Recently, Bitcoin has achieved significant all-time highs, yet many top Bitcoin treasury companies are experiencing notable underperformance. Even with Bitcoin soaring beyond $120,000, firms like (Micro)Strategy are far from their previous peaks. Will these businesses rebound, or has their time of outperforming ended?

Bitcoin Treasury Companies: Massive BTC Holdings in 2025

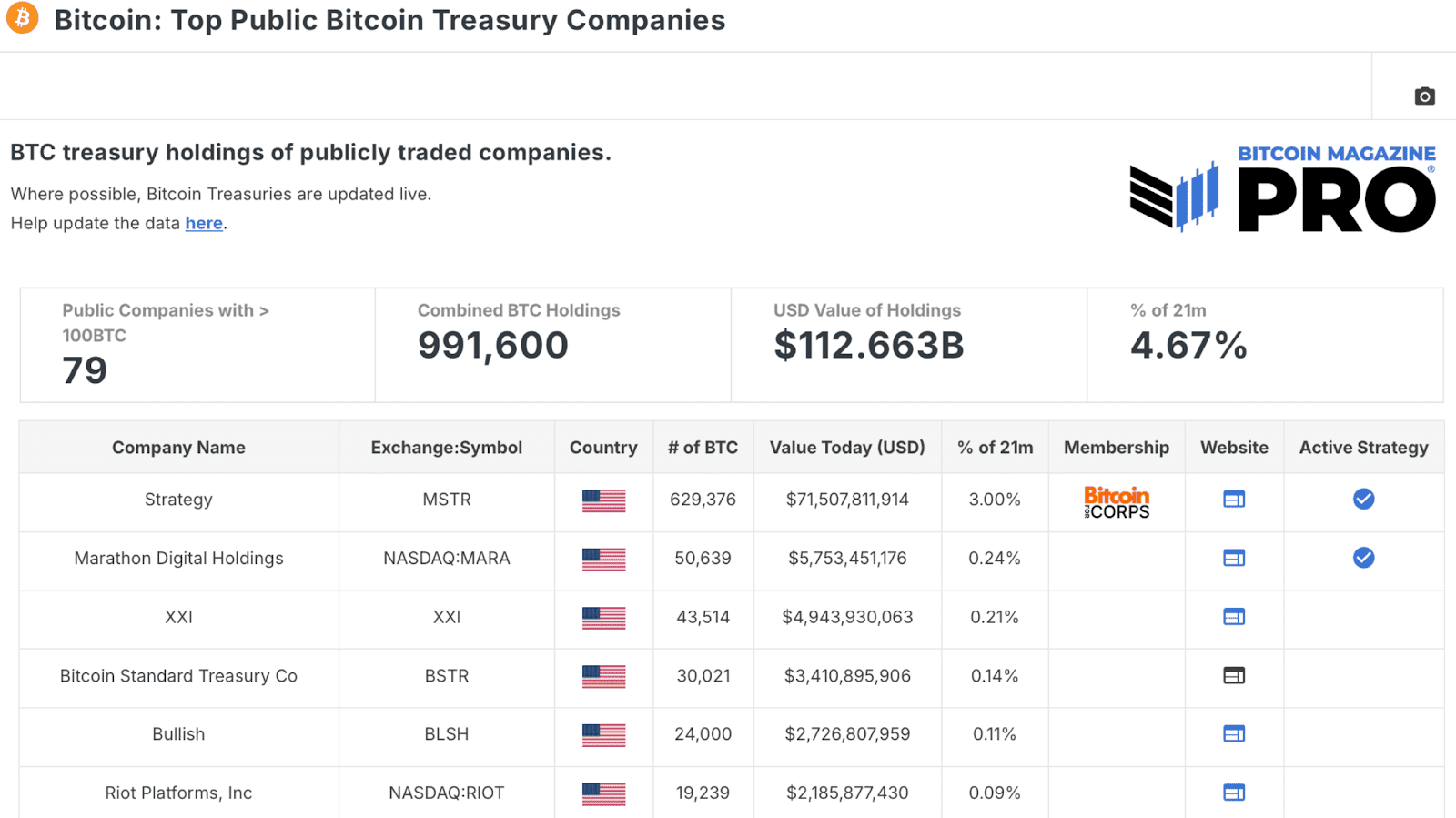

A review of the Top Public Bitcoin Treasury Companies shows that 79 public companies hold at least 100 BTC, totaling nearly a million Bitcoin valued over $110 billion. This is an impressive feat, especially considering most of these companies have only started accumulating in the last few years!

