The upcoming Federal Open Market Committee (FOMC) meeting is nearing, and speculation is rife regarding its implications for the Bitcoin and cryptocurrency landscape. The previous FOMC meeting in September saw the Federal Reserve reduce rates to 4-4.25% after several months of maintaining the same levels. This has heightened expectations for another potential rate cut, with the FedWatch Tool indicating a significant probability.

Market Anticipates Another Rate Cut to 3.75-4%

The next FOMC meeting is set for Wednesday, October 29, 2025, generating considerable buzz about the Fed’s forthcoming decisions. Current market conditions suggest a favorable stance for risk assets like Bitcoin and other cryptocurrencies, amid anticipated rate reductions.

Related Reading

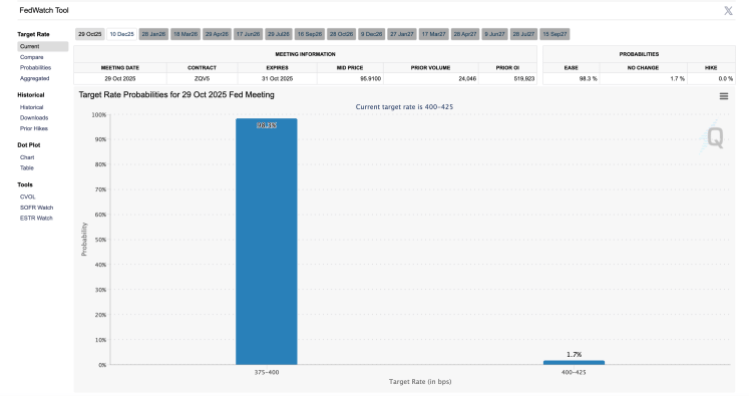

At present, the CME FedWatch Tool indicates that the likelihood of a rate cut has reached 98.3% at the time of this writing. This results in merely a 1.7% chance of the Federal Reserve maintaining current rates, with no possibility of an increase.

Lower interest rates benefit businesses broadly, as they lead to improved loan conditions and enhanced consumer borrowing and spending. This dynamic can invigorate market participation across various sectors, including the stock market and emerging arenas like Bitcoin and cryptocurrency.

Optimism for Bitcoin and Crypto is Increasing

A rate reduction from the Federal Reserve aligns with the U.S.’s increasingly pro-crypto outlook, which has evolved since President Donald Trump’s administration. Recently, the president granted clemency to Changpeng Zhao, the founder and former CEO of the Binance crypto exchange, after his guilty plea for money laundering violations in 2024. Zhao had completed four months of incarceration prior to this pardon.

Related Reading

With the U.S. recommitting to Bitcoin and cryptocurrency, a rate cut is poised to further bolster the market, facilitating greater investor access as liquidity increases. Initial announcements often spur rapid market surges, and the crypto space is likely to see ongoing growth in response.

Nevertheless, the final outcome remains uncertain until the FOMC meeting concludes and an announcement is made. For the Bitcoin and cryptocurrency market to sustain a bullish trajectory, inflation levels must also decline; rising inflation could lead investors to adopt more conservative positions.

Featured image from Dall.E, chart from TradingView.com