Key Highlights:

- Binance captured 39.8% of July’s spot market, with $698.3B in volume.

- Coinbase saw a 82.6% monthly volume jump, but slipped to ninth place.

- DEX platforms gained market share as CEX trading slowed in Q2.

Binance Leads the Global Crypto Spot Market in July 2025

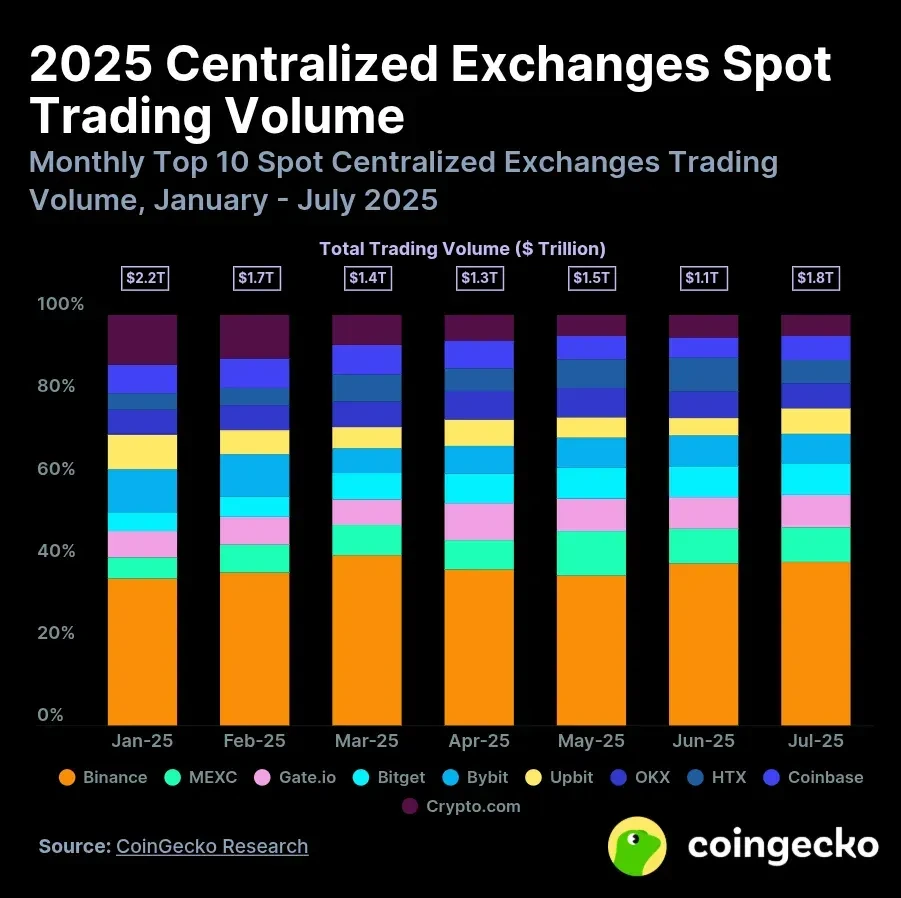

In July 2025, cryptocurrency exchange Binance maintained its first-place position in the spot market among centralized exchanges (CEX) with a market share of 39.8%. Trading volume on the platform increased by 61.4% compared to June, rising from $432.6 billion to $698.3 billion, according to a CoinGecko report.

MEXC ranked second with an 8.6% market share and $150.4 billion in trading volume, up 61.8% from $93 billion in June. Gate took third place with a 7.8% market share and a trading volume of $137.2 billion, an increase of 61.3% month-on-month.

The remaining exchanges in the top 10 control 43.8% of the market. The share of platforms ranked fourth to tenth is distributed relatively evenly, each holding between 5% and 7%.

“Coinbase has slowly lost market share throughout 2025, having started the year with a 7.0% dominance, it has since fallen to just 5.8% in July. This makes it the ninth-largest exchange, with just over $101.7 billion in trading volume in July. However, the US-based exchange did experience the largest MoM growth among the top 10, with volumes climbing +82.6% from $55.7 billion in June to $101.7 billion in July,” CoinGecko analysts note.

Second Quarter Results

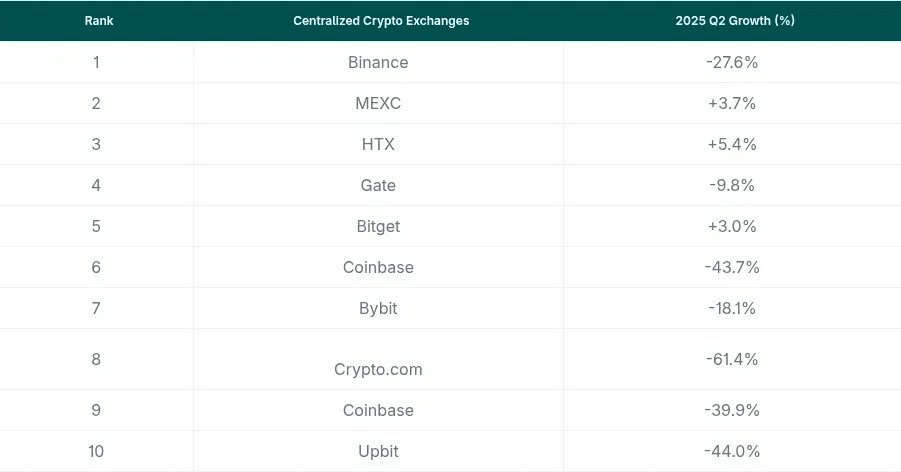

At the end of the second quarter, the total spot trading volume on the top 10 centralized exchanges amounted to $3.9 trillion. This is 27.7% less than the first quarter’s figure of $5.4 trillion.

Binance led Q2 with a 38% market share. The platform processed $1.47 trillion in transactions, although trading volume was down 21.6% from Q1, when it reached $2 trillion.

Seven of the top ten exchanges saw a decline in trading volume during the second quarter. Crypto.com experienced the largest drop (-61.4%), as its trading volume fell from $560.2 billion in the first quarter to $216.4 billion in the second.

Only three exchanges showed quarter-on-quarter growth: MEXC (+3.7%), HTX (+5.4%), and Bitget (+3%).

Market Dynamics

The increase in trading volumes in July was driven by overall bullish santeminet in the cryptocurrency market. Bitcoin reached historical highs, which attracted new participants.

Despite July’s growth, the overall trend in the second quarter indicates a decline in trader activity on centralized exchanges. Market participants are increasingly turning to decentralized exchanges (DEX), which expanded their share as CEX volumes declined.