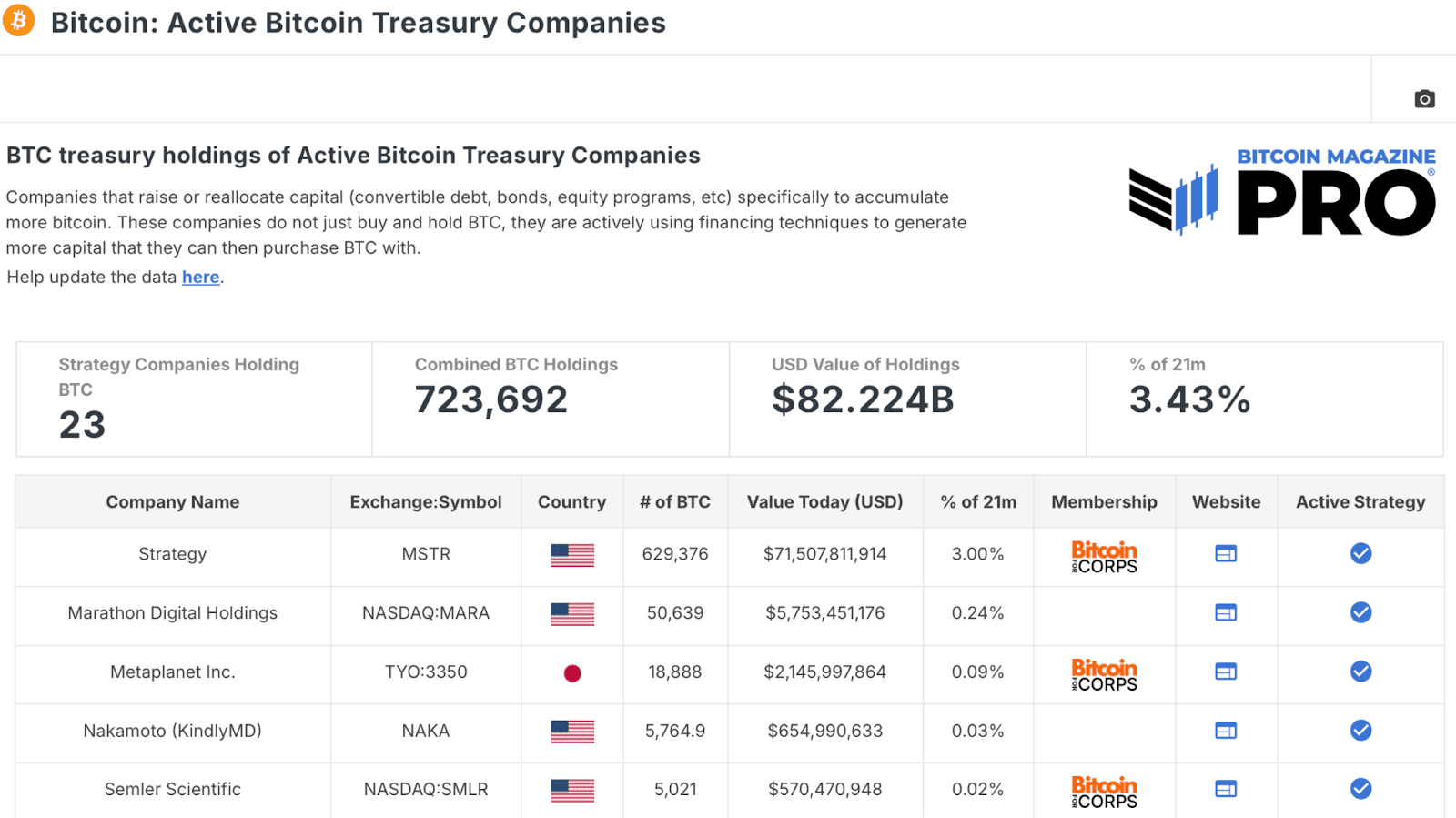

Among these, twenty-three are recognized as Active Bitcoin Treasury Companies, actively employing financial strategies to boost their BTC holdings, collectively managing 723,000 BTC and expanding swiftly. Unsurprisingly, (Micro)Strategy leads this group with an impressive allocation of nearly 630,000 BTC.

This significant institutional accumulation underscores Bitcoin’s growing relevance on corporate ledgers. Nevertheless, investors are increasingly questioning whether these companies’ previously remarkable stock performances can persist.

