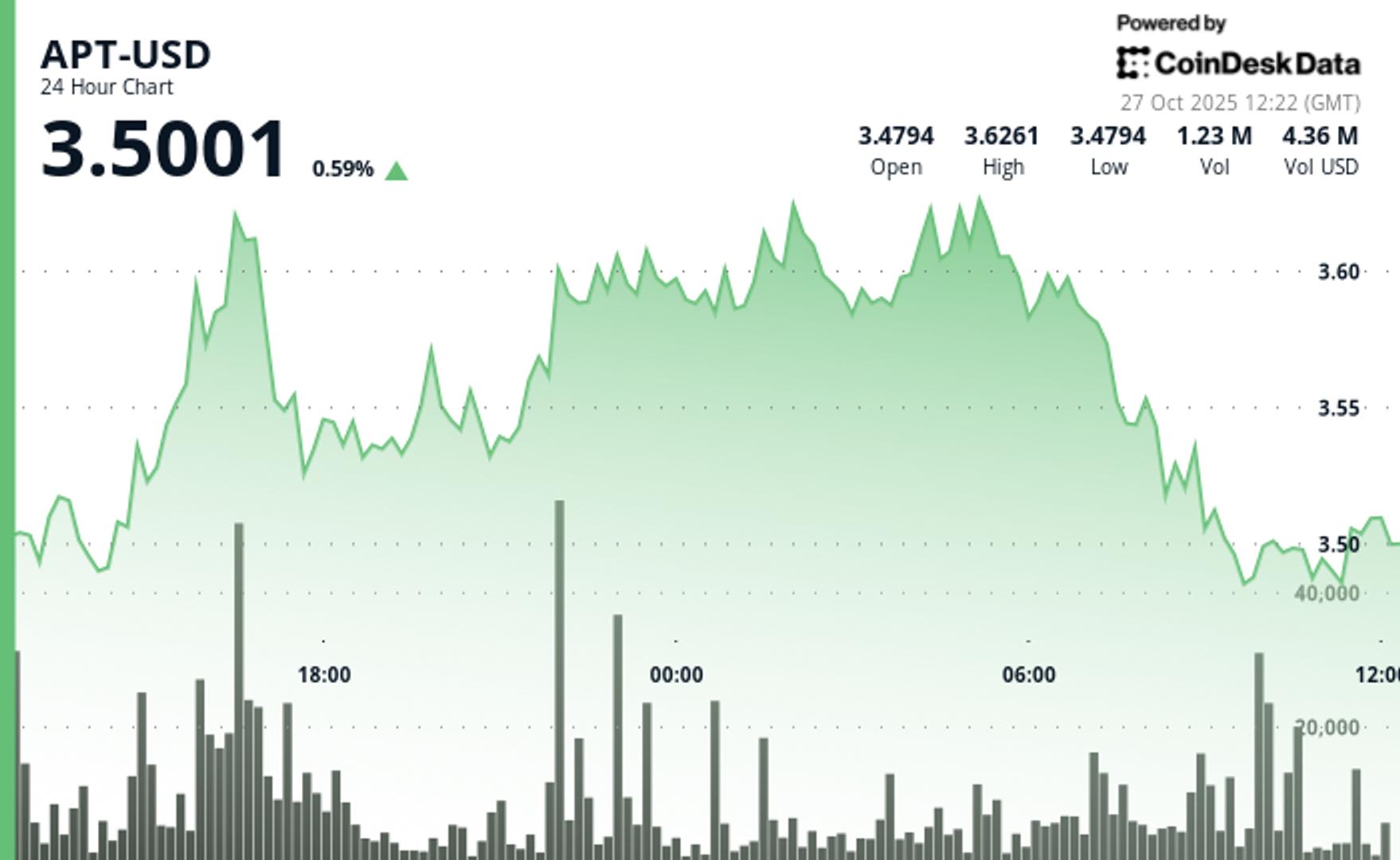

remained stable over the last 24 hours, trading around $3.50.

A possible breakout above the $3.63 resistance level could target $3.75 for an estimated 7% upside, as per the technical analysis model from CoinDesk Research.

The token lagged behind the overall crypto market, with its trading volume remaining low during this period. Meanwhile, the Coindesk 20 index surged 1.1% at the time of publication.

The model indicated that APT’s price created a $0.16 range, equating to 4.6% of current levels as it rose from session lows near $3.45.

On October 26, volume jumped to 2.48 million shares, a 68% increase over the 24-hour average of 1.47 million, before retreating quickly as the price hit resistance at $3.63, according to the model.

Multiple attempts to break out at the $3.60-$3.63 zone have solidified this area as a crucial technical barrier, noted the model.

The combination of modest gains coupled with low volume usually indicates retail-driven activity rather than significant institutional movement, suggesting that traders are currently taking a cautious approach.

Technical Analysis:

- Primary support is established at $3.48-$3.485 after a successful defense during the recent retracement, while resistance remains solid at $3.60-$3.63 following several rejection attempts

- In the last 24 hours, volume averaged 7.9% above the 7-day moving average but fell short of the 5% institutional engagement threshold, indicating retail-driven movements instead of substantial capital investment

- A V-bottom formation on the 60-minute chart hints at a short-term bullish trend, confirmed by higher lows from $3.45 to $3.48

- A breakout above the $3.63 resistance could aim for $3.75 with a potential 7% upside, while breaching the $3.48 support may expose the $3.40-$3.45 range

Disclaimer: This article includes content generated with the help of AI tools and reviewed by our editorial team to ensure accuracy and compliance with our standards. See CoinDesk’s full AI Policy for more details.