETFs Suffer Cash Withdrawals Amid Market Turmoil

According to data from SoSoValue, spot Bitcoin ETFs experienced $903 million in net withdrawals, ending a month-long inflow trend that indicated growing institutional confidence.

This sentiment shifted as macroeconomic uncertainty increased, leading many institutional investors to reduce their exposure and adopt a more cautious approach.

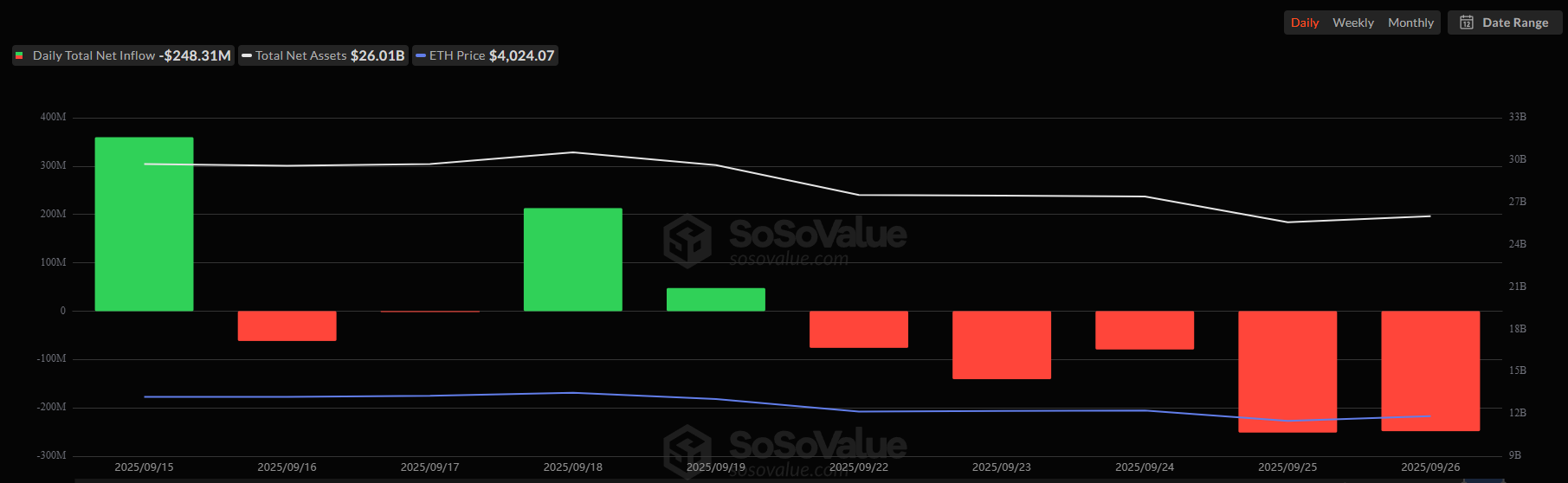

Ethereum products reflected similar trends but experienced even larger losses.

Data from SoSoValue reveals that the nine US-listed spot Ethereum ETFs saw redemptions totaling $796 million, marking their largest weekly withdrawal since their launch earlier this year.

The coordinated decline across both assets indicates a broader cooling of demand for crypto ETFs.

Sponsored

Sponsored

Institutional allocators who once considered these vehicles a simple way to access digital assets are now reevaluating their strategies in light of increasing macro challenges.

Recent weeks have seen continuous inflation concerns, slowing global growth, and heightened uncertainty surrounding US monetary policy, all of which have softened appetite for volatile assets. In this context, digital assets—traditionally labeled high risk—have been among the first to be trimmed from portfolios.

Moreover, institutional strategies have become increasingly defensive, especially as investors face potential losses.

CryptoQuant data indicates that Bitcoin treasury firms raising capital via PIPE deals are feeling pressure as share prices approach discounted issuance levels.

Meanwhile, investor focus is shifting towards newly launched ETFs connected to alternative tokens like Solana and XRP.

These funds have attracted capital away from Bitcoin and Ethereum offerings, introducing new competition and promoting exploration of underrepresented assets.

This redirection of inflows implies that, while risk sentiment has diminished, the desire for diversification within the crypto space remains active—albeit more selective and opportunistic than in the past.