Reasons for Underperformance of Bitcoin Treasury Companies in 2025

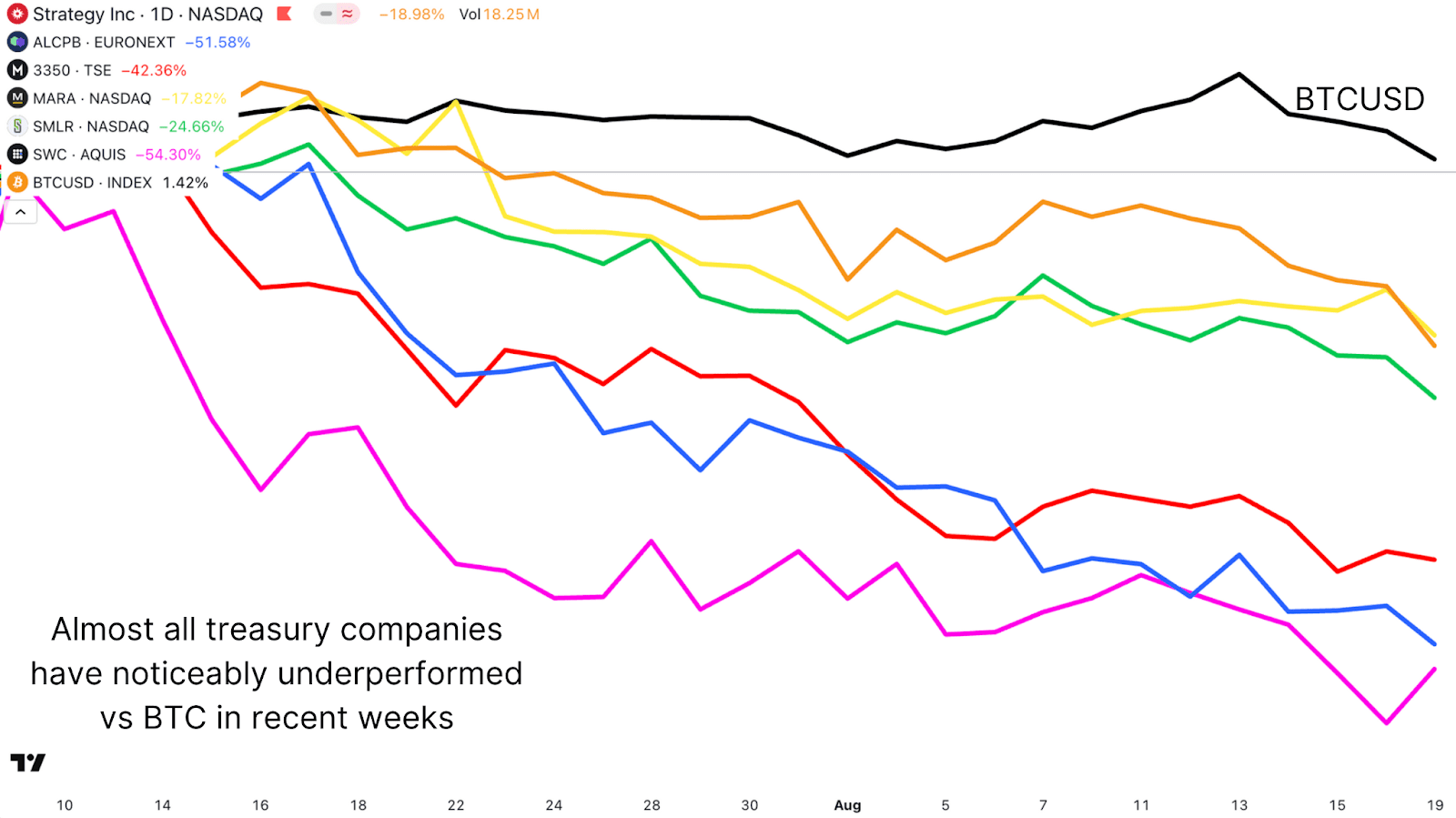

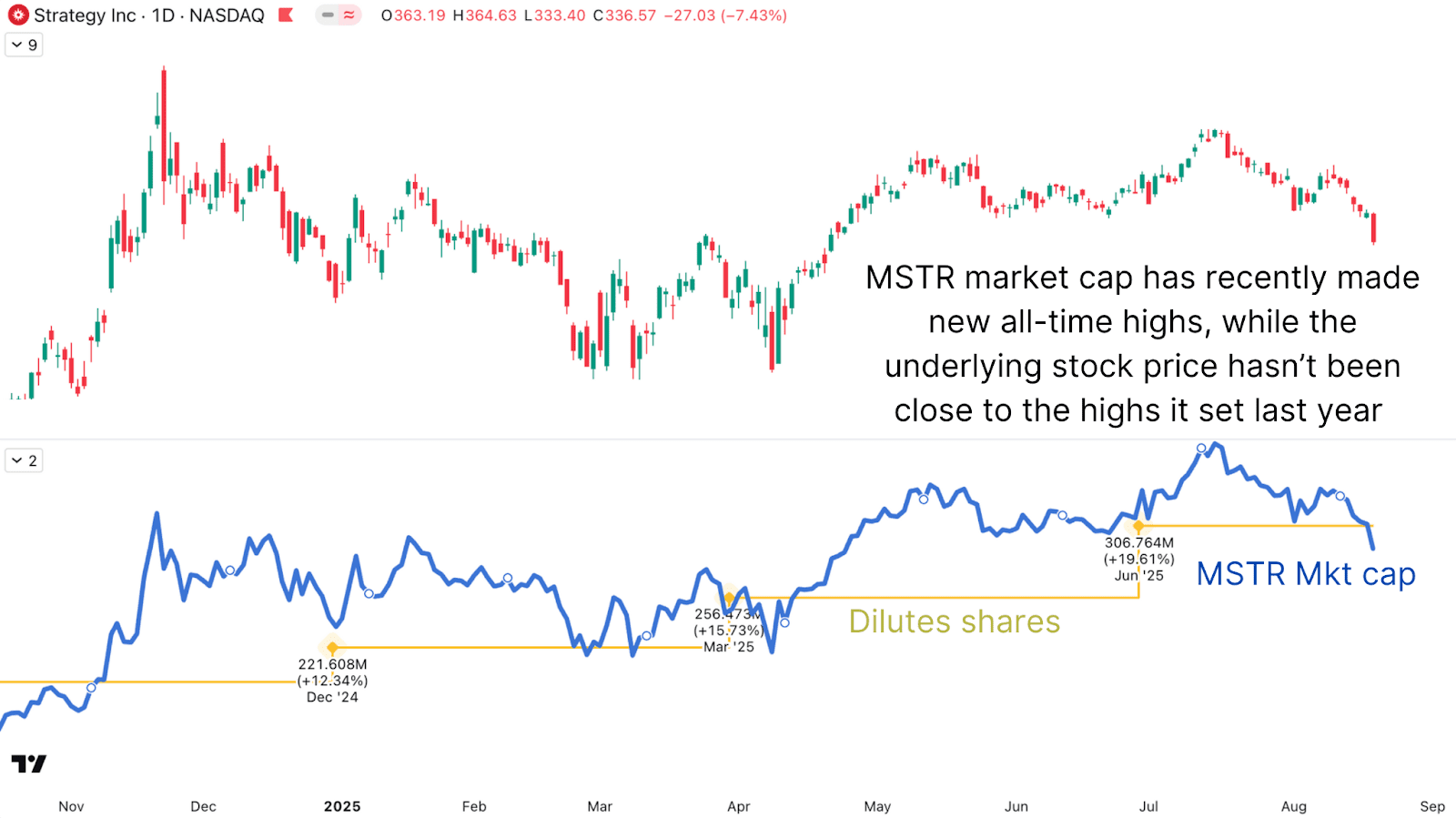

While (Micro)Strategy has been the leading Bitcoin treasury firm, its stock price hasn’t mirrored Bitcoin’s recent strength. Although BTC recently climbed past $124,000 before a slight decline, MSTR’s shares fell to around $330, significantly lower than their $543 peak. Recently, nearly all treasury companies have notably lagged behind Bitcoin.

