Sure, here’s the rewritten content while retaining the HTML tags:

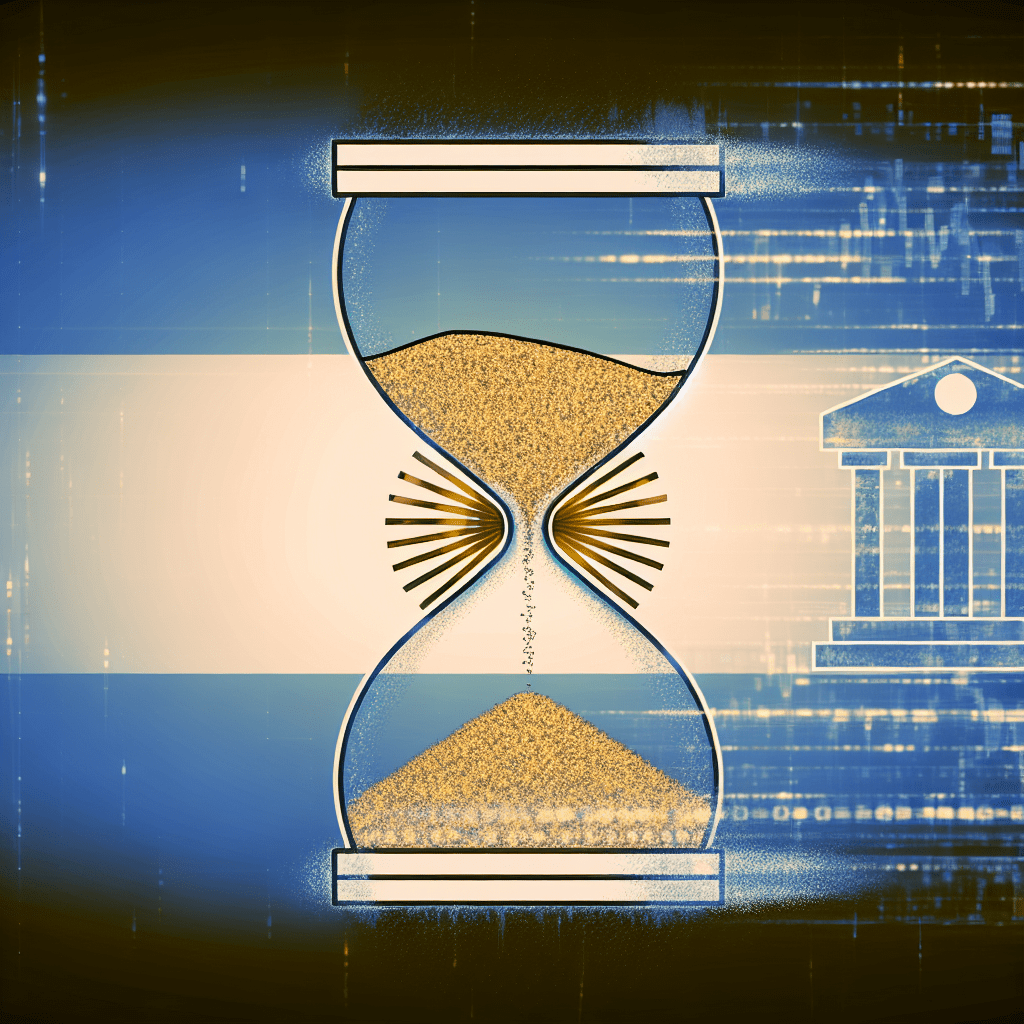

Argentina has reached another critical point, prompting intervention from the central bank to stabilize a plummeting peso, even amid recent libertarian reforms. This crisis represents a sharp shift for those who had briefly found hope in President Javier Milei’s free-market commitments.

Milei: The Libertarian Surge Stumbles

Upon taking office, Javier Milei garnered attention for floating the peso and vowing to resolve Argentina’s monetary issues through drastic economic freedoms.

Initially, some Bitcoin proponents applauded him, believing his policies could signal a significant departure from Argentina’s lengthy history of inflation and monetary mismanagement. With his critical stance on central banks, Milei seemed like a perfect ally for those who view Bitcoin as a powerful hedge against inflation.

However, optimism for stability has evaporated. Renowned Bitcoin advocate, Austrian economist, and author of The Bitcoin Standard, Saifedean Ammous, noted:

“The peso has dipped to 1510 per dollar, down from 900 on the black market or 300 officially when Milei took charge less than two years ago, despite the central bank and government intervention with borrowed dollars. The ponzi is nearing its end.”

This week, Argentina’s central bank was compelled to utilize almost $1 billion in reserves, marking its largest intervention since 2019, to stabilize the peso, which continues to decline despite efforts to adhere to IMF-set trading bands.

This action followed Milei’s partial floating of the currency in April, leading to escalating capital flight, legislative inaction, and public dissatisfaction. August saw inflation decrease to 21% from higher levels, yet it remains among the world’s worst.

The Dynamics of Argentina’s Crisis

Argentinian assets have faced significant declines as parliament blocks crucial austerity and privatization initiatives, undermining Milei’s fiscal strategies. The black-market peso has crashed to unprecedented lows, while reserves are dwindling rapidly, jeopardizing the country’s capacity to service its debt and carry out even minimal interventions.

Such central bank interventions contradict the original libertarian agenda, mirroring Argentina’s extended history of unsuccessful pegs and emergency currency defenses.

The IMF has expressed concerns as Argentina’s dollar reserves deplete in what some analysts deem a self-perpetuating downturn. Increased state involvement erodes trust in the peso as a reliable store of value.

Although monthly inflation subsided to 21% in August, this rate is still devastating for savers, businesses, and working Argentine citizens, whose real purchasing power continues to diminish.

Argentines Flock to Dollars Over Bitcoin

Bitcoin advocates frequently highlight Argentina as a compelling case for why a permissionless, non-state currency could provide relief. Peso holders have repeatedly witnessed their savings eroded, and Milei’s philosophical opposition to fiat currency resonated with Bitcoin enthusiasts who envision a world free from centralized money printing and government-imposed capital restrictions.

The current unraveling reveals a harsh reality: libertarian ideology struggles against deep-seated institutional dysfunction. Yet, instead of turning to Bitcoin, Argentines beleaguered by inflation and ineffective reforms have turned to dollars on the black market. While trading volumes on global crypto exchanges tend to spike during acute crises, daily utilization remains limited compared to the urgency of dollarization.

With dwindling reserves and stalled reform attempts, Argentina stands at a critical juncture. Should dollarization occur, it would entail forfeiting all monetary sovereignty. Ongoing interventions risk further depleting reserves and triggering additional social unrest.

At the same time, the peso’s tenuous value serves as a stark reminder to Argentines (and the world) about the dangers inherent in placing trust in a political class or central bank, no matter how libertarian it may appear.

In this urgent context, Bitcoin’s significance as a decentralized, seizure-resistant, and inflation-resistant asset comes to the forefront. Yet Argentina’s turbulence illustrates that adoption is a gradual process, hindered by institutional inertia, lack of education, and the immediate challenges of daily survival.

As former Blockstream VP, Fernando Nikolic, warned, during true currency collapses, basic necessities like food, fuel, and ammunition (not digital assets) become the only commodities of genuine worth.