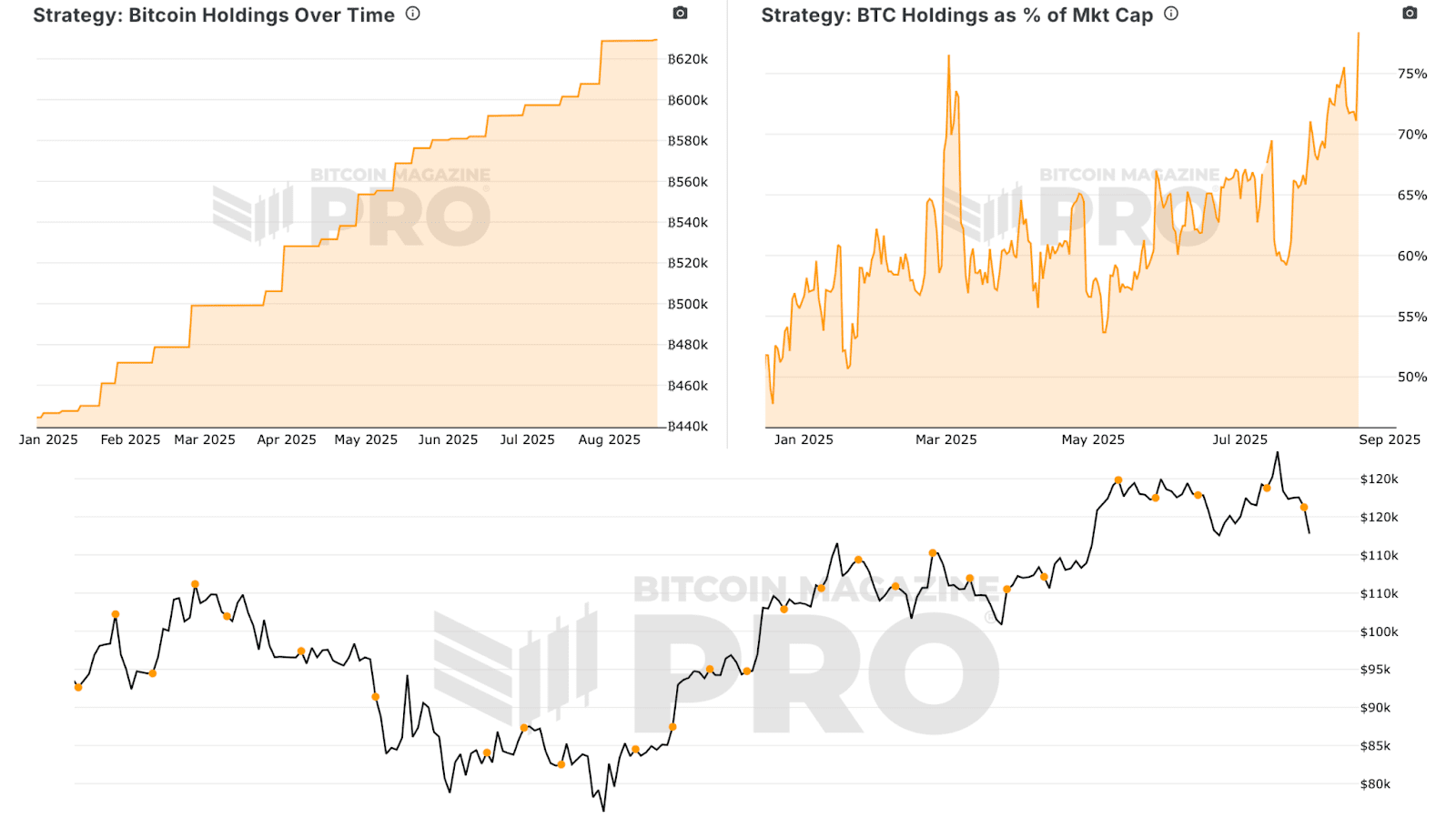

A primary factor is the slowing accumulation of Bitcoin. While (Micro)Strategy made a significant purchase in July 2025, the data from their Bitcoin Holdings Over Time indicates that their purchasing rate has slowed compared to prior years. A diminished accumulation rate may lead investors to hesitate in paying higher premiums for shares.

Impact of Share Dilution on Bitcoin Treasury Companies’ Stock Prices

(Micro)Strategy regularly issues new shares to acquire more BTC. While this increases total holdings, it dilutes current shareholders, impacting stock prices. Between 2020 and 2025, (Micro)Strategy’s diluted share count jumped from around 97 million to over 300 million, showcasing the scale of capital raised for Bitcoin. Though this strategy has led to vast BTC reserves, it has also limited share price increases.

Examining the company’s market cap rather than just the share price offers a different perspective. The market capitalization, which reflects outstanding shares, hit new highs in July 2025, closely following Bitcoin’s ascent. The share price alone presents a more pessimistic view due to substantial dilution.

Bitcoin Treasury Companies: NAV Premiums and Valuations in 2025

The net asset value (NAV) premium—how much more investors pay for shares versus their Bitcoin per-share value—has seen a significant drop. In the past, (Micro)Strategy enjoyed a notable NAV premium, being one of the few avenues for investors seeking leveraged Bitcoin exposure. With many treasury firms and ETFs now available, this “first mover” advantage has diminished. As more companies adopt Bitcoin as a reserve asset, the NAV premium across the sector will likely converge towards one.

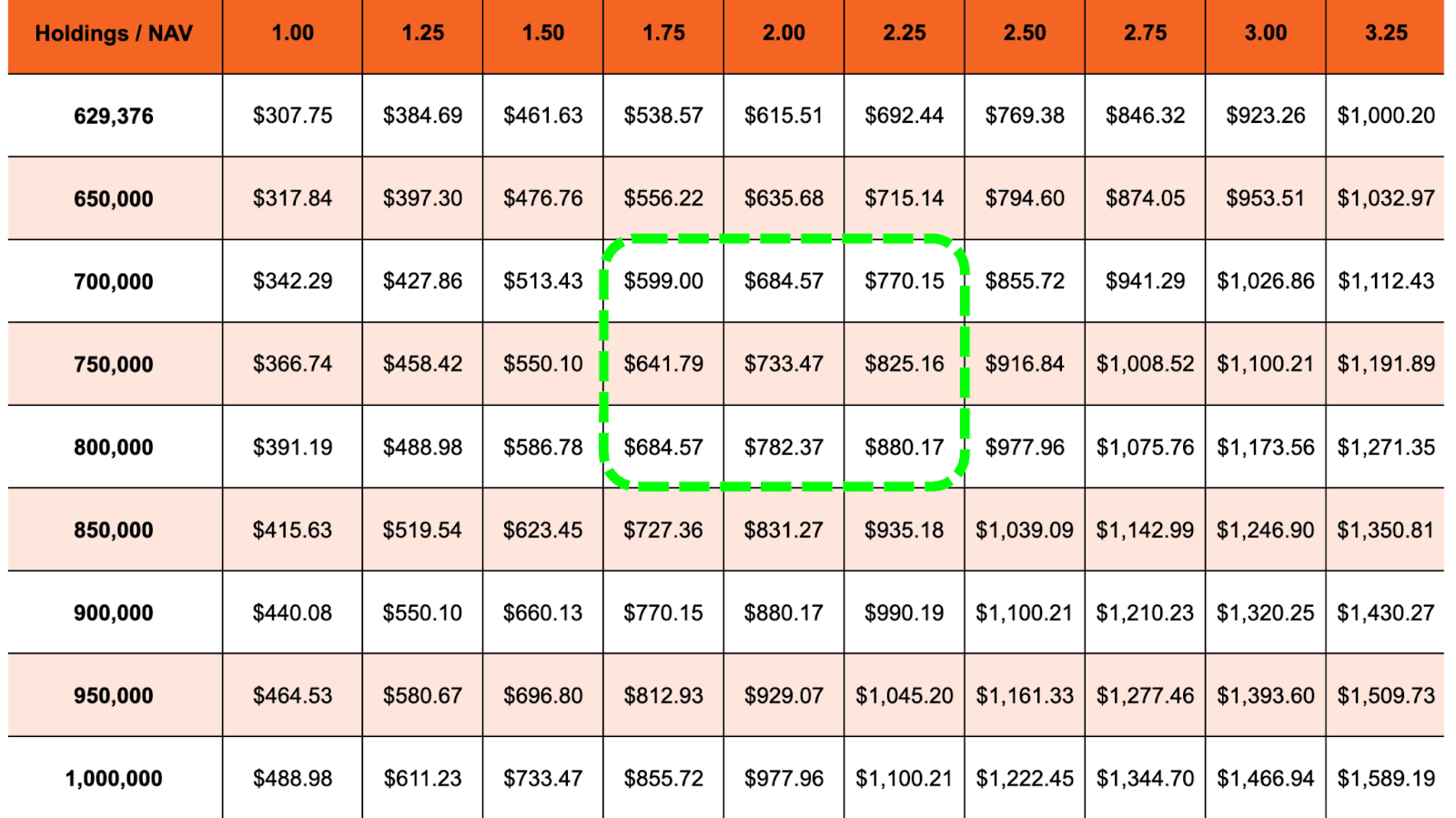

Treasury Companies and their market-adjusted NAV will experience boom and bust cycles, as is the nature of all markets. If Bitcoin ascends to $150,000, as predicted by (Micro)Strategy’s year-end forecast, the fair value based solely on current holdings and assuming no additional accumulation or share issuance could approach $308 per share at a 1.00x NAV. With continued accumulation (potentially between 700,000 and 800,000 BTC) and a reasonable NAV premium of 1.75–2.25x, share prices might reach between $600 and $880. This remains a realistic scenario, especially with potential inclusion in the S&P 500 in the near future, alongside ongoing BTC price increases.

Future of Bitcoin Treasury Companies: Investment Outlook for 2025

Despite Bitcoin treasury companies like (Micro)Strategy hitting new highs, they have struggled with underperformance. Factors like dilution, slowing accumulation, and increased competition have pressured share prices. Nonetheless, their crucial role in holding significant amounts of Bitcoin positions them as strategically relevant; during specific market phases, they might still provide leveraged gains relative to BTC.

The asymmetric opportunity continues, but investors should be cautious: the once-easy outperformance seen in the early days of (Micro)Strategy appears to have waned, giving way to a more competitive and mature environment.

Did you enjoy this in-depth exploration of bitcoin price dynamics? Subscribe to Bitcoin Magazine Pro on YouTube for more expert insights and market analysis!

For further in-depth research, technical indicators, real-time market alerts, and expert analysis, visit BitcoinMagazinePro.com.

Disclaimer: This article serves informational purposes only and should not be viewed as financial advice. Always conduct your own research before making any investment decisions.